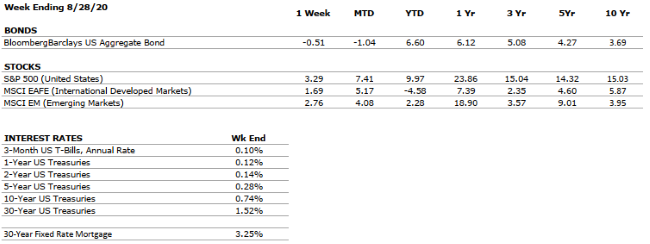

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEGATIVE |

GDP declined at an annualized rate of 32.9% in Q2, the fourth-largest fall in the last 100 years. Although the figure is staggering, it was in-line with economists’ expectations. Retail sales increased 1.2% in July; a healthy mid-pandemic result, but sharply below June’s 7.5% rise. |

|

CORPORATE EARNINGS |

VERY NEGATIVE |

S&P 500 earnings have fallen by around 33% in Q2, the sharpest year-over-year decline since 2008. However, some companies in certain sectors have reported strong results, such as in Retail and Cloud Computing. |

|

EMPLOYMENT |

VERY NEGATIVE |

1.8 million jobs were added in the U.S. during July. While gains, rather than losses, are welcomed, the figure represents a considerable deceleration from the 4.8 million jobs added in June. Unemployment remains very high at 10.2%. |

|

INFLATION |

POSITIVE |

Core inflation increased 0.6% in July, the largest one-month jump since 1991. However, on an annualized basis, CPI is running at a moderate 1.6%, below the Fed’s 2% target. More sustained indications of inflation will be necessary before the central bank curbs its stimulative policies. |

|

FISCAL POLICY |

VERY POSITIVE |

Weekly unemployment benefits are now being disseminated on a state-by-state basis, through applications to a Federal slush fund, and total $300 per week, versus the previous rate of $600 under the now-expired Federal plan. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve has supported asset markets with unprecedented speed and magnitude in response to COVID-19. In our view, Fed President, Jay Powell, reaffirmed the central bank’s accomodative stance in his virtual address “at Jackson Hole”. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

VERY NEGATIVE |

The relationship between the US and China, the world’s two largest economies, was already weakened by the trade war but has deteriorated further as a result of COVID-19. |

|

ECONOMIC RISKS |

VERY NEGATIVE |

The impacts from COVID-19 were as swift and pronounced as any shock in modern times. Robust monetary and fiscal stimulus stabilized the system, however, economic activity remains well-below that in 2019, and uncertainty remains high. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.