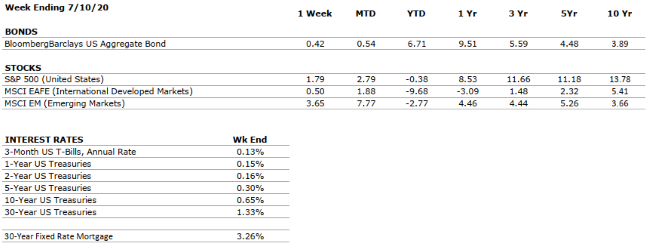

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEGATIVE |

May’s retail sales and consumer spending rebounded at record clips month-over-month, following unprecedented declines in April. However, new coronavirus cases in the US are accelerating, which threatens to rescind the gains in consumer confidence. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

According to forecasts by Blackrock, U.S. corporate earnings are unlikely to intersect with the path that they would have taken, had COVID-19 never occurred, until the end of the decade. However, Blackrock now expects higher equity returns over the prospective ten years than they did in December 2019 because of lower interest rates. |

|

EMPLOYMENT |

VERY NEGATIVE |

Non-farm payroll increased by 4.8 million jobs in June, led by the Leisure & Hospitality sector, as the unemployment rate declined to 11.1%. However, the unemployment rate remains historically high and is still 7.6% higher than it was in February. |

|

INFLATION |

POSITIVE |

The deflationary environment created by COVID-19 should provide additional room for robust stimulus from both fiscal and monetary policy initiatives. However, we will be watching closely in the intermediate term for second and third order effects leading to a return of inflationary pressure. |

|

FISCAL POLICY |

VERY POSITIVE |

The US Government has passed a series of fiscal measures to combat the economic impacts of the COVID-19 pandemic. The largest of these measures, known as the CARES Act, provides approximately $2.2 trillion of support for businesses and families that are impacted by business closures and unemployment. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve has supported asset markets with unprecedented speed and magnitude in respond to COVID-19. Monetary stimulus is perhaps the primary reason why equity markets have rallied over the three past months. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

Western opposition to China’s National Security Law, legislation that reduces Hong Kong’s autonomy, has amplified the discord already present between the US and China as a result of COVID-19. In addition, demonstrations across the US evidence considerable domestic unrest. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The impacts from COVID-19 were as swift and pronounced as any shock in modern times. Robust monetary and fiscal stimulus stabilized the system, and several measures of the economy improved in May and June. However, economic activity remains well-below that in 2019, and uncertainty remains very high. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.