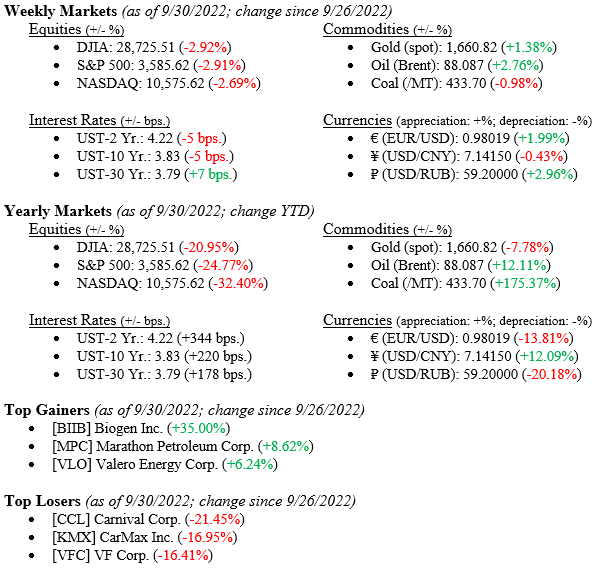

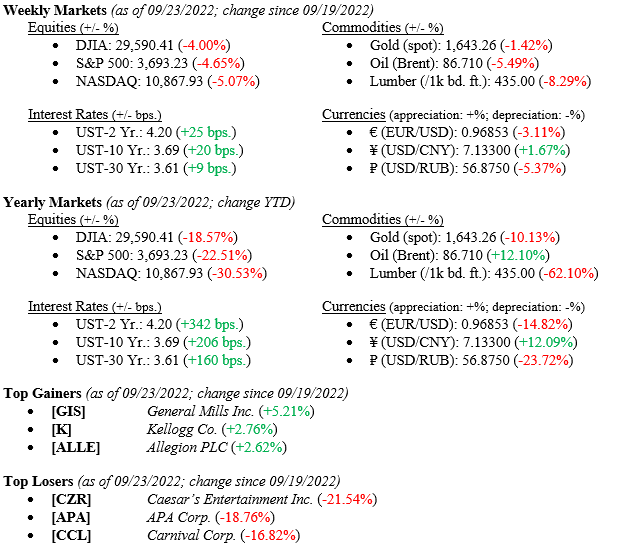

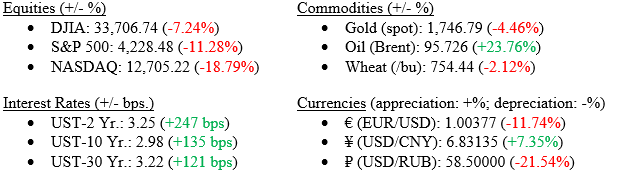

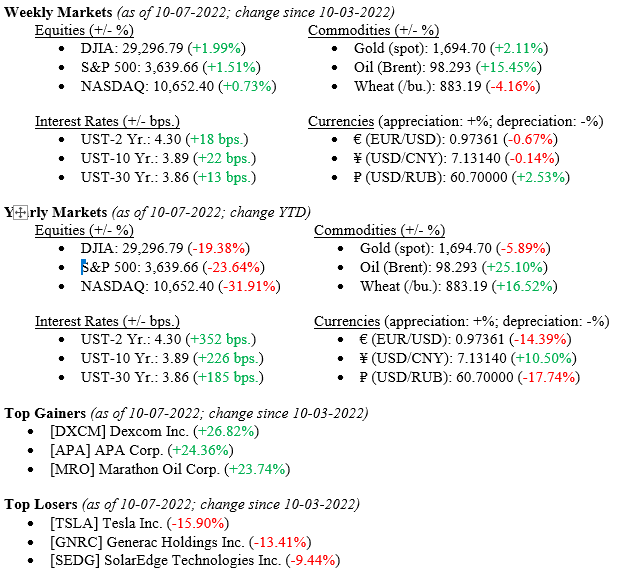

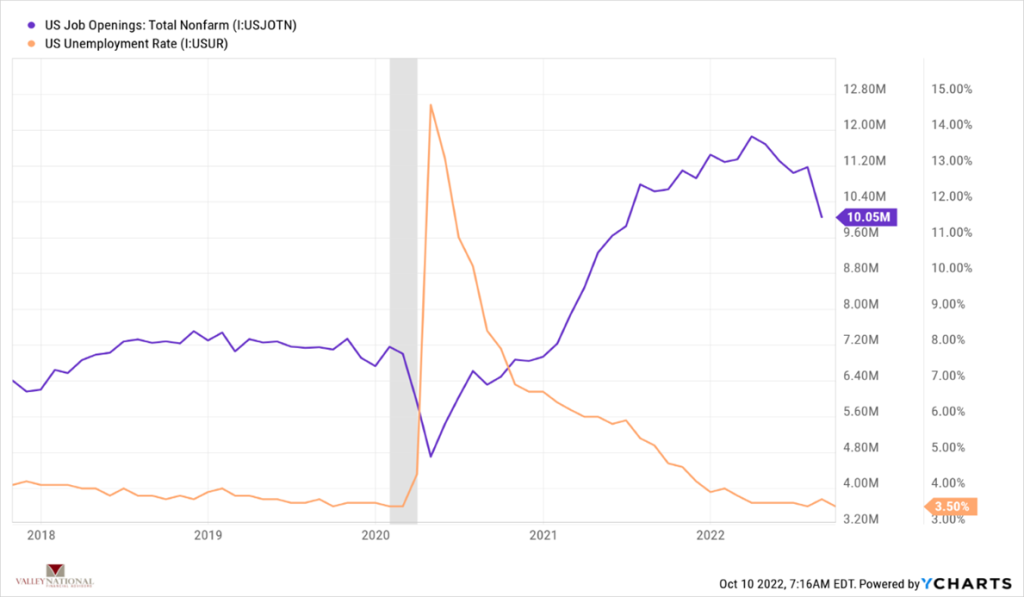

Equity markets posted their first weekly gain in several weeks as a surprise move by the Australian Central Bank to raise rates less than expected sparked a global rally in stocks. As the week progressed, hopes of an earlier “Fed Pivot” were dashed as little economic data released showed signs of a slowing economy or decreasing inflationary pressures. However, one small piece of economic data, Job Openings, released October 5 at 10.05 million vs. 11.17 million in the prior month showed a modest crack in the tight labor market.

U.S. Economy

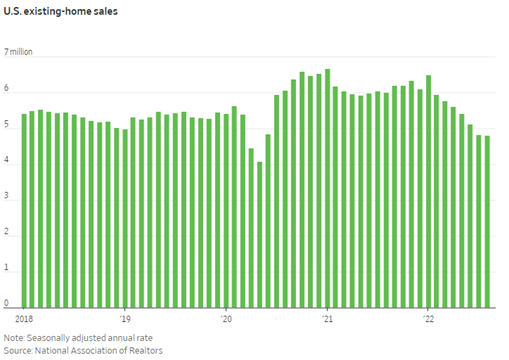

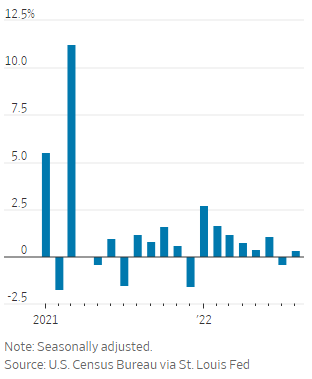

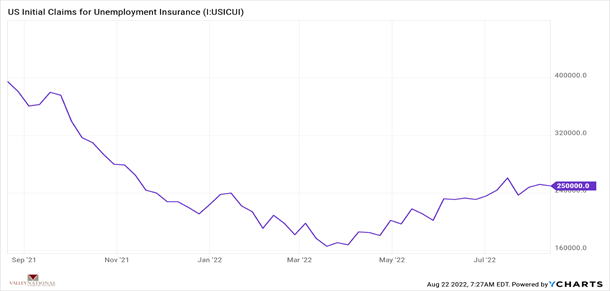

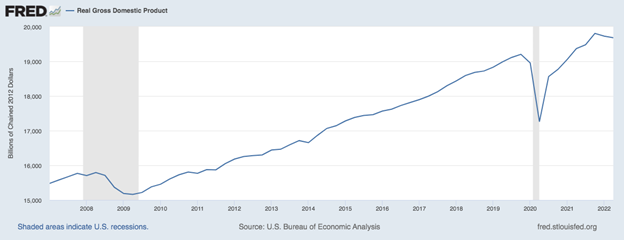

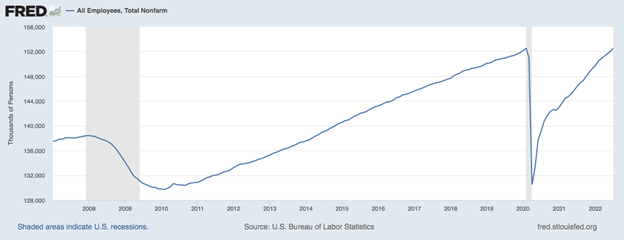

As mentioned, one piece of economic data from last week, U.S. Job Openings, which is a survey done to assess labor turnover, job openings, hires and separations, showed a decline from the prior month (-10%). Other labor data released last week including new jobs added (+263,000), unemployment (3.5%) and hourly earnings (+5%) all showed continued strength which means jobs data is strong enough to keep the Fed on track to hike interest rates +0.75% next month. The decrease in job openings shows that companies are slowing the pace of hiring before cutting jobs, therefore keeping the unemployment rate low. (See Chart 1 from Valley National Financial Advisors & Y Charts showing U.S. Job Openings and U.S. Unemployment Rate).

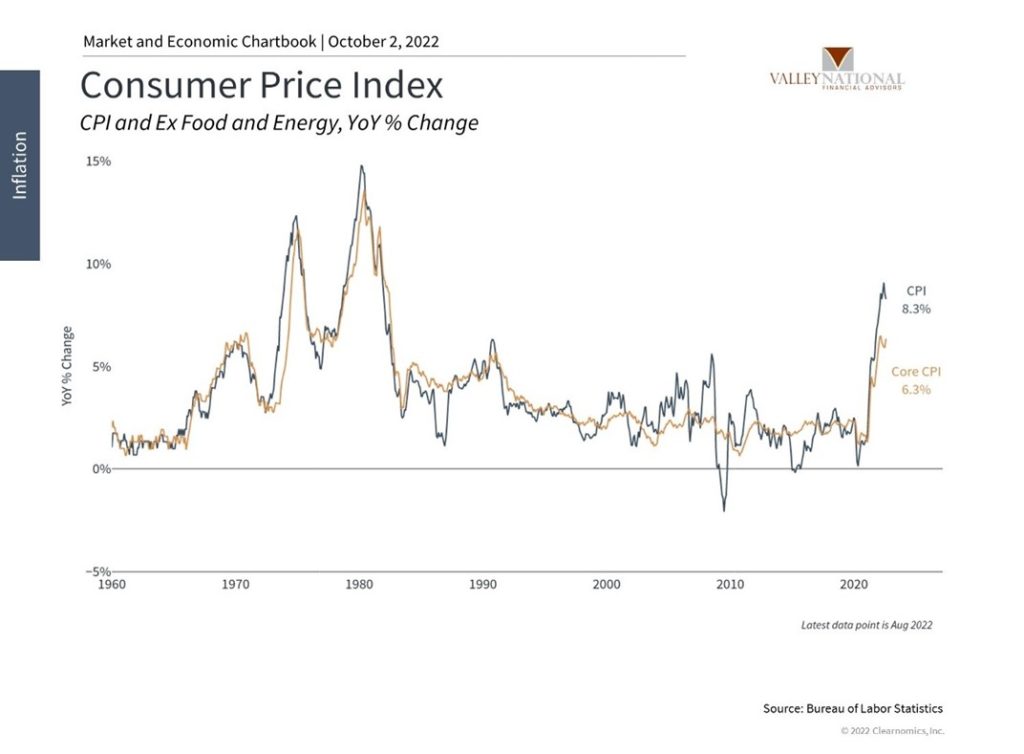

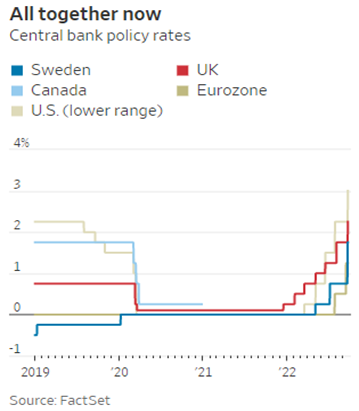

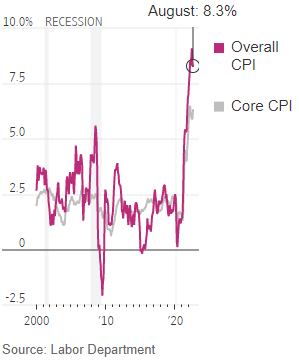

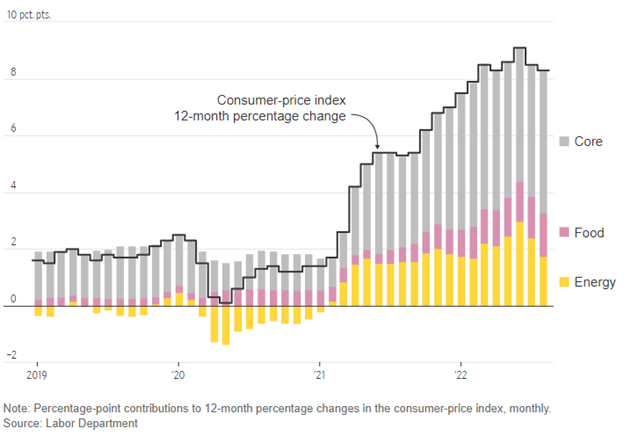

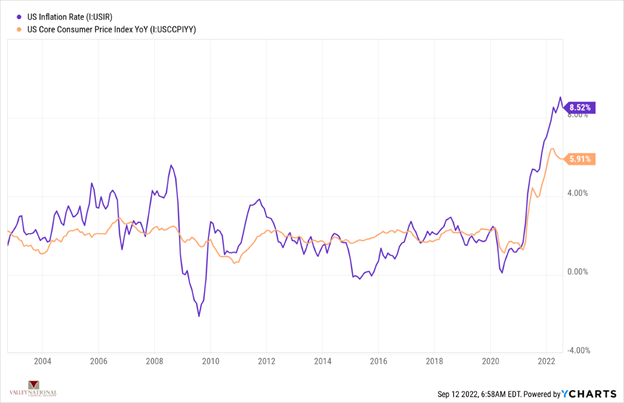

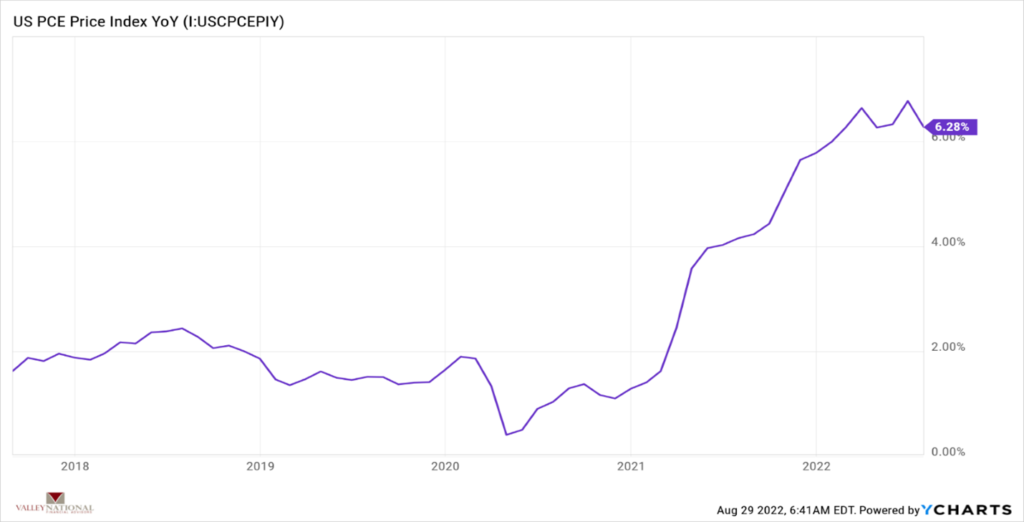

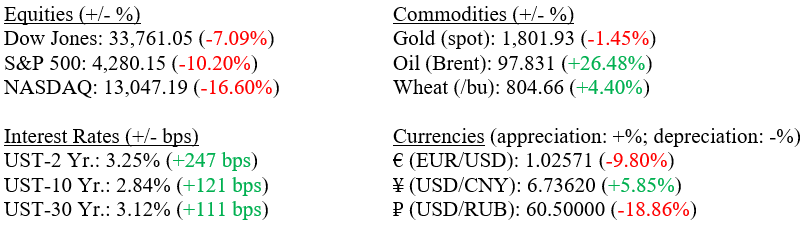

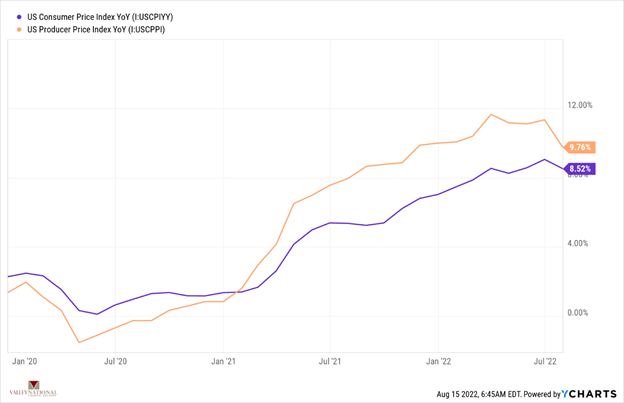

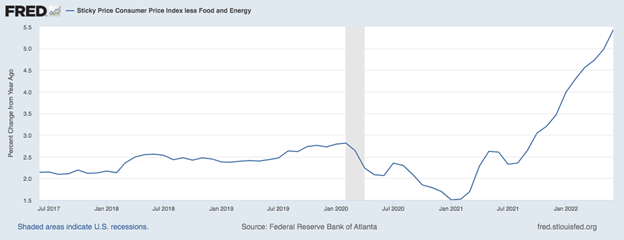

Last week’s labor trends were important, but this week’s inflation data is critically important because it will show whether the Fed’s aggressive interest rate tightening is having an impact on prices producers and consumers are paying. This is the critical data the Fed will be watching. Lastly, this week starts the third-quarter earnings season, which provides yet another reading of economic activity.

Policy and Politics

The Russia/Ukraine War is far from over. In fact, last week and this week we are seeing a drastic escalation in fighting with Vladmir Putin again casually mentioning nuclear weapons. We see this escalation as a severe threat to global stability and continued energy uncertainty and shortages for the Euro region. This opens the door (although unlikely to be used) for the U.S. to step up energy production via fracking, drilling or production and shipping of LNG (Liquefied Natural Gas) to Europe, for example.

What to Watch

- U.S. Core Producer Price Index year-over-year for September 2022, released 8:30am 10/12 (prior 7.26%)

- U.S. Producer Price Index year-over-year for September 2022, released 8:30am 10/12 (prior 8.72%)

- U.S. Consumer Price Index year-over-year for September 2022, released 8:30am 10/13 (prior 8.26%)

- U.S. Inflation Rate for September 2022, released 8:30am 10/13 (prior 8.26%)

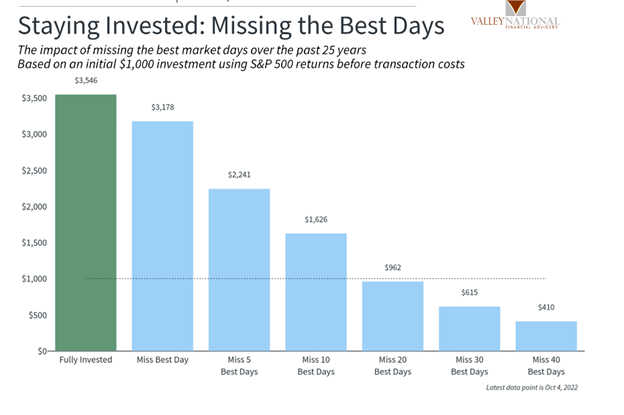

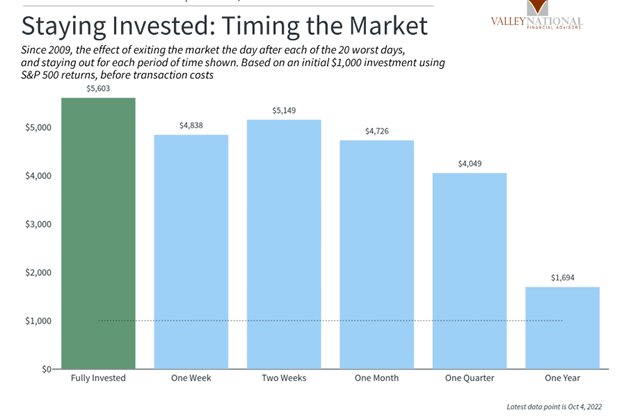

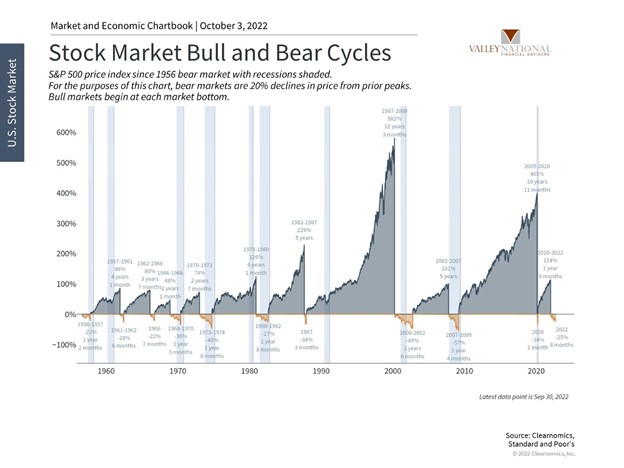

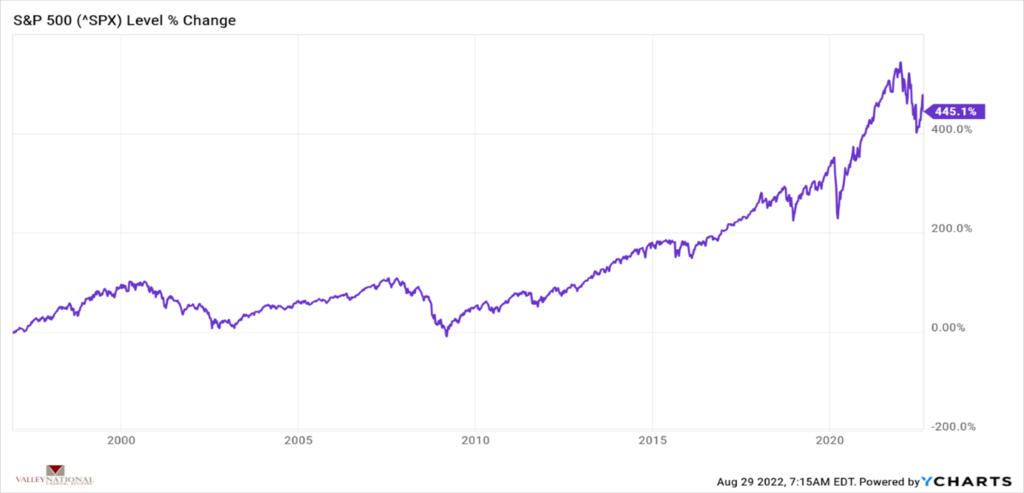

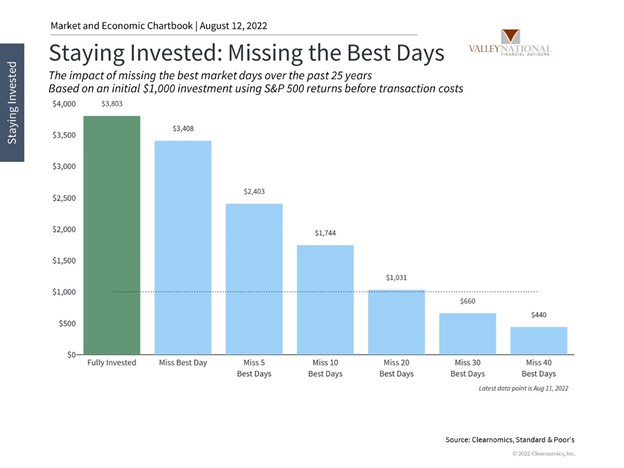

Last week we saw in just two trading sessions, the Dow Jones industrial Average gained over 5% (+1,328 points). An investor missing those two days by casually sitting on the sidelines rather than being invested, missed a major move in the markets which is why we always talk about “Time in the Markets” rather than “Timing the Markets.” Real, transferable, and generational wealth is gathered over extended periods of time by patient and committed investors. We leave you with two classic charts from Valley National Financial Advisors and Y Charts: (Staying Invested: Missing the Best Days and Timing the Market).