by Connor Darrell

CFA, Assistant Vice President – Head of Investments

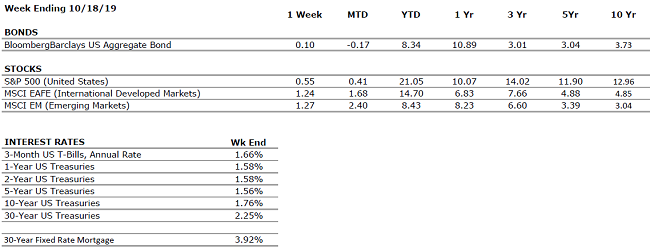

Both

equities and bonds managed to creep higher last week, with equities fueled by

positive developments in global politics (Brexit and U.S./China trade

negotiations) and bonds buoyed by a drop in short-term yields that was likely

driven by weaker than expected retail sales data. The 0.3% decline in U.S.

retail sales was the first monthly decline since February and was primarily a

product of a decrease in so-called “noncore” spending, which includes auto

sales, purchases at gas stations, and building materials stores. Moving

forward, many will be watching this and other consumer data very closely in an

effort to get a feel for whether the weakness in manufacturing has permeated to

other areas of the economy. For now, this looks more like a blip rather than a

sustained downward trend, and the U.S. consumer should continue to benefit from

the healthiest labor market in decades.

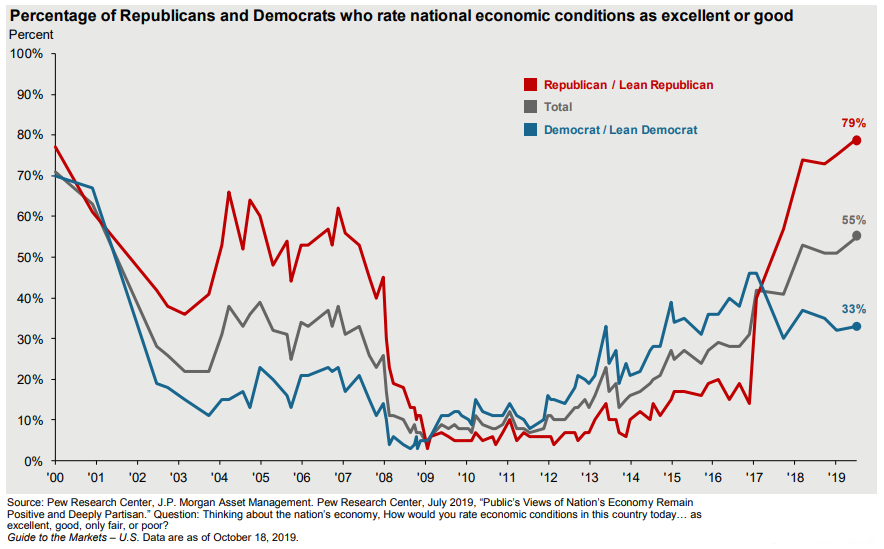

Politics and the Market

As the political climate has continued to become more and more polarized in recent years, many Americans have had a hard time separating politics from investing. We believe the below chart from JPMorgan does an excellent job of helping to convey the importance of investing discipline during periods of difficult political transition.

The chart shows consumer confidence broken down by political affiliation and tells an interesting story. Beginning in 2008 at the onset of the Great Recession, it is clear and unsurprising that neither Republicans nor Democrats felt optimistic about the economy. But as the market and economy recovered during the Obama administration, optimism among Democrats increased at a significantly higher rate. Then, almost overnight in the beginning of 2017, optimism among Republicans skyrocketed and subsequently tapered off among Democrats. Based on the data, it is clear that many Republican-leaning investors may have missed out on the strong market gains during the Obama years, and that many Democrat-leaning investors may have missed out on the market rally that transpired during the Trump years.

With all the talk of concerns over the global economy and weakening manufacturing, the consumer remains pivotal in determining how much juice is left in this economic expansion. With that as a backdrop, one other intriguing aspect of the above chart is that at present, consumer confidence among Republican-leaning investors remains very high. Market sentiment and economic activity are quite sensitive to consumer perceptions of the future, and it certainly makes it more difficult for the economy to turn toward recession if roughly half the population believes things are still looking great.