by William

Henderson, Vice President / Head of Investments

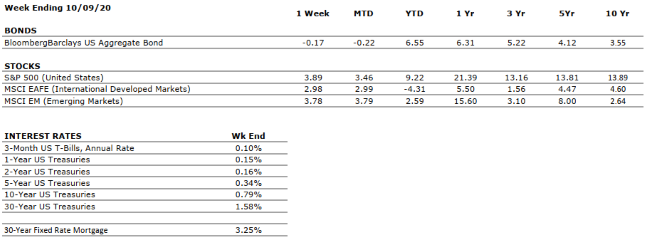

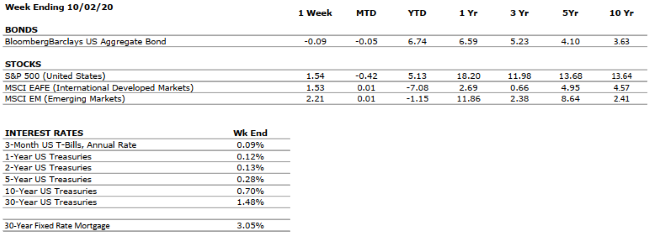

With

September in the books and the fourth quarter on everyone’s mind, the markets

looked to the renewed stimulus talks and posted some of the best weekly returns

in months. For the week ending October 9, 2020, Dow Jones Industrial

Average increased +3.3%, the S&P 500 improved by +3.7% and the NASDAQ was

up +4.6%. These weekly returns moved all three broad markets indices into

positive territory for the full year of 2020; with the Dow at +0.2%, S&P

500, +7.6% and the NASDAQ up a stunning +29.1%. While equity returns have

given investors something to smile about, bonds continue to offer nominal

returns even in the face of a steepening yield curve. The two-year U. S

Treasury Note moved two basis points higher in the week to 0.16% and the 10-year

U.S. Treasury Note rose eight basis points to 0.79%. Low rates continue to push

down mortgage rates which are fueling a strong rebound in new home sales. According

to Freddie Mac, the average 30-year fixed rate mortgage for the week ending

October 9, 2020 was a record low of 2.87%. With such low rates, buyer demand

remains robust with first-time buyers coming into the market. The demand is

particularly strong in more affordable regions of the country such as the

Midwest. The binding theme on all three markets – equities, bonds and real

estate – is the Fed’s unwavering goal of keeping rates lower for longer and

maintaining a near Zero Interest Rate Policy (ZIRP).

We continue to have concerns around a COVID-19 fall resurgence in cases. Concurrently, there is global cooperation on finding a vaccine and hopes remain that the FDA will approve one this year, with global populations actually being vaccinated by Q3 2021. Uncertainty remains around the Presidential Election, and although national polls show Joe Biden ahead over President Trump, these same pollsters and pundits had Hillary Clinton ahead by nearly the same margin in 2016. The markets seem to be pricing in a mixed or balanced government after the election rather than a “blue” or “red” wave. A mixed government typically keeps a lid on drastic policy changes by either party regardless of who is in the White House. This week watch for a fight over media camera time between the SCOTUS’ Amy Coney Barret hearings, renewed stimulus talks among Speaker Pelosi and Treasury Secretary Mnuchin, and the back and forth between President Trump and former Vice President Biden.

Staying the course and maintaining a disciplined investment policy with a keen eye towards diversification and risk management remains our policy at Valley National Financial Advisors. While major uncertainty remains in macro terms, forces exist within the economy (Fed, mortgage rates, market liquidity) that continue to fuel positive returns in the broader markets.