Q3 estimated payment reminder

Third quarter estimated tax payments are due September 15, 2022. These estimates may include federal, state and/or local vouchers depending on your situation.

There may be situations where the estimates were generated, but an overpayment was applied in full or in part. If your income or withholdings have significantly changed since last year, please contact your tax preparer to review. If you change or do not make the estimates, let your tax preparer know at tax filing time.

Daily Archives: September 13, 2022

Current Market Observations

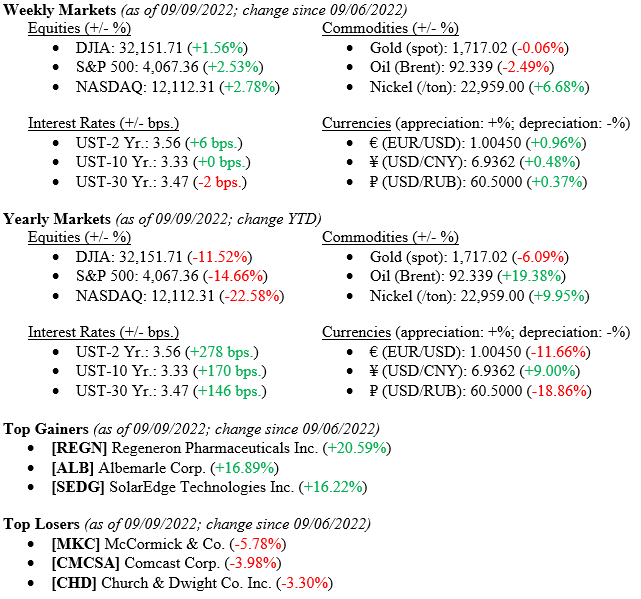

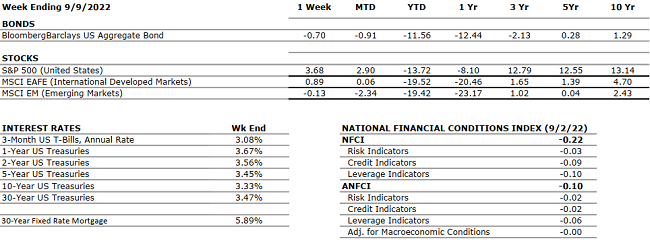

The equity markets recovered nicely last week with gains of +1.6% (Dow Jones) to +2.8% (NASDAQ) while the bond market remained quiet, trading in a tight range with the 10-Year U.S. Treasury remaining unchanged to close the week at 3.33%. There were three key themes last week positively impacting the markets: 1) Traders and economists are starting to agree that we are approaching the end of the Fed’s interest rate tightening cycle, 2) Global disinflation 3) Earnings estimates are holding steady rather than declining.

Global Economy

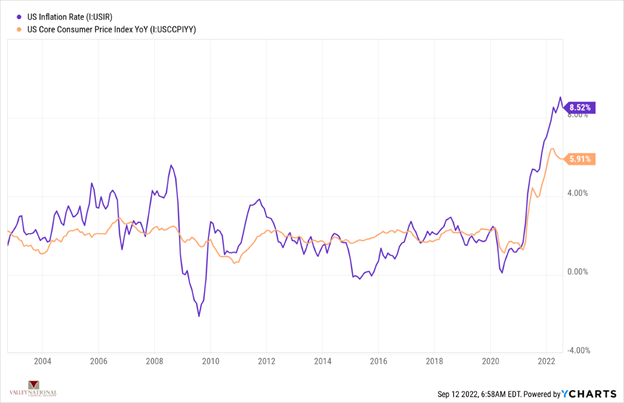

As mentioned above, we are finally starting to see some disinflationary indicators. See Chart 1 from Valley National Financial Advisors and Y Charts showing the U.S. Inflation Rate (year-over-year) and U.S. Core Consumer Price Index (year-over-year). After both rates peaked at recent record levels, we have seen these indicators coming down and these are two key rates the Fed looks at when considering future interest rate moves. Reminder – the FOMC (Federal Open Markets Committee) meets September 20-21, and they are widely expected to raise rates another 0.75%, to a target rate of 3.25%. We believe the terminal rate for Fed Funds Rate is 3.50% – 4.00%.

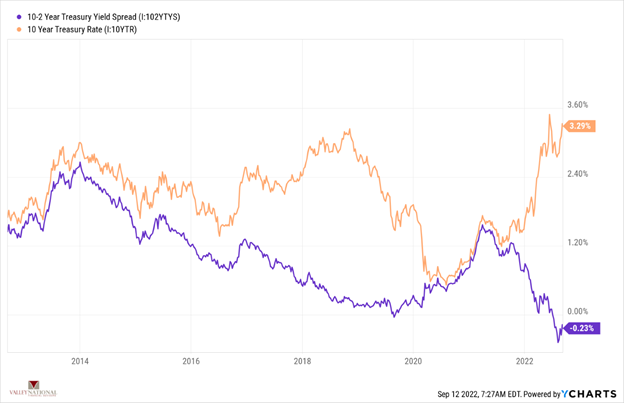

Further, yields on the 10-Year US Treasury have stabilized and, in fact, now offer investors a reasonable rate of return at 3.33%. The 10-Year US Treasury rate in June peaked at 3.48% and has since fallen, however the 10s – 2s yield curve remains negative as fixed income investors worry about a recession (See Chart 2 below from Valley National Financial Advisors and Y Charts).

Policy and Politics

While the Russia / Ukraine war ravages on, Ukraine is making major moves to push back Russian advances and the media is pushing a “Ukrainian Victory” narrative. This would be a stunning upset and a global black eye for Russian President Vladmir Putin. What concerns us is Putin’s reaction from here: whether retaliatory in terms of further energy cut offs to Europe or drastic military actions. Either way, this issue remains an unknown and a concern.

The U.S. labor market remains resilient and extremely healthy. In August, non-farm payrolls increased by more than expected and the unemployment rate decreased to 3.5%. Further, there continues to be broad based job gains across all sectors, which supports the premise that the U.S. economy is holding up well despite tightening financial conditions brought on by the monetary policy of the Fed.

What to Watch

- U.S. Inflation Rate for August 2022 released at 8:30am on 9/13/22 (prior 8.52%)

- U.S. Core Consumer Price Index for August 2022 released at 8:30am on 9/13/22 (prior 5.91%)

- U.S. Producer Price Index for August 2022 released 8:30am on 9/14/22 (prior 9.76%)

- U.S. Initial Claims for Unemployment Ins. for week of Sept 10, 2022, released 8:30am 9/15/22

Summary

While inflation is abating, global concerns exist in Europe with energy prices and shortages, the Russia / Ukraine war, and COVID-related lockdowns in China. The U.S. remains on a solid recovery path with companies successfully dealing with pricing issues and thereby continuing to show earnings growth, albeit at a more tepid pace. The strong labor market, healthy bank, and consumer balance sheets all look to power the U.S. economy to a rebound in economic activity though year-end 2022.

The Numbers & “Heat Map”

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Q1 2022 Real GDP shrunk at a 1.6% annual rate. The main factors that resulted in a decrease in GDP were a surge in imports and trade deficit highlighting that the U.S. is buying more goods from foreign countries. According to the second estimate, real GDP for Q2 2022 decreased at an annual rate of 0.6% (up from the first estimate of -0.9%) marking the second consecutive quarter of declining GDP. |

|

CORPORATE EARNINGS |

NEUTRAL |

The earnings growth rate for Q2 2022 was 6.7% (up from previous estimates of 4.3%) which marked a new post-pandemic low; but still solidly in the “growth” stage. The estimated growth rate for Q3 2022 is 3.7%, which was adjusted downward from 9.8% in June. |

|

EMPLOYMENT |

NEUTRAL |

U.S. Nonfarm Payrolls for August 2022 increased by 315,000 and the unemployment rate for August rose slightly to 3.7% compared to 3.5% in July. Professional and business services, health care, and retail trade were among the sectors with the most notable job gains. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the U.S. increased by 8.5% for July 2022. The gasoline index fell 7.7% and the energy index fell 4.6% which offset the increases in food and shelter indexes. The PPI decreased 0.5% in July and registered a year-over-year gain of 9.8%. PCE (Personal Consumption Expenditures) fell to 6.28% in July vs 6.80% for June. |

|

FISCAL POLICY |

NEUTRAL |

Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill with incentives for green energy, electric cars, and conversely oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. Last week, President Biden announced student loan forgiveness of up to $20,000 subject to income limitations. |

|

MONETARY POLICY |

NEGATIVE |

With inflation still running hot, Fed Chairman Jay Powell is clear on his path to slow the economy enough to cool inflation. This plan has been reiterated at the Jackson Hole symposium. The next Fed meeting is September 20-21 and markets are pricing in another 0.50-0.75% increase in short- term rates to continue to battle inflation. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia has defaulted on its debt as of late June for the first time since 1918. Sanctions imposed by Western powers effectively isolated Russia and its financial system from Europe and the U.S. making it much harder for Russia to complete international financial transactions. On a good note – Israel and Turkey have restored diplomatic ties and will be exchanging ambassadors again after four years. This should result in a significant improvement in regional stability. |

|

ECONOMIC RISKS |

NEGATIVE |

COVID-19 lockdowns in China are persistent and the ongoing Russian-Ukraine war is causing a major energy crisis in Europe. Putin shut down the pipeline that supplies Europe with natural gas indefinitely until all sanctions affecting Russia are lifted. European countries are struggling to find alternative energy resources and are starting to implement significant restrictions on the use of energy in households and businesses. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“True success, true happiness lies in freedom and fulfillment.’” – Dada Vaswani

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” on WDIY 88.1FM. Laurie will welcome Rob Ziobro, Assistant Vice President of Technology at Valley National Financial Advisors to discuss: Back to school with CYBERSECURITY

Questions can be submitted at yourfinancialchoices.com during or in advance of the live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.