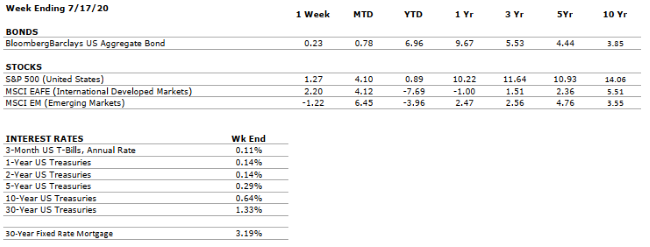

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEGATIVE |

In June, retail sales increased by 5.4% month-over-month while new home sales were up 55% compared to last year, the largest increase in ten years, as consumers take advantage of historically low mortgage rates. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

Q2 is expected to represent the low-point of corporate earnings during this recession, with profits forecasted to fall 44%, the largest decline since 2008. According to Blackrock, U.S. corporate earnings are unlikely to intersect with the path that they would have taken, had COVID-19 never occurred, until the end of the decade. |

|

EMPLOYMENT |

VERY NEGATIVE |

Non-farm payroll increased by 4.8 million jobs in June, led by the Leisure & Hospitality sector, as the unemployment rate declined to 11.1%. However, the unemployment rate remains historically high and is still 7.6% higher than it was in February. |

|

INFLATION |

POSITIVE |

The deflationary environment created by COVID-19 should provide additional room for robust stimulus from both fiscal and monetary policy initiatives. However, we will be watching closely in the intermediate term for second and third order effects leading to a return of inflationary pressure. |

|

FISCAL POLICY |

VERY POSITIVE |

Unemployment benefits, which have been instrumental in stabilizing the economy, are set to expire at July’s end. Though Congress is expected to pass another round of unemployment assistance, the size and duration of future benefits is unknown. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve has supported asset markets with unprecedented speed and magnitude in respond to COVID-19. Monetary stimulus is perhaps the primary reason why equity markets have rallied over the three past months. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

The relationship between the US and China, the world’s two largest economies, was already weakened by the trade war but has deteriorated further as a result of Covid-19. Given both countries’ importance in the global economy, the status of relations between the two superpowers is worth monitoring. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The impacts from COVID-19 were as swift and pronounced as any shock in modern times. Robust monetary and fiscal stimulus stabilized the system, and several measures of the economy improved in May and June. However, economic activity remains well-below that in 2019, and uncertainty remains very high. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.