Our New Jersey Office Has Moved!

755 Memorial Parkway, Suite 206, Phillipsburg, NJ 08865

Contact us if you have any questions at 908-454-1000.

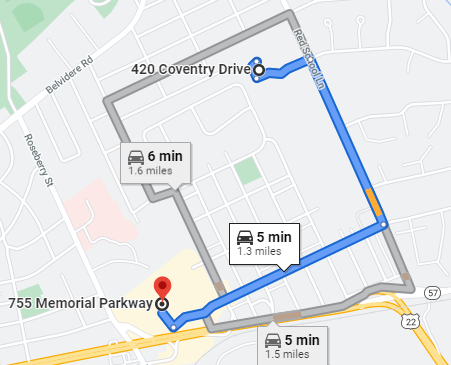

Click here for directions to our new office from our previous location.

Our New Jersey Office Has Moved!

755 Memorial Parkway, Suite 206, Phillipsburg, NJ 08865

Contact us if you have any questions at 908-454-1000.

Click here for directions to our new office from our previous location.

Team VNFA is committed to Living in the Community. Join us in supporting Holiday Hope Chests – a program of Volunteer Center of the Lehigh Valley. This program supports our regional nonprofit partners who support youth in the community through their programs and services.

Our Bethlehem office will be accepting donations of shoeboxes, wrapping paper, gifts from the suggested lists throughout November. Learn more about how you can help directly at Volunteer Center of Lehigh Valley | Holiday Hope Chests (volunteerlv.org).

by William Henderson, Vice President / Head of Investments

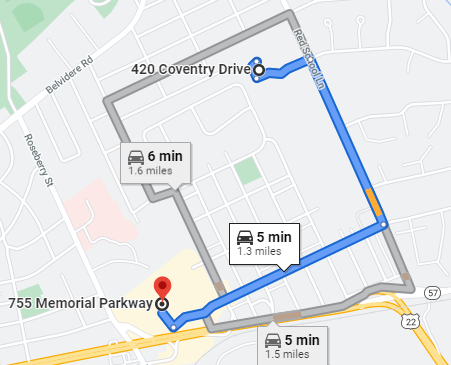

The day, the week, the month; each ended higher as last week posted strong gains for the markets, ending the strongest monthly performance since November of 2020. Last week, the Dow Jones Industrial Average rose +0.4%, the S&P 500 Index increased by +1.3% and the NASDAQ moved higher by +2.7%. Year-to-date, the Dow Jones Industrial Average has returned +18.8, the S&P 500 Index +24.0% and the NASDAQ +20.9%. The stock market seems to be reacting to future growth expectations in earnings even in the face of missed EPS releases. The bond market saw falling yields last week as fixed income investors shook off FED tapering fears and higher interest rates in 2020 and moved bond prices higher. The 10-year U.S Treasury closed the week at 1.57% down eight basis points from the previous week and well below the 1.74% level reached in March of this year. See the chart below of the 10-year U.S. Treasury from the Federal Reserve Bank of St. Louis dating to just before the Pandemic. Even at this level (1.57%), bonds offer investors an anchor for their portfolios while providing a needed risk management tool.

While the markets moved higher last week, three bellwether stocks, Apple, Amazon, and Starbucks released Q3 earnings and all surprisingly missed analysts’ expectations. The common themes mentioned in their earnings announcements were supply chain disruptions, labor shortages and inflationary pressures. Recognize that a miss on analysts’ expectations does not mean the companies did not grow their profitability year-over-year; on the contrary, each reported strong earnings growth, just not as strong as Wall Street analysts had expected. As we have mentioned many times, the markets are efficient and can see past short-term disappointments, however, the common problems (supply chain, labor, inflation) eventually will no longer be acceptable as “surprise” reasons for EPS misses. That said, successful companies will need to react and overcome in the new normal.

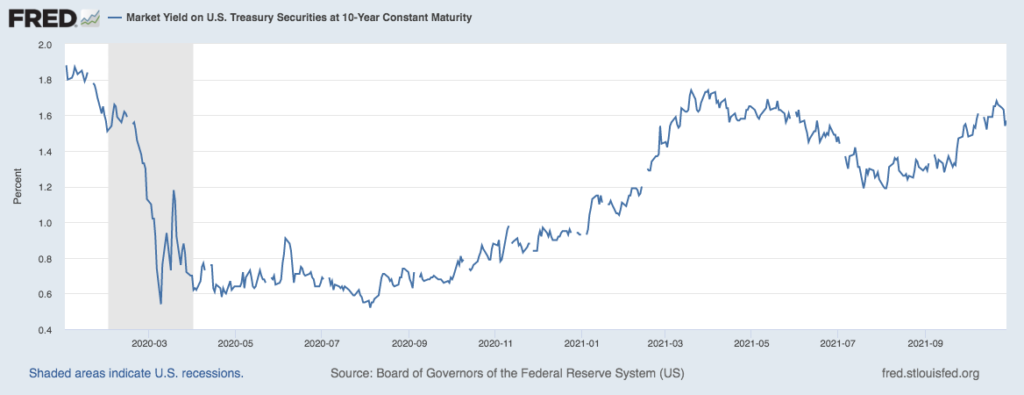

Meanwhile, other companies are enjoying the inflationary pressures we are seeing in crude oil prices. See the chart below from the Federal Reserve Bank of St. Louis on the spot price of West Texas Intermediate (WTI sweet crude oil). While well below levels seen before the Great Financial Crisis of 2008-09, WTI hit $72/barrel last week, well above the pandemic lows of $16/barrel. Last week, citing higher oil prices as the reason, Dow component Chevron announced Q3 earnings of $2.96/share, its highest level since Q1 2013.

We are optimists at VNFA and believe that firms will adapt and innovate as they have done for centuries. Further, technology will continue to be the driving force behind economic growth and continued improvement in production efficiencies. However, analysts are naturally predicting slower growth in 2022 as fiscal and monetary stimulus is gradually removed from the economy. While the pandemic is fading and vaccinations are now reaching most parts of the world, the post-pandemic impacts are still being felt everywhere. Supply-chain bottlenecks are real, and companies are dealing with shortages of all raw materials, as a result. “Help Wanted” signs are posted everywhere from McDonalds to Amazon to JP Morgan and the labor shortage is going to impact inflation more so than supply-chain disruptions and material shortages. Lastly, as engineered by central banks around the world, we will see inflation continue well into 2022. Higher inflation and full employment will be the recipe for higher interest rates next year. Markets are efficient and companies will need to be efficient too if they expect to perform as solidly in 2022 as they did in 2021. Watch for strong holiday shopping this year and healthy retail sales as the “wealthy” consumer gets freed from COVID-variants and begins to spend again.

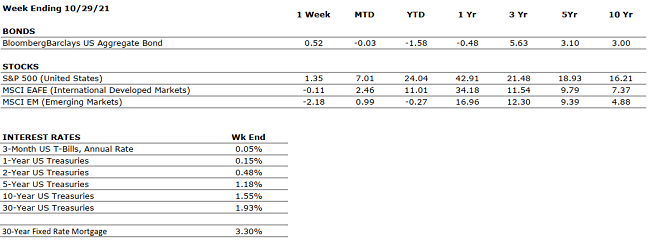

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

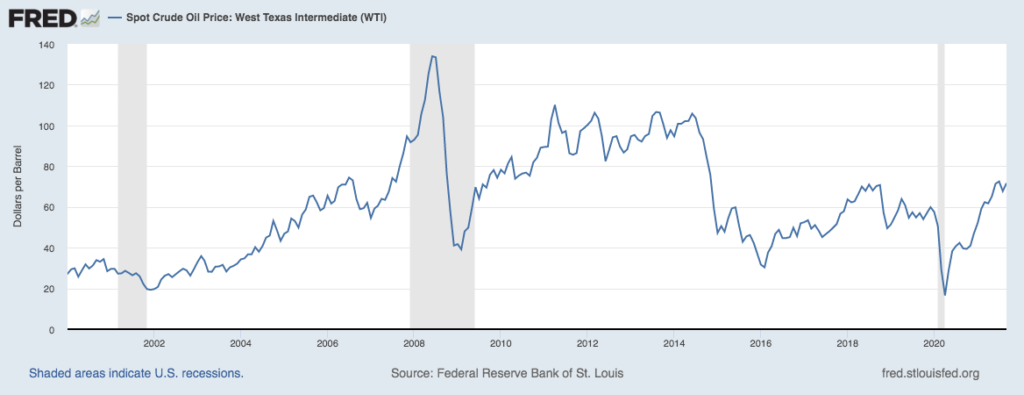

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. GDP growth decelerated to a 2% annualized pace in Q3. The slowdown was driven primarily by supply chain constraints. Economists expect a modest acceleration in Q4. |

|

CORPORATE EARNINGS |

POSITIVE |

With 55% of S&P 500 companies having reported Q3 results, sales and earnings are up 15.5% and 26.5%, respectively. However, company commentary suggests that the supply chain has been and will continue to be problematic in the coming quarters. |

|

EMPLOYMENT |

POSITIVE |

The unemployment rate is down to 4.8%, as of September. The labor market is very tight at present, as many employers, particularly in the Leisure and Logistics sectors, are struggling to fully staff. The labor shortage is one of the causes of the global supply chain glut. |

|

INFLATION |

NEUTRAL |

CPI rose 5.4% year-over-year in September, driven by the global supply chain backlog. |

|

FISCAL POLICY |

POSITIVE |

A bill to lift the U.S. debt ceiling by $480 billion – which should provide enough headroom for government operations until December 3 – was passed. |

|

MONETARY POLICY |

POSITIVE |

In recent communications, the Fed has indicated bond tapering may begin by the end of 2021 while rate hikes could commence by the end of 2022. Nonetheless, monetary policy remains relatively accommodative with rates at historical lows. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

Although the Taliban’s control in Afghanistan is concerning, it is unlikely to have a meaningful economic impact. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions are hampering the economy; however, demand remains very strong. The hold-ups should ease progressively over time. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

“Magic is really very simple; all you’ve got to do is want something and then let yourself have it.” – Aggie Cromwell, Halloweentown (1998)

Tune in Wednesday, 6 PM for “Your Financial Choices” with Laurie Siebert on WDIY 88.1FM. Laurie will welcome guest Daniel Banks from Silvercrest Insurance to discuss: What is Medicare Annual Enrollment?

Laurie can address questions on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.