Our offices will close at 1 p.m. with the markets on Monday, December 24 and remain closed Tuesday, December 25 in observance of the Christmas holiday. We will be back to normal hours on Wednesday, December 26.

Daily Archives: December 18, 2018

Valley National News

We are pleased to announce that Associate Financial Advisor, Jessica Goedtel, has earned the Certified Financial PlannerTM (CFP®) professional designation.

We are pleased to announce that Associate Financial Advisor, Jessica Goedtel, has earned the Certified Financial PlannerTM (CFP®) professional designation.

The marks mentioned above, identify those individuals who have met the rigorous experience and ethical requirements of the CFP Board of Standards, have successfully completed financial planning coursework and have passed the CFP® Certification Examination covering the following areas: the financial planning process, risk management, investments, tax planning and management, retirement and employee benefits, and estate planning.

Jessica joined Valley National Financial Advisors in May 2016 as Associate. The following year she was promoted to Senior Associate, and in 2018 was given the title of Associate Financial Advisor. Her CFP® certification makes her the ninth on the team at Valley National – the most of any financial planning firm in the Lehigh Valley.

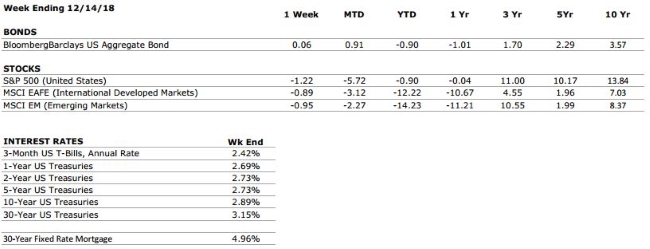

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Freddie Mac

US ECONOMIC HEAT MAP

The health of the US economy is a key driver of long-term returns in the stock market. Below, we grade 5 key economic conditions that we believe are of particular importance to investors.

|

CONSUMER SPENDING |

A+ |

Consumer confidence is near all time highs with recent tax reform providing further support. We are anticipating a strong holiday shopping season. |

|

FED POLICIES |

C- |

There will be heightened focus on the Federal Reserve this week as the committee gathers for its final meeting of 2018. Markets are largely anticipating one additional interest rate hike. Rising interest rates tend to reduce economic growth potential and can lead to repricing of income producing assets. |

|

BUSINESS PROFITABILITY |

B+ |

Corporate earnings remain strong, but we anticipate earnings growth will taper off in 2019. We are also beginning to see a higher number of companies reducing forward earnings guidance, a sign that earnings growth may have reached its peak in 2018. |

|

EMPLOYMENT |

A+ |

The US economy added 155,000 new jobs in November, which was below estimates. However, the unemployment rate remained at 3.7% and the data suggests that there have been more job openings available in the economy than there are unemployed workers to fill them for 6 consecutive months. |

|

INFLATION |

B |

Inflation is often a sign of “tightening” in the economy, and can be a signal that growth is peaking. The inflation rate remains benign at this time, but we see the potential for an increase moving forward. This metric deserves our attention. |

|

OTHER CONCERNS |

||

|

INTERNATIONAL RISKS |

5 |

The above ratings assume no international crisis. On a scale of 1 to 10 with 10 being the highest level of crisis, we rate these international risks collectively as a 5. These risks deserve our ongoing attention. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

FROM THE PROS… VIDEO

Associate Financial Advisors Jessica Goedtel, CFP® touches on a few common types of charitable contributions. WATCH NOW

Quote of the Week

“The stories we tell literally make the world. If you want to change the world, you need to change your story. This truth applies both to individuals and institutions.” – Michael Margolis

The Markets This Week

by Connor Darrell CFA, Assistant Vice President – Head of Investments

The world’s major equity indices ended lower for the second consecutive week, with some uninspiring Chinese economic data and continued geopolitical uncertainty stemming from the Brexit negotiations weighing on investor sentiment. Some of that negative sentiment was outweighed by potential progress in the ongoing trade tensions between China and the United States, but it was not enough to push markets into positive territory. In fixed income, the closely watched spread between the 10-Year and 2-Year Treasury rates held firm at 16 bps. Thus far, high quality bonds have upheld their traditional role as equity diversifiers, producing positive returns amid the recent equity volatility.

A Look Ahead at 2019

In a meaningful deviation from the prior few years, uncertainty and volatility have played a much larger role in market returns during 2018, and we anticipate this will continue into 2019. Global economic growth is likely to slow modestly, led by a deceleration in the U.S. and continued softening in China and Europe. Geopolitical uncertainties will likely remain elevated, with the market’s focus primarily fixed upon potential spillovers from the Brexit negotiations, the U.S./China trade saga, and the potentially disruptive consequences of growing populism around the world.

Despite the change in tone, its important to note that a deeper look at the fundamentals of the U.S. economy still yields no major signs of overheating, and the probability of recession remains low. For that reason, it is likely too early to become overly defensive. History tells us that late-cycle investing, while occasionally tense, can be very rewarding. As in all stages of the cycle, the key for successful investing will be relying upon the benefits of diversification within a disciplined and structured process. A properly constructed financial plan is designed to weather all stages of the economic cycle, including periods where returns are more subdued.

“Your Financial Choices”

The show airs on WDIY Wednesday evenings, from 6-7 p.m. The show is hosted by Valley National’s Laurie Siebert CPA, CFP®, AEP®. This week, Laurie will discuss Gifting – How Much, When and How? She will take your questions live on the air at 610-758-8810 or online through yourfinancialchoices.com.

Recordings of past shows are also available to listen or download at both yourfinancialchoices.com and wdiy.org.