Our Bethlehem and New Jersey offices will be closing at 11:30 a.m. on Friday, December 14th so that our team can celebrate the holidays together. For our clients, we are still accessible if you need us urgently!

Daily Archives: December 11, 2018

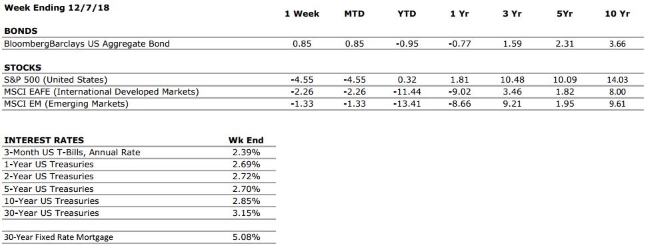

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer confidence is near all time highs with recent tax reform providing further support. We are anticipating a strong holiday shopping season. |

|

FED POLICIES |

C- |

Despite recent comments from Fed Chairman Jerome Powell that rates are getting closer to “neutral”, we expect the Federal Reserve to raise interest rates one more time at its December meeting. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

B+ |

We have downgraded our Business Profitability grade to B+. Corporate earnings remain strong, but we anticipate earnings growth will taper off in 2019. We are also beginning to see a higher number of companies reducing forward earnings guidance, a sign that earnings growth may have reached its peak in 2018. |

|

EMPLOYMENT |

A+ |

The US economy added 155,000 new jobs in November, which was below estimates. However, the unemployment rate remained at 3.7% and the data suggests that there have been more job openings available in the economy than there are unemployed workers to fill them for 6 consecutive months. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Did You Know…?

Valley National Financial Advisors provides one-stop financial planning. That means that our team is here to support our clients throughout their financial lives, but also in planning for their eventual transfer of wealth. Maybe you are familiar with how our advisors integrate estate planning, but did you know that our team also provides Trust Services?

Valley National Trust Services is a Trust Representative Office of National Advisors Trust Company, FSB. This means that our team has all the resources of a professional trust company and the ability to coordinate and manage trust services locally for our clients. We work directly with the attorney of your choice to help facilitate the trust and we manage the assets/accounts.

Want to learn more about Trusts? Visit our Resources for Individual/Families or our Trust Services overview on our website. Contact your advisory team if you would like to learn more – CONTACT US.

Quote of the Week

“If anyone tells you that America’s best day are behind her, they’re looking the wrong way.” – President George H. W. Bush

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

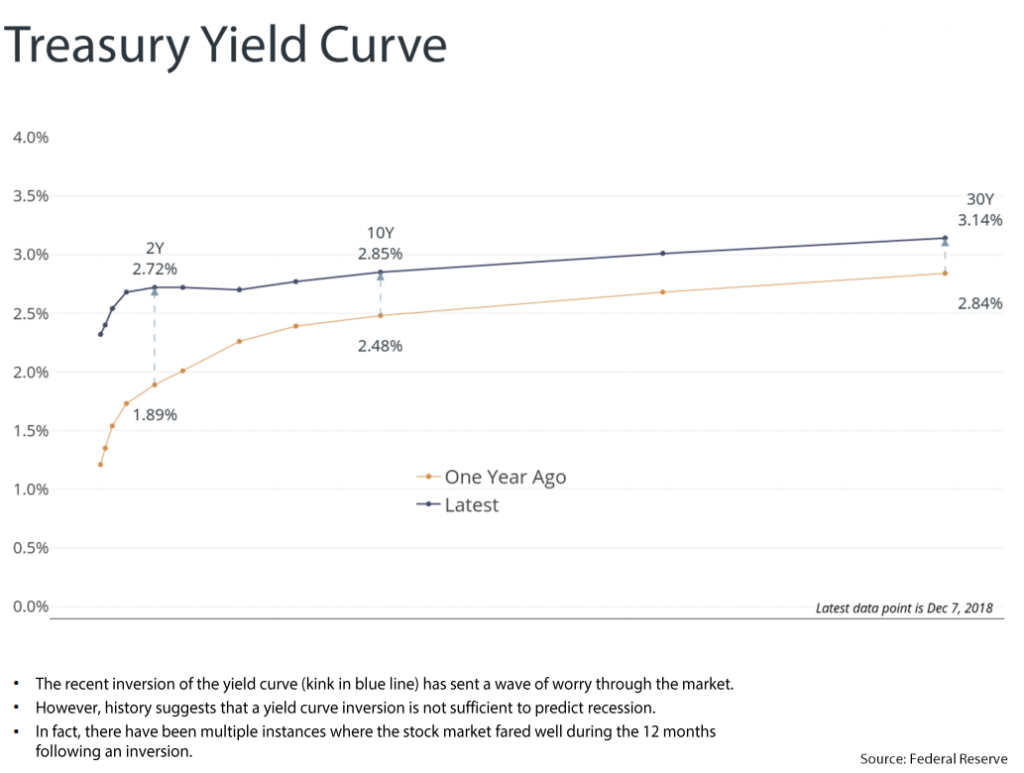

Stocks traded lower in a volatile week where the key focus of investors shifted from the U.S. trade conflict with China to the shape of the yield curve. Late in Monday’s trading session, the yields on five-year Treasury notes fell below two- and three-year Treasury yields for the first time in more than a decade. Historically, yield curve inversions have been a bearish signal for the economy, and markets sold off as a result. The focus of investors will likely now move to the Federal Reserve over the next week in anticipation of its final policy meeting of 2018. The Fed is widely expected to move forward with an additional rate increase, but some have begun to question whether the recent inversion of the curve will lead to a pause. Either way, investors should likely prepare for more volatility as the uncertainty permeates through global markets.

A Historical Look at Yield Curve Inversions

The recent inversion of the yield curve has sent a wave of worry through the market. However, it is important to note that while a curve inversion has typically preceded a recession, a curve inversion itself is not a sufficient condition for recession. According to Goldman Sachs Research, a historical analysis from the 1960s onward shows that in three of the last 10 instances when there has been an inversion in the yield curve, there was no recession over a subsequent two-year window. Furthermore, we have observed at least two instances since 1998 where the S&P 500 managed to achieve double digit gains over the 12 months immediately following an inversion of the three-year and five-year Treasury yields.

As the yield curve has flattened over the past several years (see chart below), the bond market has been signaling to investors that growth is likely peaking. Based on history, that fact alone does not mean that a recession is imminent, or even that the stock market has plateaued.  Additionally, when we also consider the level of central bank intervention in the global economy over the past several years (where global monetary policy involved direct manipulation of short-term interest rates), it is reasonable to question whether the signaling power of the yield curve has been impacted. In any case, investors should continue to watch other market and economic indicators in order to conduct a more complete assessment of the economic cycle. We still believe that when this more holistic approach is taken, it is difficult to draw the conclusion that a recession is near.

Additionally, when we also consider the level of central bank intervention in the global economy over the past several years (where global monetary policy involved direct manipulation of short-term interest rates), it is reasonable to question whether the signaling power of the yield curve has been impacted. In any case, investors should continue to watch other market and economic indicators in order to conduct a more complete assessment of the economic cycle. We still believe that when this more holistic approach is taken, it is difficult to draw the conclusion that a recession is near.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®.

This week, Laurie welcomes back Attorney Dennis Pappas from the Law Offices of Vasiliadis Pappas Associates to discuss: Special Situations in Estate Planning. They will take your questions live on the air at 610-758-8810 or online through yourfinancialchoices.com.

Recordings of past shows, including last week’s Year in Review & What’s Ahead with guests Timothy G. Roof, CFP® and Connor Darrell, CFA from Valley National Financial Advisors, are also available to listen or download at both yourfinancialchoices.com and wdiy.org.

Recordings of past shows, including last week’s Year in Review & What’s Ahead with guests Timothy G. Roof, CFP® and Connor Darrell, CFA from Valley National Financial Advisors, are also available to listen or download at both yourfinancialchoices.com and wdiy.org.