View/Download PDF version of Q3 Commentary (or read text below)

Stocks

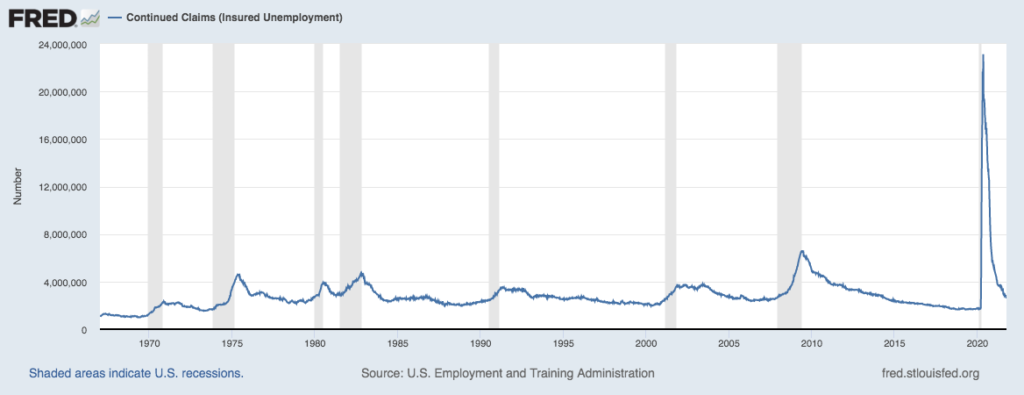

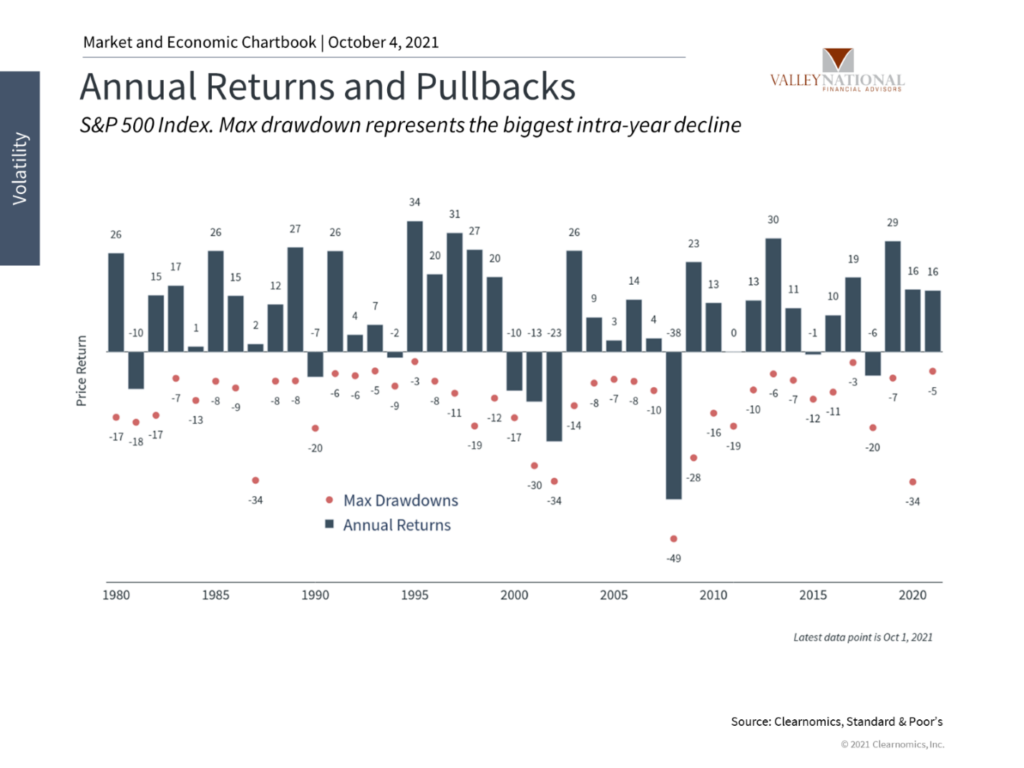

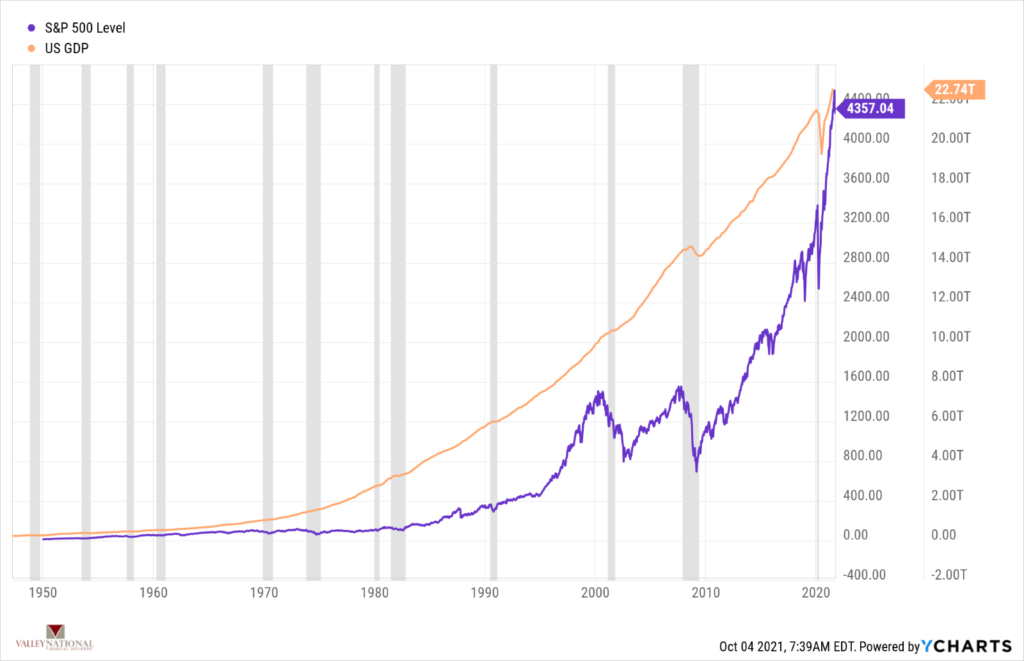

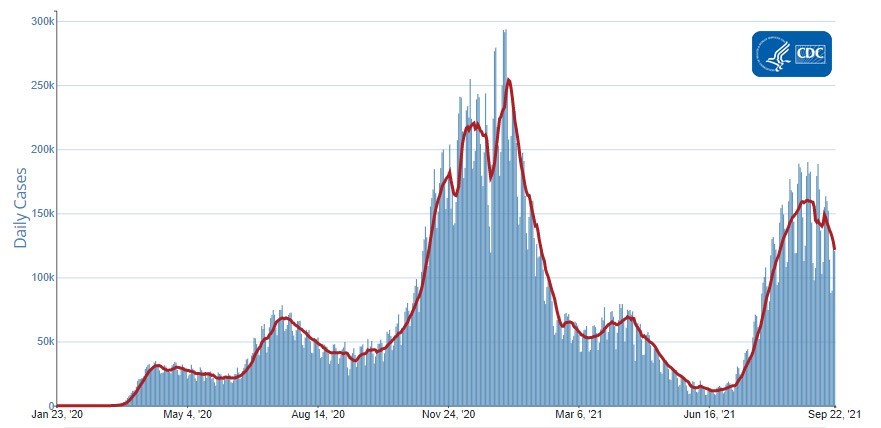

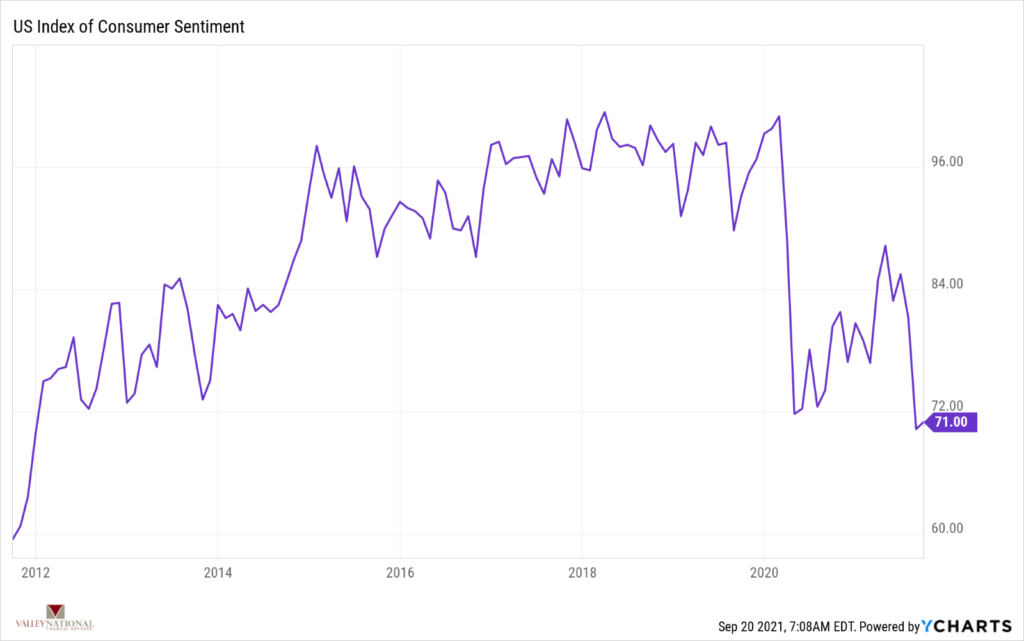

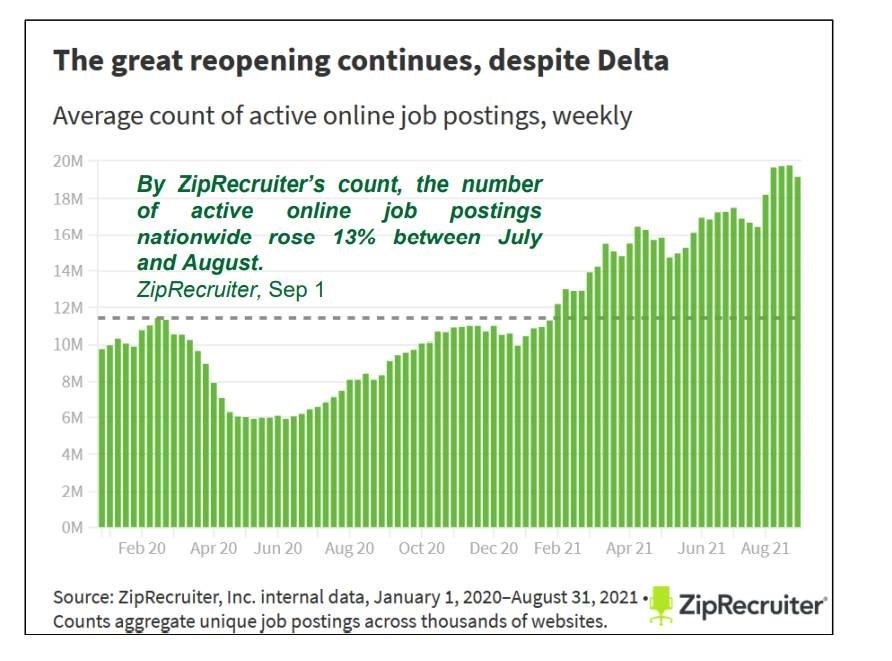

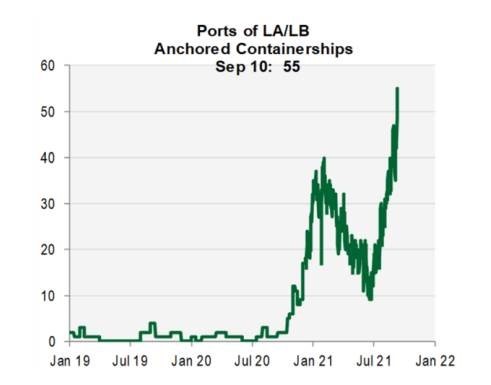

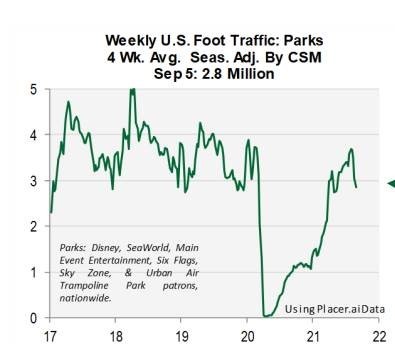

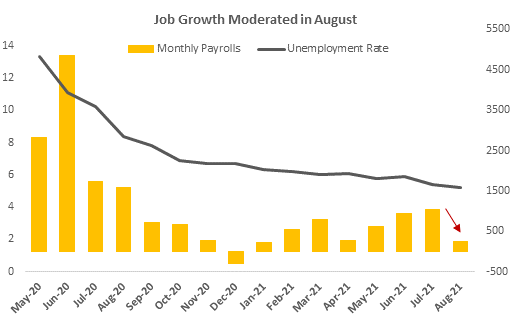

U.S. stocks were modestly down, between 1-2% in the case of each of the major indices, during Q3. Although Q2 corporate earnings (reported during Q3) were very strong, the positive results were already priced in, given that equity markets rose about 15% in the first half of 2021. Moreover, supply chain challenges were noted widely in company commentary, dampening the earnings outlook for Q3 and Q4. In the present environment, demand remains extremely strong – even in the face of the Delta Variant – but companies are struggling to meet said demand as labor and material shortages abound, while global logistics are obstructed by recurring covid outbreaks in Asia. Expectations are that consumer sentiment will remain very healthy for the foreseeable future, with the unemployment rate nearly back to long-run central bank targets, from as a high as 14.8% in April 2020, so the key determinant to corporate earnings over the coming periods is the health of the global supply environment.

Bonds

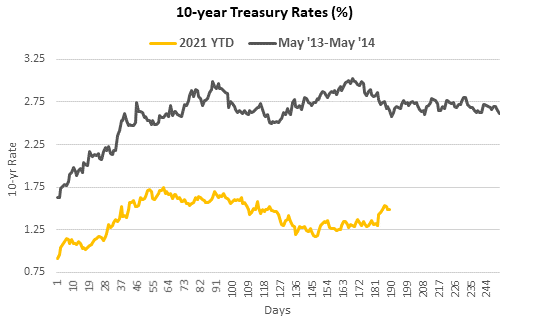

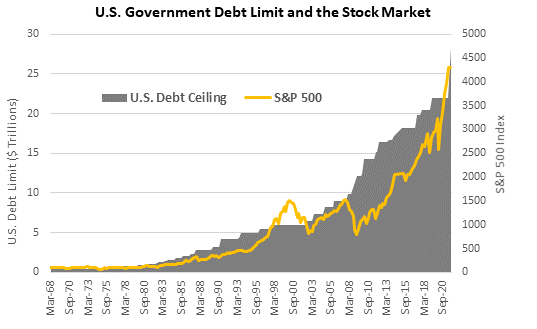

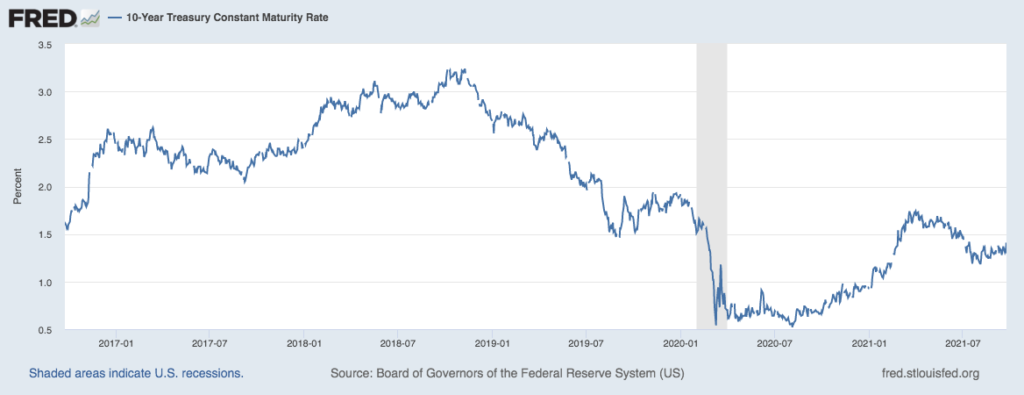

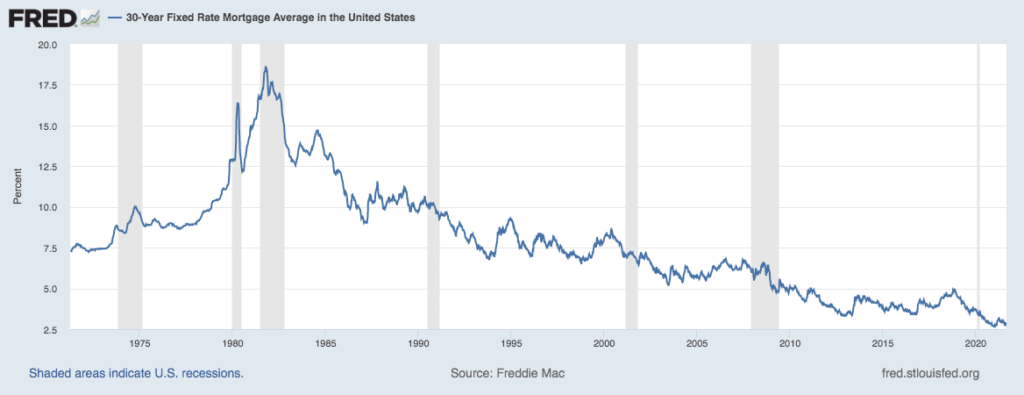

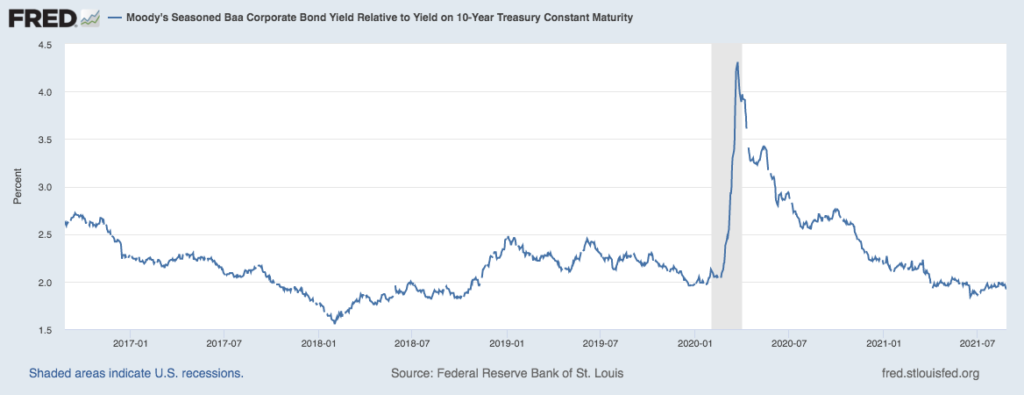

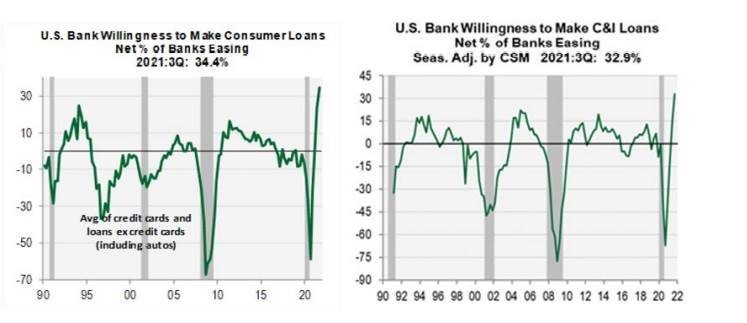

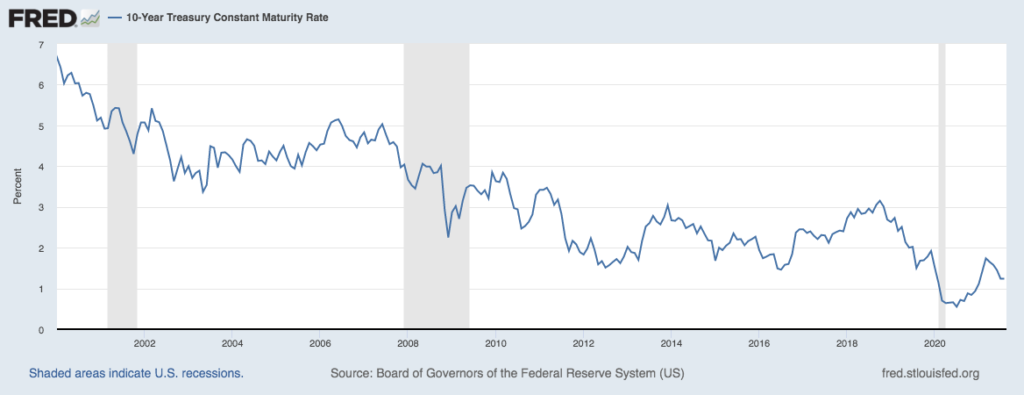

The ten-year Treasury Bond ticked up a bit, from 1.44% to 1.48%, between the first and last days of the quarter; correspondingly, bond indices were basically flat in Q3. However, rate volatility tells a different story: the ten-year declined to as low as 1.19% in early August and peaked at 1.55% in late September. In turn, bonds performed negatively in the last month of Q3 as rates rose. Nonetheless, rates remain very low, that is, accommodative to economic growth, in the context of the long-term precedent, with the U.S. economy historically operating with a ten-year around 4-5%.

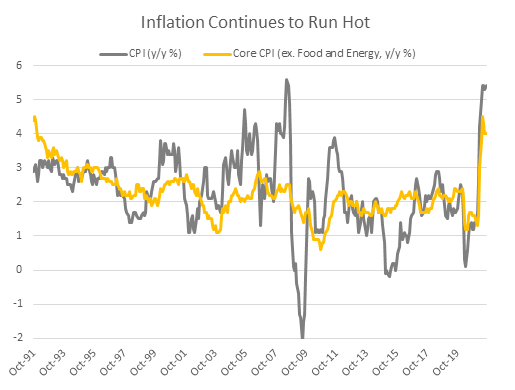

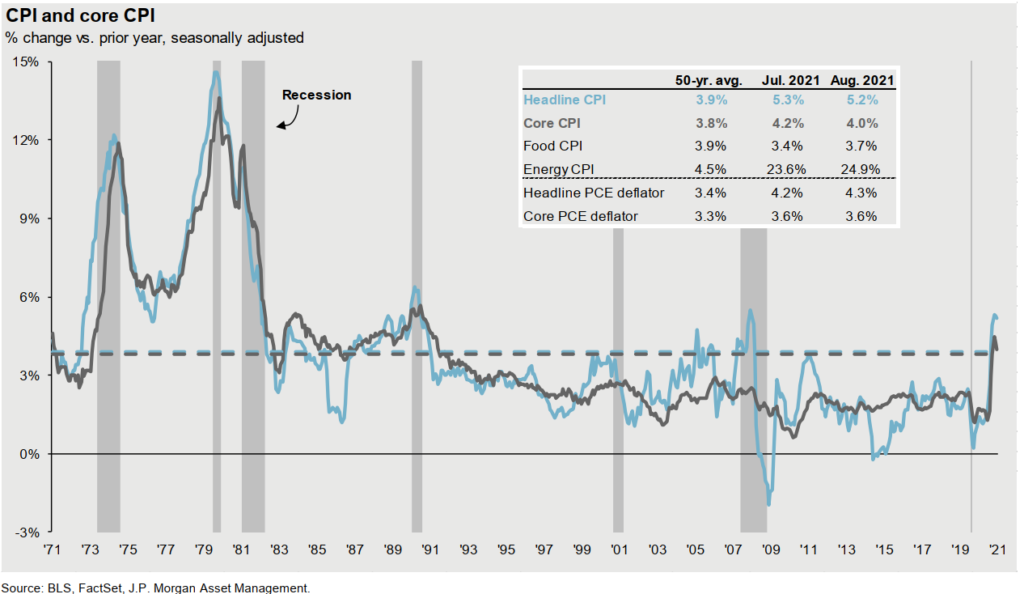

Inflation was high during the quarter, with CPI readings near 5%, because of the tight supply environment combined with booming consumer demand. Although economists and central bank personnel now believe inflation may be of greater permanence than previously considered, Q3 2021 could represent the inflation peak. Inflation was quite low following the Great Financial Crisis, so modestly higher and persistent price increases relative to pre-covid is not necessarily concerning. Fed Chairman, Jay Powell, indicates he will not be increasing rates until the end of 2022, and the probable future environment in which rates move higher, slowly and at a consistent pace, with inflation readings near 3%, is unlikely to be harmful to economic activity. Should inflation continue at clips near 5%, more rapid and material rate increases could be in order, which may present an obstacle to economic growth.

Outlook

Looking forward to the next 6-18 months, the most important economic issue is the status of supply. As previously noted, supply challenges are primarily deriving from 1) sheer natural resource shortages, 2) labor shortages, 3) logistics congestion resulting from covid outbreaks. It is impossible to know with certainty when global supply will resume in a fully functional, normalized way, however, generally speaking, the global economy is extraordinarily good at allocating resources such that demand is fulfilled. It may take up to a couple years for supply to resolve itself fully, during which inflation may be elevated around 3%, but as mentioned, this scenario is not a bad one for economic health. Demand should remain strong, though the U.S. labor shortage is likely to persist, challenging employers. Finally, a fiscal infrastructure bill remains up for vote, providing additional demand stimulus if passed.