Our offices will be closed until noon on Friday, November 1 for our annual compliance and security training. A client service representative will be available to assist you in the afternoon, and your advisory teams will be checking e-mail and voicemail periodically throughout the day.

Monthly Archives: October 2019

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

Stocks continued their positive start to the fourth quarter as markets grappled with a mixed bag of corporate earnings results, additional delays in the Brexit negotiations, and a lack of further developments in the U.S./China trade dispute. The United States and China are reportedly close to a “phase one” agreement which may be signed by next month, but with both sides interested in projecting strength to the rest of the world, it may be another long wait before a “phase two” agreement is reached. International stocks have outperformed U.S. stocks so far in the fourth quarter as optimism surrounding trade has improved.

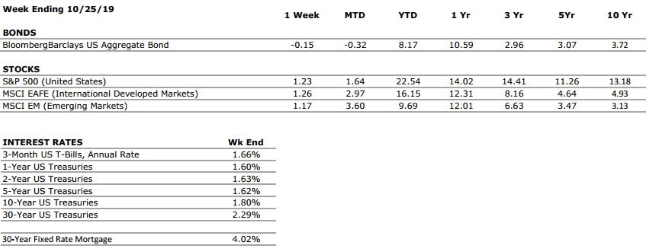

Interest rates moved slightly higher during the week, with the 10-year Treasury reaching the 1.80% mark. Rates are likely to take center stage this week as the Federal Reserve convenes for its penultimate meeting of 2019. Markets are expecting another rate cut, which would be the third this year.

Cash Not What It Used to Be

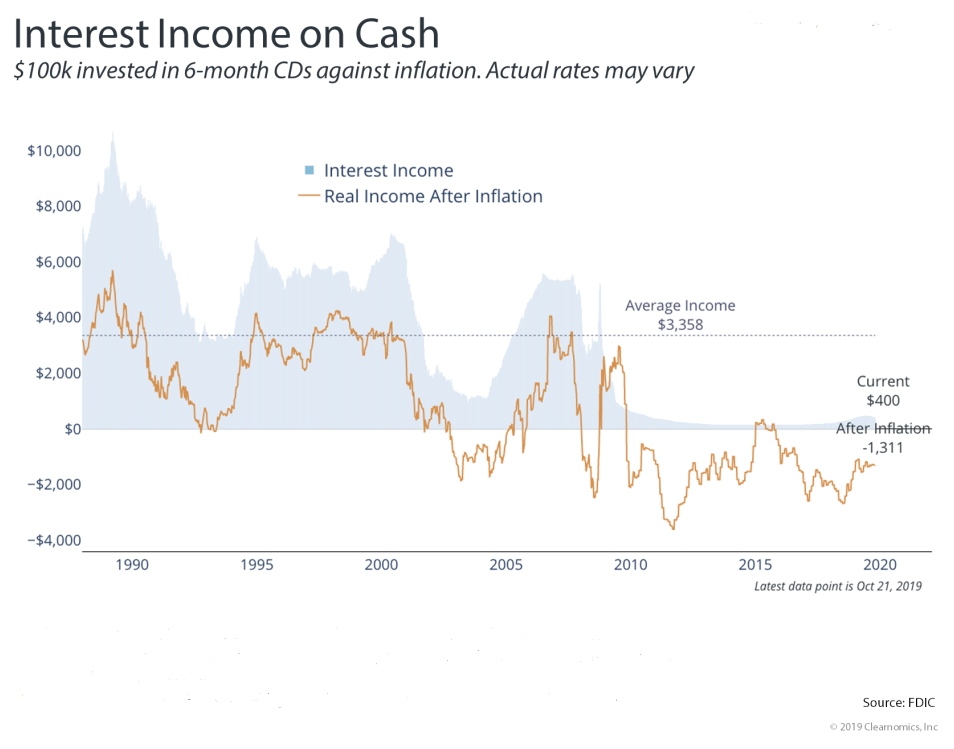

With both stock and bond markets generating strong returns in 2019 despite rising economic and geopolitical uncertainty, many investors have grown concerned about future market returns. In a recent poll conducted by Barron’s, the percentage of professional money managers calling themselves “bullish” has decreased to its lowest level in 20 years. As a result of waning optimism, many investors have begun pondering the role of cash in a diversified portfolio, and our general belief is that it still pays to stay invested. The chart below provides a picture of the true return on cash when factoring in inflation. Since the financial crisis, cash yields have been extremely low as a result of aggressive monetary policies, and with the Fed no longer raising rates, it is unlikely that cash yields will be moving higher in the near future. Adjusting for inflation, investors who choose to sit things out in cash are still losing significant purchasing power over time.

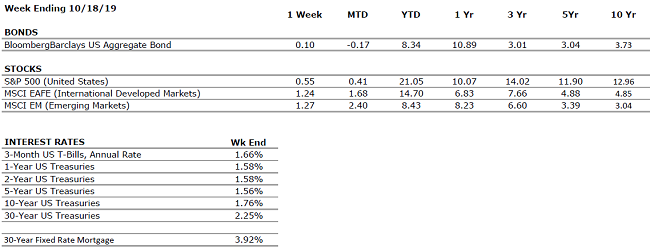

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A despite a recent decline in retail sales numbers. US consumer confidence remains high, but we will be watching this metric closely over the next couple of weeks and throughout earnings season. The consumer has been the bedrock of the US economy through much of the current expansion. |

|

FED POLICIES |

A- |

Our Fed Policies grade has been increased to A- after the Federal Reserve cut its interest rate target by 25 bps following its September meeting. The Fed will be meeting again this week and markets are expecting an additional rate cut, which would be the third cut this year. |

|

BUSINESS PROFITABILITY |

B- |

As was largely expected by markets, corporate earnings growth has been weak thus far in Q3 as a result of the global slowdown and trade policy uncertainty. Throughout earnings season, we will be paying closer attention to management commentary and updates to forward guidance, which are likely to have a bigger impact on stock prices. |

|

EMPLOYMENT |

A |

The US economy added 136,000 new jobs in September, below the consensus expectations of analysts. However, despite the lower than expected job creation, there was evidence of an acceleration of wage growth. The labor market continues to look quite healthy. |

|

INFLATION |

A |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. Recent inflationary data has increased slightly, but inflation remains benign at this time, which bodes well for the extension of the economic cycle. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

Following a re-escalation of the US/China trade dispute, we have raised our “international risks” metric back to a 7. Other key areas of focus for markets include the ongoing Brexit negotiations, rising economic nationalism around the globe, and escalating tensions in the Middle East. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Adopt the pace of nature: her secret is patience.” – Ralph Waldo Emerson

From The Pros… VIDEO

Tax-Savvy Charitable Giving

Senior Vice President Rod Young, CPA/PFS, CFP® offers ideas for maximizing your tax planning to incorporate charitable giving within the updated tax law landscape. WATCH NOW

RELATED ITEMS

AUDIO: Charitable Giving & Itemized Deductions

Laurie Siebert, CPA, CFP®, AEP® discusses charitable giving during WDIY’s annual Fall Pledge Drive on “Your Financial Choices: – Conversation Radio for Your Financial Life. LISTEN NOW

VIDEO: Charity – Deductible (and Non-Deductible) Donations

Associate Financial Advisor Jessica Goedtel, CFP® touches on a few common types of charitable contributions. WATCH NOW

“Your Financial Choices”

“Your Financial Choices”

The

show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by

Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie and her guest Ryan Fields, Esq. from King, Spry, Herman, Freund & Faul will discuss: “Estate Planning Basics (and Beyond).”

Laurie and her guest will take your questions live on the air at 610-758-8810 or in advance via yourfinancialchoices.com/contactlaurie.

Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

The Markets This Week

by Connor Darrell

CFA, Assistant Vice President – Head of Investments

Both

equities and bonds managed to creep higher last week, with equities fueled by

positive developments in global politics (Brexit and U.S./China trade

negotiations) and bonds buoyed by a drop in short-term yields that was likely

driven by weaker than expected retail sales data. The 0.3% decline in U.S.

retail sales was the first monthly decline since February and was primarily a

product of a decrease in so-called “noncore” spending, which includes auto

sales, purchases at gas stations, and building materials stores. Moving

forward, many will be watching this and other consumer data very closely in an

effort to get a feel for whether the weakness in manufacturing has permeated to

other areas of the economy. For now, this looks more like a blip rather than a

sustained downward trend, and the U.S. consumer should continue to benefit from

the healthiest labor market in decades.

Politics and the Market

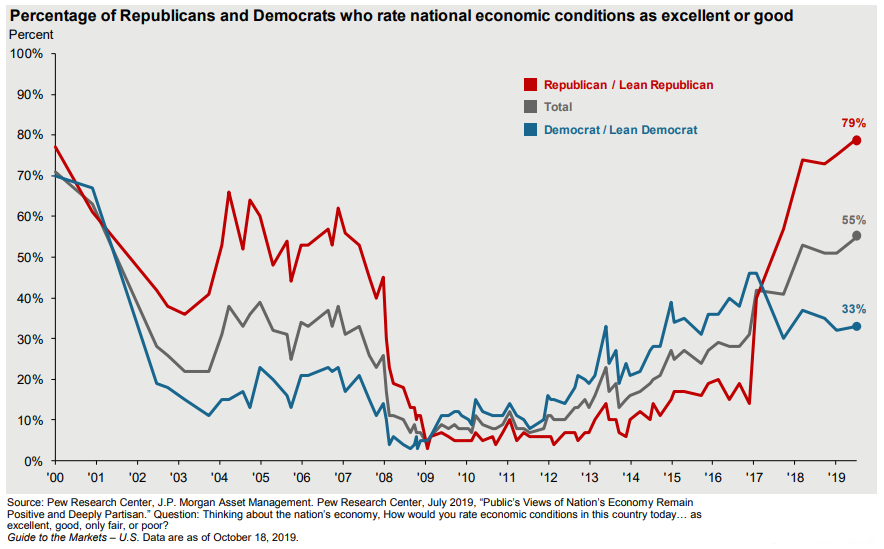

As the political climate has continued to become more and more polarized in recent years, many Americans have had a hard time separating politics from investing. We believe the below chart from JPMorgan does an excellent job of helping to convey the importance of investing discipline during periods of difficult political transition.

The chart shows consumer confidence broken down by political affiliation and tells an interesting story. Beginning in 2008 at the onset of the Great Recession, it is clear and unsurprising that neither Republicans nor Democrats felt optimistic about the economy. But as the market and economy recovered during the Obama administration, optimism among Democrats increased at a significantly higher rate. Then, almost overnight in the beginning of 2017, optimism among Republicans skyrocketed and subsequently tapered off among Democrats. Based on the data, it is clear that many Republican-leaning investors may have missed out on the strong market gains during the Obama years, and that many Democrat-leaning investors may have missed out on the market rally that transpired during the Trump years.

With all the talk of concerns over the global economy and weakening manufacturing, the consumer remains pivotal in determining how much juice is left in this economic expansion. With that as a backdrop, one other intriguing aspect of the above chart is that at present, consumer confidence among Republican-leaning investors remains very high. Market sentiment and economic activity are quite sensitive to consumer perceptions of the future, and it certainly makes it more difficult for the economy to turn toward recession if roughly half the population believes things are still looking great.

The Number & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

U.S. ECONOMIC HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A |

Our consumer spending grade remains an A despite a recent decline in retail sales numbers. US consumer confidence remains high, but we will be watching this metric closely over the next couple of weeks and throughout earnings season. The consumer has been the bedrock of the US economy through much of the current expansion. |

|

FED POLICIES |

A- |

Our Fed Policies grade has been increased to A- after the Federal Reserve cut its interest rate target by 25 bps following its most recent meeting. This marks the second time the Fed has cut interest rates in the past few months, but Chairman Jerome Powell hinted that he does not expect “a more extensive series of rate cuts” moving forward. |

|

BUSINESS PROFITABILITY |

B- |

As was largely expected by markets, corporate earnings growth has been weak thus far in Q3 as a result of the global slowdown and trade policy uncertainty. Throughout earnings season, we will be paying closer attention to management commentary and updates to forward guidance, which are likely to have a bigger impact on stock prices. |

|

EMPLOYMENT |

A |

The US economy added 136,000 new jobs in September, below the consensus expectations of analysts. However, despite the lower than expected job creation, there was evidence of an acceleration of wage growth. The labor market continues to look quite healthy. |

|

INFLATION |

A |

Inflation is often a sign of “tightening” in the economy and can be a signal that growth is peaking. Recent inflationary data has increased slightly, but inflation remains benign at this time, which bodes well for the extension of the economic cycle. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

7 |

Following a re-escalation of the US/China trade dispute, we have raised our “international risks” metric back to a 7. Other key areas of focus for markets include the ongoing Brexit negotiations, rising economic nationalism around the globe, and escalating tensions in the Middle East. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Our goals can only be reached through a vehicle of a plan in which we must fervently believe, and upon which we must vigorously act. There is no other route to success.” – Pablo Picasso

Did You Know…?

The FAFSA application season began October 1 and deadline for the 2019-2020 FAFSA is midnight, Central Time, June 30, 2020. SavingforCollege.com prepared some tips for filing. READ THE ARTICLE