by Connor Darrell CFA, Assistant Vice President – Head of Investments

Stocks continued their positive start to the fourth quarter as markets grappled with a mixed bag of corporate earnings results, additional delays in the Brexit negotiations, and a lack of further developments in the U.S./China trade dispute. The United States and China are reportedly close to a “phase one” agreement which may be signed by next month, but with both sides interested in projecting strength to the rest of the world, it may be another long wait before a “phase two” agreement is reached. International stocks have outperformed U.S. stocks so far in the fourth quarter as optimism surrounding trade has improved.

Interest rates moved slightly higher during the week, with the 10-year Treasury reaching the 1.80% mark. Rates are likely to take center stage this week as the Federal Reserve convenes for its penultimate meeting of 2019. Markets are expecting another rate cut, which would be the third this year.

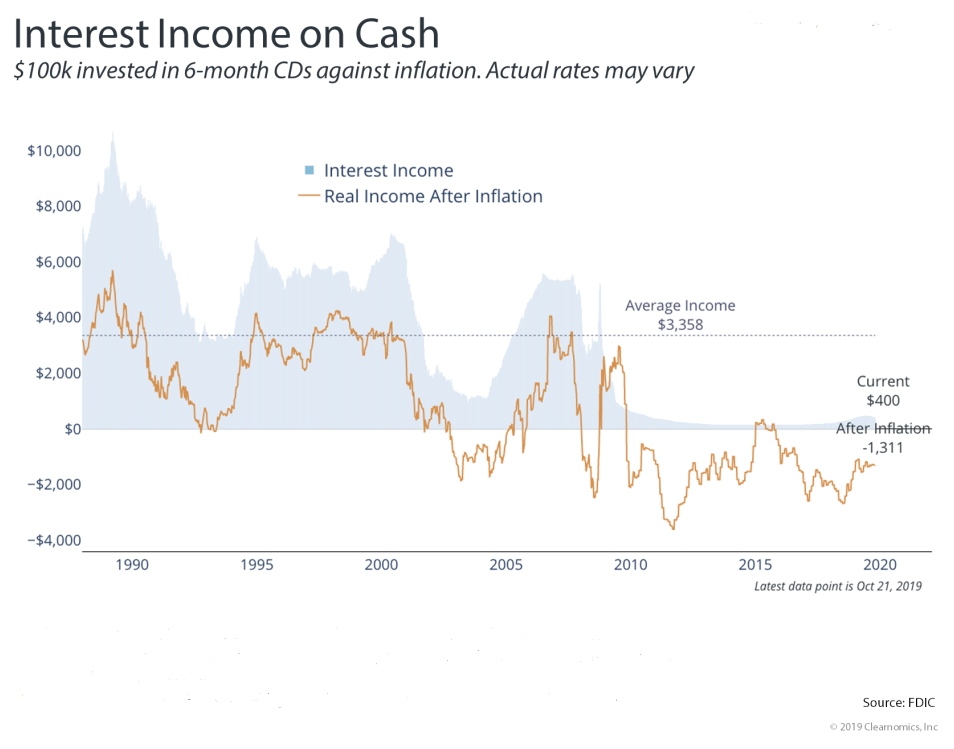

Cash Not What It Used to Be

With both stock and bond markets generating strong returns in 2019 despite rising economic and geopolitical uncertainty, many investors have grown concerned about future market returns. In a recent poll conducted by Barron’s, the percentage of professional money managers calling themselves “bullish” has decreased to its lowest level in 20 years. As a result of waning optimism, many investors have begun pondering the role of cash in a diversified portfolio, and our general belief is that it still pays to stay invested. The chart below provides a picture of the true return on cash when factoring in inflation. Since the financial crisis, cash yields have been extremely low as a result of aggressive monetary policies, and with the Fed no longer raising rates, it is unlikely that cash yields will be moving higher in the near future. Adjusting for inflation, investors who choose to sit things out in cash are still losing significant purchasing power over time.