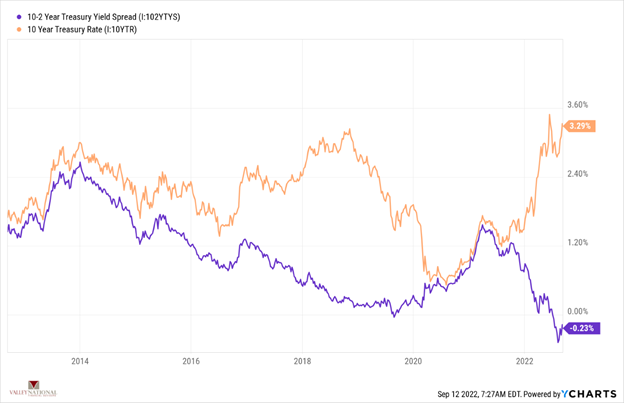

The equity markets recovered nicely last week with gains of +1.6% (Dow Jones) to +2.8% (NASDAQ) while the bond market remained quiet, trading in a tight range with the 10-Year U.S. Treasury remaining unchanged to close the week at 3.33%. There were three key themes last week positively impacting the markets: 1) Traders and economists are starting to agree that we are approaching the end of the Fed’s interest rate tightening cycle, 2) Global disinflation 3) Earnings estimates are holding steady rather than declining.

Global Economy

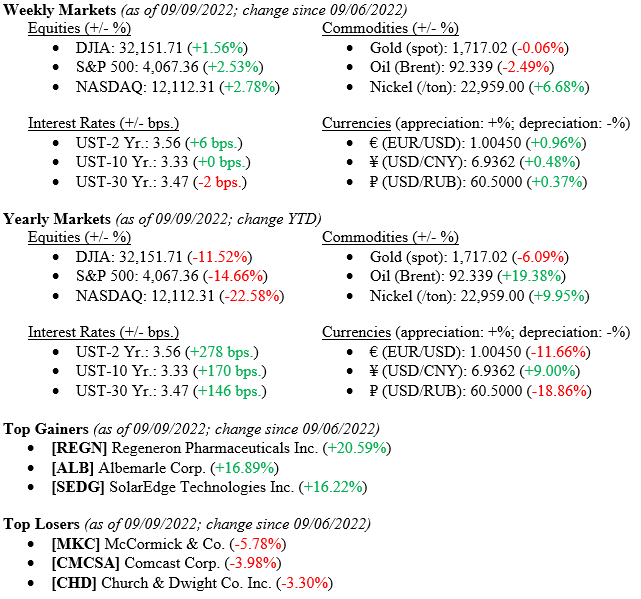

As mentioned above, we are finally starting to see some disinflationary indicators. See Chart 1 from Valley National Financial Advisors and Y Charts showing the U.S. Inflation Rate (year-over-year) and U.S. Core Consumer Price Index (year-over-year). After both rates peaked at recent record levels, we have seen these indicators coming down and these are two key rates the Fed looks at when considering future interest rate moves. Reminder – the FOMC (Federal Open Markets Committee) meets September 20-21, and they are widely expected to raise rates another 0.75%, to a target rate of 3.25%. We believe the terminal rate for Fed Funds Rate is 3.50% – 4.00%.

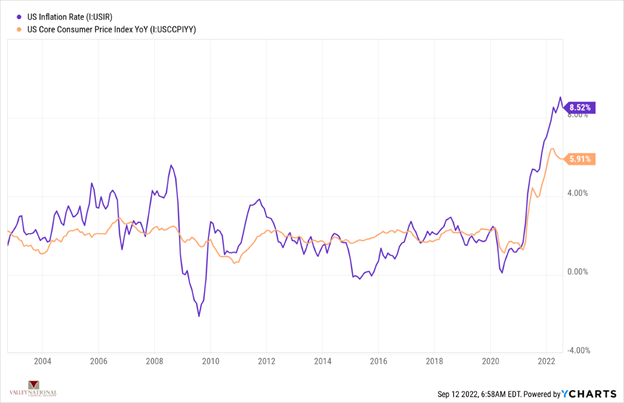

Further, yields on the 10-Year US Treasury have stabilized and, in fact, now offer investors a reasonable rate of return at 3.33%. The 10-Year US Treasury rate in June peaked at 3.48% and has since fallen, however the 10s – 2s yield curve remains negative as fixed income investors worry about a recession (See Chart 2 below from Valley National Financial Advisors and Y Charts).

Policy and Politics

While the Russia / Ukraine war ravages on, Ukraine is making major moves to push back Russian advances and the media is pushing a “Ukrainian Victory” narrative. This would be a stunning upset and a global black eye for Russian President Vladmir Putin. What concerns us is Putin’s reaction from here: whether retaliatory in terms of further energy cut offs to Europe or drastic military actions. Either way, this issue remains an unknown and a concern.

The U.S. labor market remains resilient and extremely healthy. In August, non-farm payrolls increased by more than expected and the unemployment rate decreased to 3.5%. Further, there continues to be broad based job gains across all sectors, which supports the premise that the U.S. economy is holding up well despite tightening financial conditions brought on by the monetary policy of the Fed.

What to Watch

- U.S. Inflation Rate for August 2022 released at 8:30am on 9/13/22 (prior 8.52%)

- U.S. Core Consumer Price Index for August 2022 released at 8:30am on 9/13/22 (prior 5.91%)

- U.S. Producer Price Index for August 2022 released 8:30am on 9/14/22 (prior 9.76%)

- U.S. Initial Claims for Unemployment Ins. for week of Sept 10, 2022, released 8:30am 9/15/22

Summary

While inflation is abating, global concerns exist in Europe with energy prices and shortages, the Russia / Ukraine war, and COVID-related lockdowns in China. The U.S. remains on a solid recovery path with companies successfully dealing with pricing issues and thereby continuing to show earnings growth, albeit at a more tepid pace. The strong labor market, healthy bank, and consumer balance sheets all look to power the U.S. economy to a rebound in economic activity though year-end 2022.