by Maurice (Mo) Spolan, Investment Research Analyst

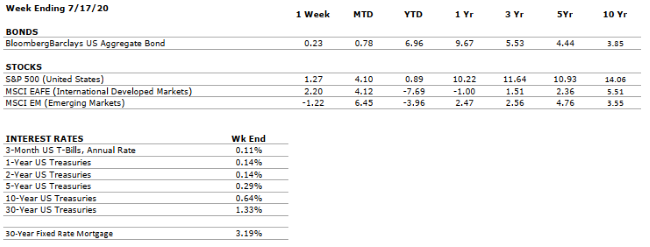

Equity markets were up mildly last week as investors weighed the continuing surge in coronavirus cases against a couple of promising vaccine candidates. Moderna Therapeutics and Oxford University, the engineers behind the two leading inoculants, both announced last week that their vaccines demonstrate signs of efficacy. Anthony Fauci added that he believes that a vaccine will be approved by year-end, however, the timeframe between a vaccine’s certification of safety and effectiveness, and its mass production and widespread dissemination, remains unclear.

In other news, the world’s largest banks kicked off earnings season by tucking away billions of dollars for expected loan losses over the coming period. Jamie Dimon, the CEO of JP Morgan Chase who is known for his prudence, noted that the past several months has not represented a traditional recessionary environment because of massive government support, and that he expects the economic situation to worsen over the back-half of the year. With this said, stock market analysts polled by Factset expect impacts from the coronavirus to be present in second quarter corporate updates: S&P 500 earnings are forecasted to decline by 44% versus the year-ago period, which would be the largest fall since the Great Recession. In contrast to Dimon’s cautions, analysts expect Q2 to represent the worst for corporate earnings.