by William Henderson, Vice President / Head of Investments

Last week, the markets moved lower from their previous record highs as investors reacted negatively to signs of higher inflation evident in the release of core inflation data. For the week that ended May 14, 2021, the Dow Jones Industrial Average returned -1.1%, the S&P 500 Index fell by -1.4% and the NASDAQ fell by -2.3%. U.S. Treasury bond yields rose as a result of the news. The 10-year U.S. Treasury Bond rose five basis points to close the week at 1.63%. Even considering last week’s losses in the markets, year-to-date returns remain positive. The Dow Jones Industrial Average has returned +13.1%, the S&P 500 Index +11.7% and the NASDAQ +4.5%.

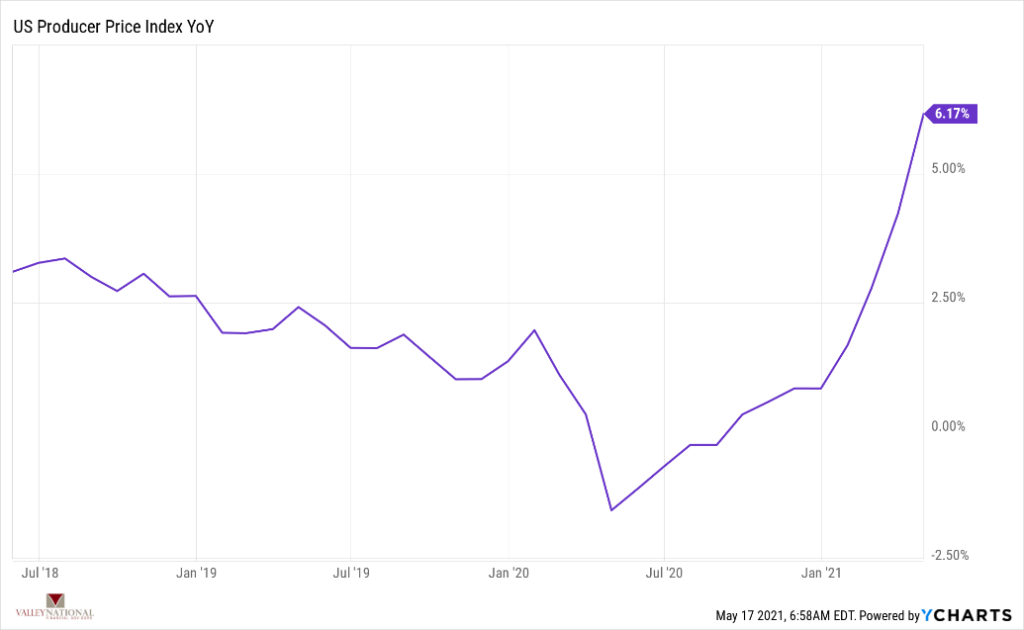

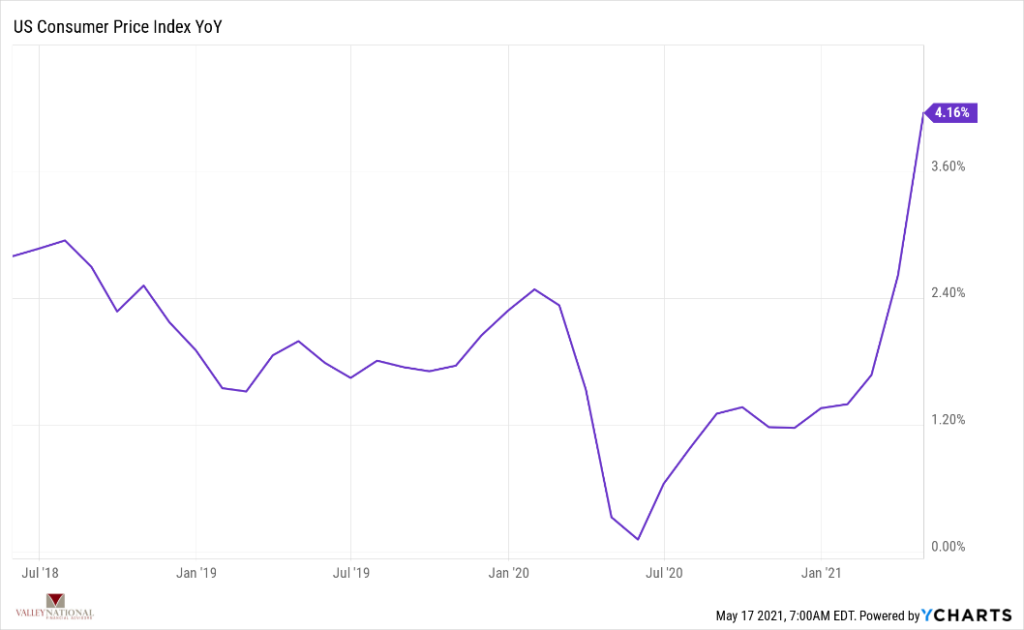

As mentioned, the inflation data released last week cast a pall over the markets. Two generally accepted measures of inflation were released, and both saw substantial increases. The April 2021, year-over-year change in CPI (Consumer Price Index) jumped +4.2% while PPI (Producer Price Index) popped +6.2%. CPI is the average change in prices consumer pay for all goods; PPI is the average change in prices received by domestic producers for their output. (See two charts below from Y-Charts).

While this inflation data was much larger than economists predicted, it does not point to doom and gloom for the economy or the markets. Remember, the Fed (Federal Reserve Bank), is looking for inflation. Last week, Fed Vice Chair Richard Clarida acknowledged the surprise data by stating, “this data is entirely consistent with the Fed’s goals.” Additional comments from the Fed reminded investors that the economy remains far from the Fed’s employment goals. Recall, the Fed’s objective is to seek full employment and control inflation. For years, inflation has been running well below their stated objective of 2% per year and unemployment remains above 6%. So, the Fed has been clear about keeping interest rates lower for longer – at least until both inflation and employment are in check.

Beyond inflation worries, investors were also forced to digest other unsettling events, including a hacker-induced shutdown of a major gasoline pipeline operated by Colonial Pipeline, the primary supplier of gas to the Southeast. Further, shortages in microchips have hampered car production in the U.S. which has oddly led to a rental car shortage. Lastly, and not unexpectedly, there was a sell-off in cryptocurrencies, specifically Bitcoin, as tech wizard Elon Musk announced that Tesla would no longer accept Bitcoin as payment for its cars because of the large carbon footprint that cryptocurrency mining leaves behind.

There was plenty of good news last week as well. The CDC announced an easing of mask wearing requirements for fully vaccinated people and vaccine distribution for COVID-19 could begin for children aged 12-15. We have finally, hopefully, turned the corner on the pandemic and a grand reopening is upon us. A consumer flush with cash and willing Fed should provide the continued stimulus the economy and the markets need to move forward.