Trending Topics (December 2020 – PART I)

Financial Advisors Laurie Siebert, CPA, CFP®, AEP® and Tim Roof, CFP® discuss estate planning topics including beneficiary and charitable giving elements. WATCH NOW (and stay tuned for PART II next week).

Daily Archives: December 15, 2020

Current Market Observations

by William

Henderson, Vice President / Head of Investments

For

the week that ended December 11, 2020, U.S. stock markets pulled back a bit

with each of the major indices turning in modest negative returns. For the

week, The Dow returned -0.6%, the Standard & Poor’s 500 Index returned

-1.0%, and the NASDAQ returned -0.7%. Last week’s pull back, however, was

not significant enough to move any of the major indices into red territory for

the full year. In fact, the major markets have given investors comfortable

returns across the board. Year-to-date, the Dow has returned +5.3%, the

S&P 500 +13.4%, and the NASDAQ Composite +38.0%.

We continue to see positive notes impacting the economy. President Trump signed a stopgap spending bill on December 11, 2020 to avoid a government shutdown. Congress now has one week to agree on a full-year $1.4 trillion spending bill combined with COVID-19 relief. Lawmakers are squabbling over the details of another stimulus package with one group at $908 billion and another at $748 billion. The good news is that House Speaker Nancy Pelosi has agreed to speak with Treasury Secretary Steven Mnuchin so we could see an additional stimulus plan before year end. According to Gustave Perna, the army general who serves as Chief Operating Officer for Operation Warp Speed, the first shipments of Pfizer Inc.-BioNTech’s COVID-19 vaccines are scheduled to arrive this week in all 50 U.S. states. The widespread release of a vaccine for COVID-19 first by Pfizer, and quickly followed by Johnson & Johnson and Moderna by early spring 2021, is just what consumers and the markets are looking for to release pent up demand for spending. We have seen a faster-than-expected economic recovery and a concomitant rebound in risk assets like stocks; but yields on U.S. Treasury Bonds remain depressed. Don’t expect the Federal Reserve to raise rates anytime soon as they have clearly reflected a plan to keep rates lower for longer even in the face of higher inflation risks.

What is important for investors is diversification. A thoughtfully diversified portfolio can weather different environments better than one that is stuck on a single style, geography or factor. A glance at returns for 2020 across the markets reinforces this notion as we have the Dow at a reasonable +5.3%, the NASDAQ posting a stellar +38.0%; and for fixed income, we have the Bloomberg Barclays US Treasury Total Return Index returning +8.0%. Diversification, when coupled with a sound financial plan, may be the last remaining free lunch for intelligent investors. There are just under three weeks left in 2020, a year that will be remembered long after the books are closed on the markets’ returns.

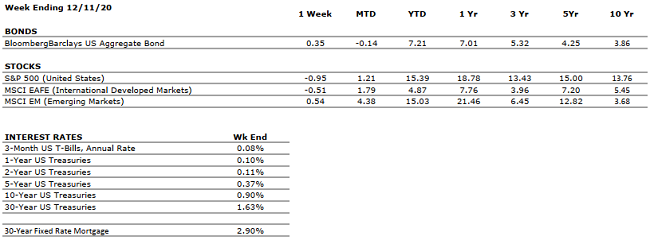

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

GDP increased at a 33.1% annualized pace in Q3. The U.S. economy has now recovered about 2/3 of its output lost to the COVID-19 pandemic. |

|

CORPORATE EARNINGS |

NEUTRAL |

As more than 90% of S&P 500 constituents have reported Q3 results, the index’s earnings are down 7-8% from the year-ago period. This compares to Q2 2020, in which S&P 500 earnings were down by 1/3 from the comparable 2019 quarter. |

|

EMPLOYMENT |

NEGATIVE |

In November, the unemployment rate declined to 6.7%. This continued the month-over-month improvements seen since April, when the metric was above 14%. However, the pace of hiring slowed greatly in November as COVID-19 cases surged. |

|

INFLATION |

POSITIVE |

The Fed plans to allow inflation to temporarily overshoot its 2% target such that the long-term average is 2%. Inflation has been tame since the Great Financial Crisis, less than 2%. |

|

FISCAL POLICY |

POSITIVE |

A second major COVID-19 stimulus bill is likely to be passed over the coming months. |

|

MONETARY POLICY |

VERY POSITIVE |

The Federal Reserve supported asset markets with unprecedented speed and magnitude in response to COVID-19. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

Although economic activity mostly remains below 2019’s levels, improvement has occurred across nearly every measure since the April nadir. With a vaccine on the horizon, a fiscal package probable, and interest rates low, 2021 is positioning to be a strong economic year. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Sometimes you just need to talk to a 4-year-old and an 84-year-old to understand life again. – Kristen Butler

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM: Social Security and Medicare odds and ends. Filing options, withholdings, IRMAA adjustments and Form SSA-44

Laurie can take your questions live on the air at 610-758-8810, or address those submitted via yourfinancialchoices.com.

Recordings of past shows are available to

listen or download at both yourfinancialchoices.com and wdiy.org.