by William Henderson, Vice President / Head of Investments

Markets ended mixed last week with a reversal of the technology and value sectors for the first time in a while. The tech-heavy NASDAQ returned +0.3% for the week that ended May 21, 2021, while the Dow Jones Industrial Average lost –0.5% and the S&P 500 Index lost –0.4% over the same period. With the Fed on hold for interest rate movements and some weaker than expected employment and economic information, the bellwether 10-year U.S. Treasury Bond remained well below its 2021 high of 1.74% to close the week at 1.62%. Rising bond yields can be indicative of improving economic conditions. For the full year of 2021, returns on the stock market remain solidly positive. Year-to-date, the Dow Jones Industrial Average has returned +12.6%, the S&P 500 Index +11.3% and the NASDAQ +4.8%.

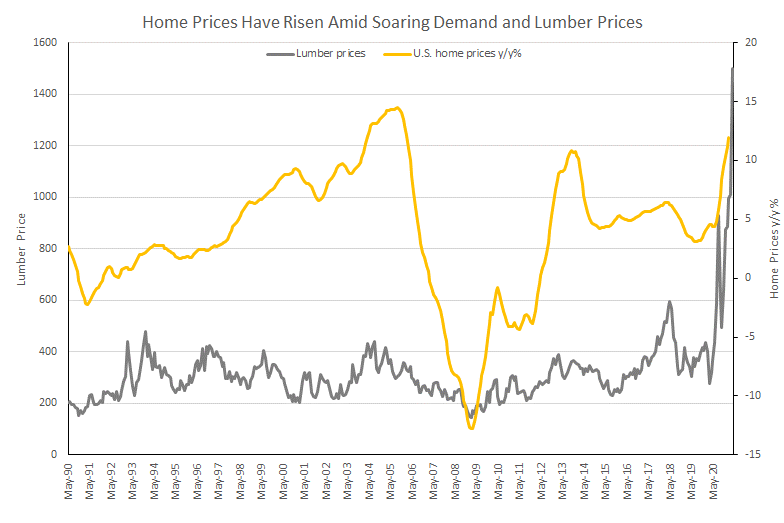

Inflation concerns have cast a pall on the markets over past weeks. One such area of noted inflation can certainly be seen in the housing market. Due to a significant jump in demand, home prices have skyrocketed in many regions of the country. Lower inventories and dramatically rising building-materials costs have impacted home prices. Higher lumber prices, for example, have had a substantial impact on new home construction prices. The chart below from Bloomberg, shows the gain in housing prices and lumber after the COVID-related recession.

While the spike is reminiscent of the housing crisis of 2008-09 that led to the Great Financial Crisis, it is not likely to have a similar effect this time around. This time, we have falling unemployment rates, an increase in “work from home” demand, record low mortgage rates, and tight new housing construction trends. Conversely, the current housing climate gives the economy a sound foundation for a continued recovery.

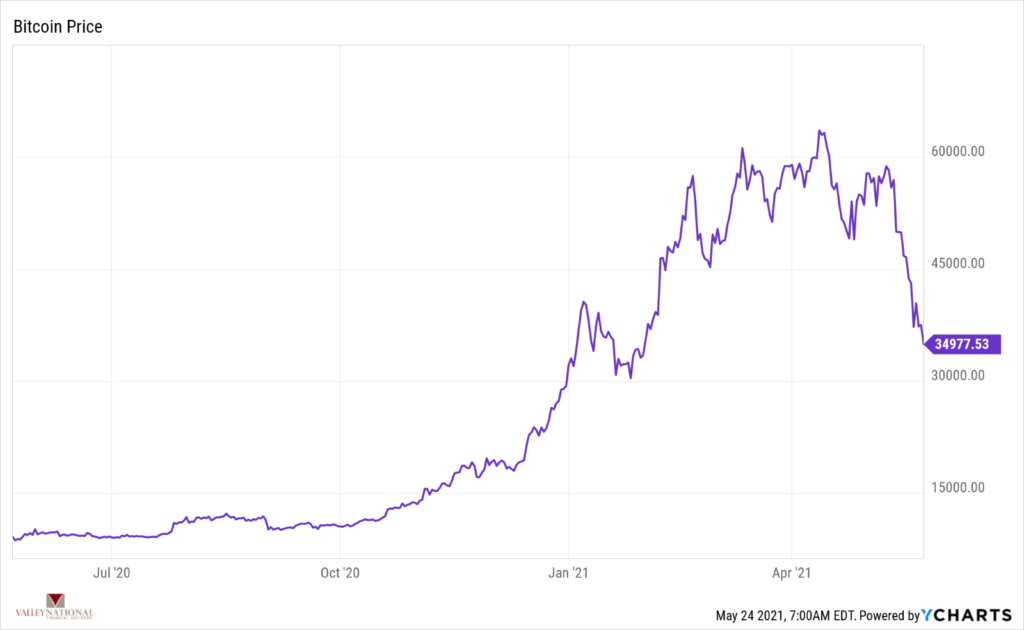

We cannot mention the word “spike” without a brief discussion of Bitcoin. Bitcoin and other cryptocurrencies have garnered plenty of attention during this market bull run, which is clearly indicative of two things: market liquidity and excess cash chasing investment opportunities. The chart below from Y-Charts, shows the run up in Bitcoin to near 60,000 (in U.S. dollars) and the recent near-50% sell-off. While drastic drops in asset prices are unsettling, Bitcoin is still a new asset class and small in terms of the overall market capitalization. However, volatility in esoteric areas of the market have, on occasion, roiled investors in a wider arena.

This week we will see the final batch of 1st quarter earnings reports, with some major retailers and tech names reporting. Important names like Urban Outfitters, AutoZone, Dick’s Sporting Goods, Best Buy and Costco report and will give us a glimpse of the consumer’s move back to shopping whether online or in person. High-flying tech names like Snowflake, Salesforce, and Workday all report this week as well. The work from home trend has impacted these names and we will see if the recent push by corporate CEOs back to the workplace has a different impact.

Nationally, we have witnessed a major victory over COVID-19 as we reached the critical 50% vaccination rate. Further, local economies are opening and lifting capacity restrictions on gatherings and restaurants. As we move into the summer, we will see the last area of the economy: travel and leisure surge with activity; limited only by constraints on labor. Our best friend remains Fed Chairman Jay Powell and his commitment to low interest rates for longer.