by William

Henderson, Vice President / Head of Investments

U.S. stocks

finished last week modestly down across the board. The

Dow Jones Industrial Average fell -1.1%, the

S&P 500 Index lost -0.6%,

and the NASDAQ fell by

-0.7%. The

modest losses for the week did not take much from full

year 2021 returns, which remain healthy across

all three indexes. Year-to-date,

the Dow Jones Industrial Average has returned +16.1%,

the S&P 500 Index +19.4% and the

NASDAQ +14.7%. Treasury

bonds changed very

little last

week with

the yield on the 10-year U.S. Treasury

dropping two basis

points to 1.26% from 1.28% the

previous week. 1.26% on the 10-year U.S.

Treasury is a full 48 basis points

lower than the 1.74% yield level hit in March of this year. Further,

traders and equity markets certainly

were caught off guard last week when

the FOMC meeting minutes were

released and showed that the Central Bank was considering a “tapering” of bond

purchases. This had

to have been an “Emperor Has No Clothes” moment as the worst kept secret on

Wall Street was revealed. Everyone, everywhere

expects the Fed to taper its bond purchases, so why did the markets

sell off?

As we planned this

week’s market commentary, it was agreed that we would not follow the herd and

mention the “Taper Tantrum of 2013,” however, it

seems we failed. This event refers to the 2013 modest sell off in bonds

resulting from the Fed announcement that it would finally reduce bond purchases

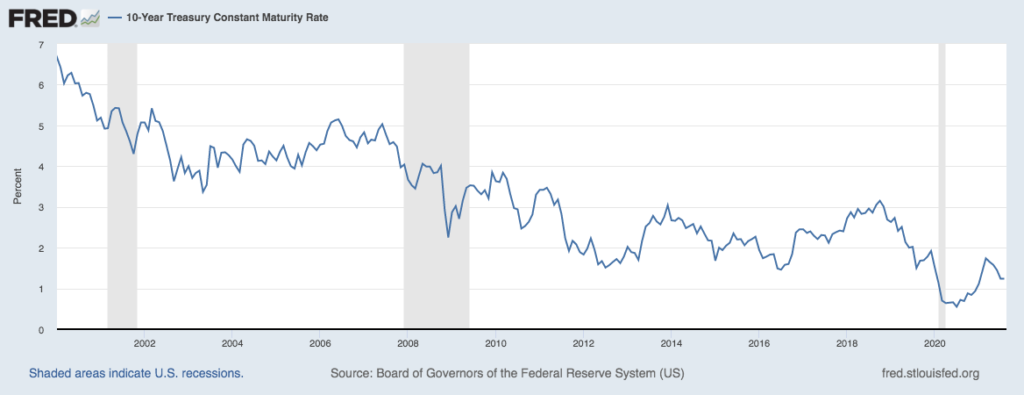

it had been making since 2008 because of the Great Financial Crisis. Looking

at the chart below from the Federal

Reserve Bank of St. Louis, the “event” of 2013 looks more like

a buying opportunity in bonds rather than a blood bath for bond traders as

the 10-year U.S. Treasury hit 3.04% at the end of 2013.

The point is that everyone knew in 2013 that the Fed needed to slow its bond purchases and allow the markets to return to somewhat normal trading patterns. Just like 2021 – everyone knows the Fed must slow its purchases. So, again, why did the markets sell off on last week’s news from the Fed meeting minutes? The markets are most likely seeing the gradual end to the massive monetary stimulus that the Fed has provided since March of 2020 and that simply removes a comfortable layer of protection and adds an unsettling layer of uncertainty.

There are two opposing thoughts: First, actions

by the Fed to reduce its

bond purchases thereby starting to remove monetary stimulus, shows the economy

is well on its way to a solid recovery. This is healthy news and should

eventually result in strong

market performance. Second and more worrisome

was the Fed’s last-minute change

to its annual symposium in Jackson Hole, Wyoming, to

a virtual event rather than the previously planned in

person event. The Fed’s decision to cancel

this live event is certainly indicative of wider

implications from the spiking in cases of delta-variant of COVID-19 and signs

of overall weakness in economic activity. Data

released from the Transportation Security Administration last Friday showed

a slowdown in travel, with the number of people passing through TSA checkpoints down

10% from a mid-July high. In our opinion, one could certainly brush off

this drop in travel as typical of the summer travel season ending and the “back

to school” season starting. Either way,

it is information and activity that the market must digest

and then react to in one way or another.

Just

like we need things to write about each week, so do the business news channels

needs things to talk about every day all day. Economic noise and

information are widely

available and overly celebrated. We like to focus on long-term trends like the 50-year growing

GDP of the United States, favorable demographic trends in the

U.S. compared to other developed countries, and finally, long-term performance

of stock and bond markets. Keep focused on your investment and ignore

the noise.