by William Henderson, Vice President / Head of Investments

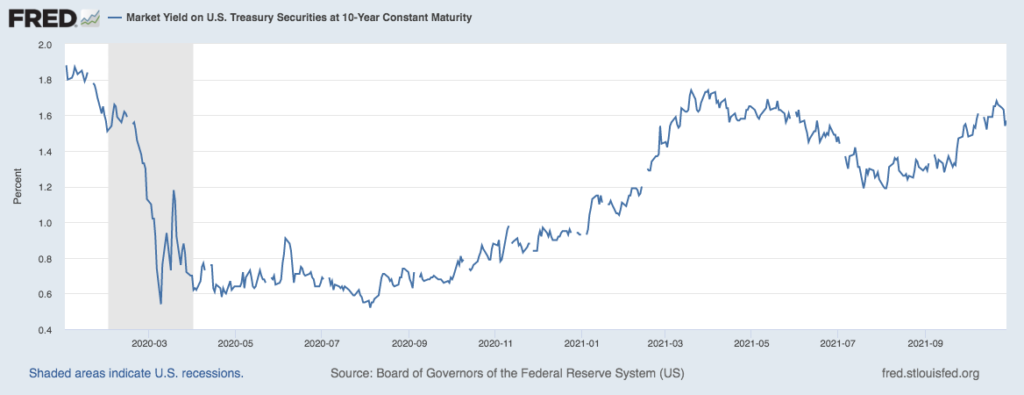

The day, the week, the month; each ended higher as last week posted strong gains for the markets, ending the strongest monthly performance since November of 2020. Last week, the Dow Jones Industrial Average rose +0.4%, the S&P 500 Index increased by +1.3% and the NASDAQ moved higher by +2.7%. Year-to-date, the Dow Jones Industrial Average has returned +18.8, the S&P 500 Index +24.0% and the NASDAQ +20.9%. The stock market seems to be reacting to future growth expectations in earnings even in the face of missed EPS releases. The bond market saw falling yields last week as fixed income investors shook off FED tapering fears and higher interest rates in 2020 and moved bond prices higher. The 10-year U.S Treasury closed the week at 1.57% down eight basis points from the previous week and well below the 1.74% level reached in March of this year. See the chart below of the 10-year U.S. Treasury from the Federal Reserve Bank of St. Louis dating to just before the Pandemic. Even at this level (1.57%), bonds offer investors an anchor for their portfolios while providing a needed risk management tool.

While the markets moved higher last week, three bellwether stocks, Apple, Amazon, and Starbucks released Q3 earnings and all surprisingly missed analysts’ expectations. The common themes mentioned in their earnings announcements were supply chain disruptions, labor shortages and inflationary pressures. Recognize that a miss on analysts’ expectations does not mean the companies did not grow their profitability year-over-year; on the contrary, each reported strong earnings growth, just not as strong as Wall Street analysts had expected. As we have mentioned many times, the markets are efficient and can see past short-term disappointments, however, the common problems (supply chain, labor, inflation) eventually will no longer be acceptable as “surprise” reasons for EPS misses. That said, successful companies will need to react and overcome in the new normal.

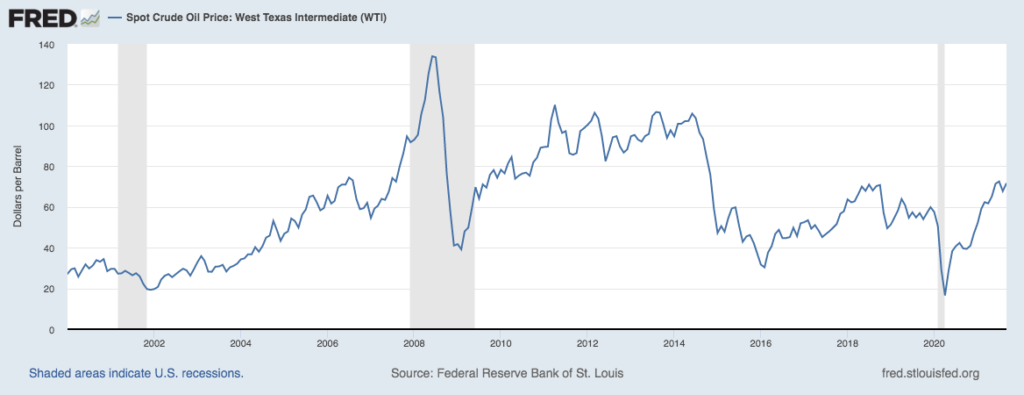

Meanwhile, other companies are enjoying the inflationary pressures we are seeing in crude oil prices. See the chart below from the Federal Reserve Bank of St. Louis on the spot price of West Texas Intermediate (WTI sweet crude oil). While well below levels seen before the Great Financial Crisis of 2008-09, WTI hit $72/barrel last week, well above the pandemic lows of $16/barrel. Last week, citing higher oil prices as the reason, Dow component Chevron announced Q3 earnings of $2.96/share, its highest level since Q1 2013.

We are optimists at VNFA and believe that firms will adapt and innovate as they have done for centuries. Further, technology will continue to be the driving force behind economic growth and continued improvement in production efficiencies. However, analysts are naturally predicting slower growth in 2022 as fiscal and monetary stimulus is gradually removed from the economy. While the pandemic is fading and vaccinations are now reaching most parts of the world, the post-pandemic impacts are still being felt everywhere. Supply-chain bottlenecks are real, and companies are dealing with shortages of all raw materials, as a result. “Help Wanted” signs are posted everywhere from McDonalds to Amazon to JP Morgan and the labor shortage is going to impact inflation more so than supply-chain disruptions and material shortages. Lastly, as engineered by central banks around the world, we will see inflation continue well into 2022. Higher inflation and full employment will be the recipe for higher interest rates next year. Markets are efficient and companies will need to be efficient too if they expect to perform as solidly in 2022 as they did in 2021. Watch for strong holiday shopping this year and healthy retail sales as the “wealthy” consumer gets freed from COVID-variants and begins to spend again.