by Connor Darrell CFA, Assistant Vice President – Head of Investments

Stocks traded lower in a volatile week where the key focus of investors shifted from the U.S. trade conflict with China to the shape of the yield curve. Late in Monday’s trading session, the yields on five-year Treasury notes fell below two- and three-year Treasury yields for the first time in more than a decade. Historically, yield curve inversions have been a bearish signal for the economy, and markets sold off as a result. The focus of investors will likely now move to the Federal Reserve over the next week in anticipation of its final policy meeting of 2018. The Fed is widely expected to move forward with an additional rate increase, but some have begun to question whether the recent inversion of the curve will lead to a pause. Either way, investors should likely prepare for more volatility as the uncertainty permeates through global markets.

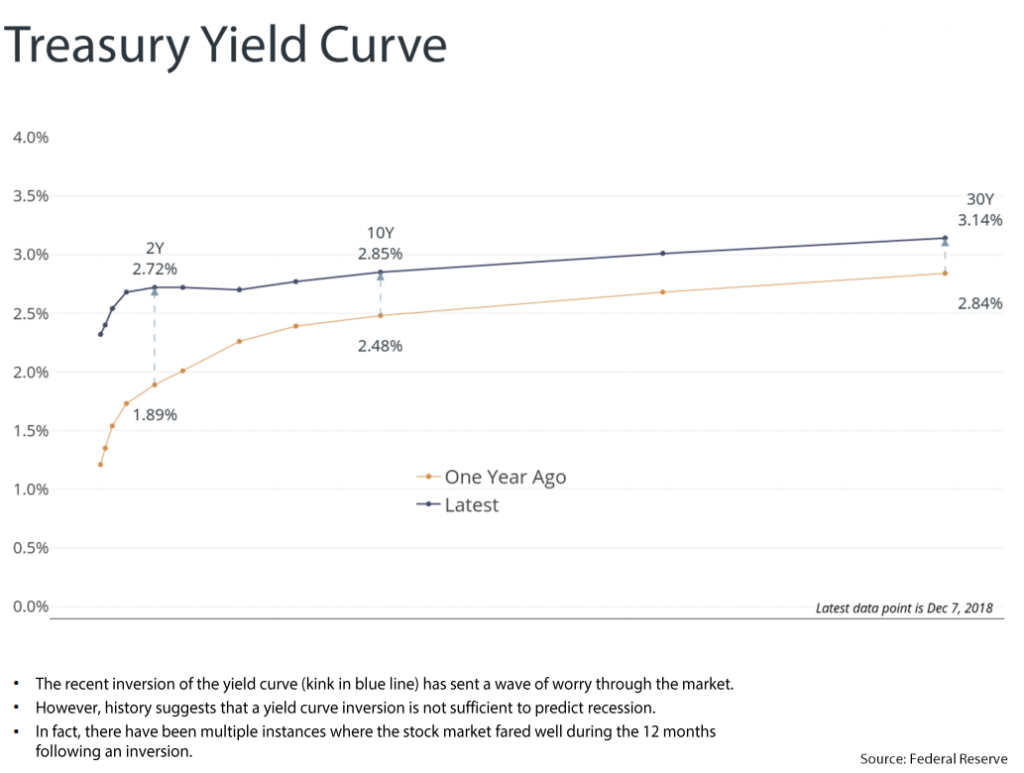

A Historical Look at Yield Curve Inversions

The recent inversion of the yield curve has sent a wave of worry through the market. However, it is important to note that while a curve inversion has typically preceded a recession, a curve inversion itself is not a sufficient condition for recession. According to Goldman Sachs Research, a historical analysis from the 1960s onward shows that in three of the last 10 instances when there has been an inversion in the yield curve, there was no recession over a subsequent two-year window. Furthermore, we have observed at least two instances since 1998 where the S&P 500 managed to achieve double digit gains over the 12 months immediately following an inversion of the three-year and five-year Treasury yields.

As the yield curve has flattened over the past several years (see chart below), the bond market has been signaling to investors that growth is likely peaking. Based on history, that fact alone does not mean that a recession is imminent, or even that the stock market has plateaued.  Additionally, when we also consider the level of central bank intervention in the global economy over the past several years (where global monetary policy involved direct manipulation of short-term interest rates), it is reasonable to question whether the signaling power of the yield curve has been impacted. In any case, investors should continue to watch other market and economic indicators in order to conduct a more complete assessment of the economic cycle. We still believe that when this more holistic approach is taken, it is difficult to draw the conclusion that a recession is near.

Additionally, when we also consider the level of central bank intervention in the global economy over the past several years (where global monetary policy involved direct manipulation of short-term interest rates), it is reasonable to question whether the signaling power of the yield curve has been impacted. In any case, investors should continue to watch other market and economic indicators in order to conduct a more complete assessment of the economic cycle. We still believe that when this more holistic approach is taken, it is difficult to draw the conclusion that a recession is near.