by Connor Darrell CFA, Assistant Vice President – Head of Investments

Global equities slid lower last week as investors grappled with continued trade and geopolitical uncertainty, including the announcement by House Speaker Nancy Pelosi of an official impeachment inquiry. Also noteworthy was that shares of fitness equipment manufacturer Peloton fell dramatically on their first day of trading, the latest in a flurry of disappointing initial public offerings (IPOs) this year. Peloton’s disappointing trading debut was further evidence of waning enthusiasm for so called “unicorns” – private companies with valuations in excess of $1 billion, many of which are still relatively immature and not yet profitable.

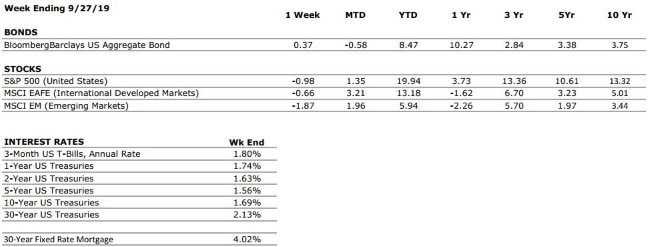

Despite the ongoing political and trade sagas, the most impactful driving force in markets during recent months has been central bank activity. Both the ECB and the Federal Reserve cut their policy targets during September, and several other banks issued forward guidance that suggested an easing in monetary policy was on the table. Bond yields have moved lower as a result of the shifting tone and continued evidence of softening in the global economy (particularly in manufacturing) and continued that trend last week. In aggregate, the bond market generated modest returns as rates shifted lower.

Politics in both China and the U.S. Creating More Uncertainty

According to comments made by Treasury Secretary Steve Mnuchin during the week, trade talks with China are expected to resume in early October. The two sides will sit down to try and make progress on a trade agreement even as both Presidents face mounting political pressure at home.

For President Trump, the impeachment inquiry will undoubtedly put additional pressure on his relationships with senior advisors and could add an additional layer of complexity to future budget negotiations; in addition to the obvious potential for impacts on his political capital. Ultimately however, with the Republicans still holding a majority in the Senate and a two-thirds vote required to remove the president from office, a transition of power looks highly unlikely. But if the inquiry extends beyond what many seem to believe, the political pressure created by the inquiry might encourage the White House to reach a trade deal sooner rather than later.

For President Xi, the ongoing protests and unrest in Hong Kong represent a difficult situation as well. If Xi is forced to give in to any of Hong Kong’s demands, it could create a perception of weakness and put additional pressure on him to be particularly steadfast in his negotiations with the United States in an attempt to preserve his public image in China. This would likely make a trade deal more difficult to reach.

Ultimately, we continue to advise clients against implementing wholesale portfolio changes in the wake of geopolitical news. While uncertainty often leads to volatility, long-term market performance is driven primarily by economics rather than politics.