Reminder – Contactless Pick-up / Drop Off Appointments

Our team appreciates your patience as we work toward a safe reopening of our office spaces. If you need to sign paperwork, you can arrange a contactless appointment to quickly complete forms in our lobby. If you prefer, you can also arrange to pick up forms, fill them out at home and return them at a secondary appointment. These visits require an advance appointment and screening clearance. Please speak to your service team who can help you coordinate an available date and time with our reception desk in the Bethlehem office. If you have questions about this process, please call our office at 610-868-9000 during normal business hours.

Daily Archives: September 22, 2020

The Markets This Week

by William Henderson, Vice President / Head of Investments

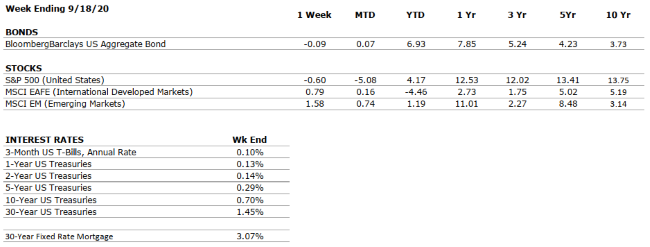

For a week with a lot of big news events: super-successful IPO of Snowflake, Big-10 Football starting up again and the sad news of Supreme Court Justice Ruth Bader Ginsburg dying; the Dow Jones Industrial Average changed a whole 0.1% over the week ended September 18, 2020. That is not to say we didn’t have some big swings in the market during the week; and the broader markets did close down for the week with the S&P 500 (0.60%) and the Tech-Larded NASDAQ (0.60%). Year-to-date returns remain mixed running in the face of some truly epic headwinds with the DJIA (3.1%), the S&P 500 +2.8% and the NASDAQ +20.3%. The markets continue to hope for something beyond the Fed’s open spigot of free money and believe Washington will finally agree on the next round of fiscal stimulus. In that regard, watch for Washington to be solely focused this week on a battle to replace Ruth Bader Ginsburg on the U.S. Supreme Court. There was interesting news from the U.S Commerce Department on Friday in an order prohibiting certain transactions of two Chinese e-commerce giants, Tencent’s WeChat and ByteDance’s TikTok. This is all part of the continuing U.S./China trade negotiations. Oracle & Wal-Mart are still in talks to buy the U.S. operations of TikTok but have yet to resolve the final details; even after receiving approval from President Trump.

The Fed’s two-day policy meeting wrapped up on Wednesday with Fed Chair Jerome Powell revealing that policymakers expect official short-term rates to remain near 0% through 2023 and tempered their expectations for the size of the economic contraction in 2020 from 6.5% to 3.7%. Mr. Powell seemed concerned that the Fed’s massive monetary accommodation may be reaching its limits and instead began calling on Washington for a stronger fiscal boost to aid the economic recovery.

In more local news, Governor Wolf loosened restrictions on gatherings, specifically allowing restaurants to operate at 50% capacity rather than a paltry 25%. While not a full-blown removal of COVID-19 related restrictions, it does point to a lessening impact the global pandemic is having on the economy. A vaccine is still underway, with many global companies moving into a vaccine trial phase. Along with the explosion in virtual conferencing and working from home, cash usage is taking a dive while electronic payments are on the rise. According to an article in Barron’s this weekend, the volume of ATM withdrawals tumbled more than 12% in the second quarter. Companies that provide services allowing electronic payment transactions will continue to grow and benefit. As we saw the bank building replaced by the ATM, will we see the ATM replaced by the smartphone? Perhaps by the next generation.

It could be a tumultuous week with so much uncertainty abounding: 1) Washington (additional stimulus plan, replacing RBG), 2) Wall Street (TikTok, economic data, Fed) and 3) Main Street (Presidential Election, social unrest, COVID-19 resurgence in the fall). Remember, the markets hate uncertainty and we have a lot of that around these days. Keep a long-term view on your financial plans and try and look past the noise.

Did You Know…?

A Transfer on Death Plan or other beneficiary document supersedes your will and turns what might have been probate assets into non-probate assets. You can add this designation to investment accounts and even bank accounts. It is the designation, not the Will, that controls the transfer. You can name beneficiaries on retirement accounts as well which also keeps the assets out of your probate estate. You will want to coordinate this with your overall estate planning to make sure you understand how the assets will pass and to whom – consult with an attorney. Read more about Planning for Transition at finra.org.

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEGATIVE |

GDP declined at an annualized rate of 32.9% in Q2, the fourth-largest fall in the last 100 years. In mirror opposition, Q3 GDP is expected to represent the greatest quarter-over-quarter increase in history, coming in somewhere between 25-35% on an annualized basis. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

With over 90% of companies in the books, S&P 500 earnings have fallen by around 33% in Q2, the sharpest year-over-year decline since 2008. However, some companies in certain sectors have reported strong results, such as in Retail and Cloud Computing. |

|

EMPLOYMENT |

VERY NEGATIVE |

About 1.4 million U.S. jobs were added in August, in-line with market expectations. The American economy has now added back roughly half of the 22 million jobs lost since March. The unemployment rate remains well above historical averages, at 8.4%. |

|

INFLATION |

POSITIVE |

Core inflation has come in at 1.7% over the last twelve months. The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

VERY POSITIVE |

Weekly unemployment benefits are now being disseminated on a state-by-state basis, through applications to a Federal slush fund, and total $300 per week, versus the previous rate of $600 under the now-expired Federal plan. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve has supported asset markets with unprecedented speed and magnitude in response to COVID-19. In our view, Fed President, Jay Powell, reaffirmed the central bank’s accommodative stance in his virtual address “at Jackson Hole”. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

The relationship between the US and China, the world’s two largest economies, was already weakened by the trade war but has deteriorated further as a result of COVID-19. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The impacts from COVID-19 were as swift and pronounced as any shock in modern times. Robust monetary and fiscal stimulus stabilized the system, however, economic activity remains well-below that in 2019, and uncertainty remains high. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“It is literally true that you can succeed best and quickest by helping others to succeed.” – Napoleon Hill

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM: Retiree Cash-Flow Management

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.