Team VNFA is pleased to celebrate Ryan Mulhearn, CIMA® being recognized as one of the Lehigh Valley Business 2021 Forty Under 40. We look forward to the virtual event on September 28. Forty Under 40 Awards – LVB

Monthly Archives: July 2021

Did You Know…?

The IRS has created

the ability for taxpayers to create an online account to securely access

information, view notices, make payments and more. Read about the online

benefits and create an account at IRS.gov/account.

Current Market Observations

by William Henderson, Vice President / Head of Investments

Last week’s rollercoaster ride in the markets ended with the Bulls taking command by the end of the week with each of the major stock market indexes finishing well into positive territory. For the week, the Dow Jones Industrial Average gained +1.1%, the S&P 500 Index added +2.0% and the tech-heavy NASDAQ gained an impressive +2.8%. Weekly gains added to an already strong year of returns across all three indexes. Year-to-date, the Dow Jones Industrial Average has returned +15.7%, the S&P 500 Index +18.4% and the NASDAQ +15.5%. Treasury Bonds rallied for another week, with the yield on the 10-year U.S. Treasury Bond falling by 2 basis points to close at 1.23%. Bonds continue to puzzle investors as most traders expected yields to rise this year as the Fed started to taper its bond purchases. The Fed meets this week and perhaps during Chairman Powell’s press conference after the meeting we will get some direction. The bellwether 10-year U.S. Treasury Bond dropped more than a quarter percentage point since the Fed’s last policy meeting, and at that meeting we saw the U.S. central bank officially kick off discussions about a timeline for reducing asset purchases (tapering) and lifting interest rates from their current 0-0.25% range.

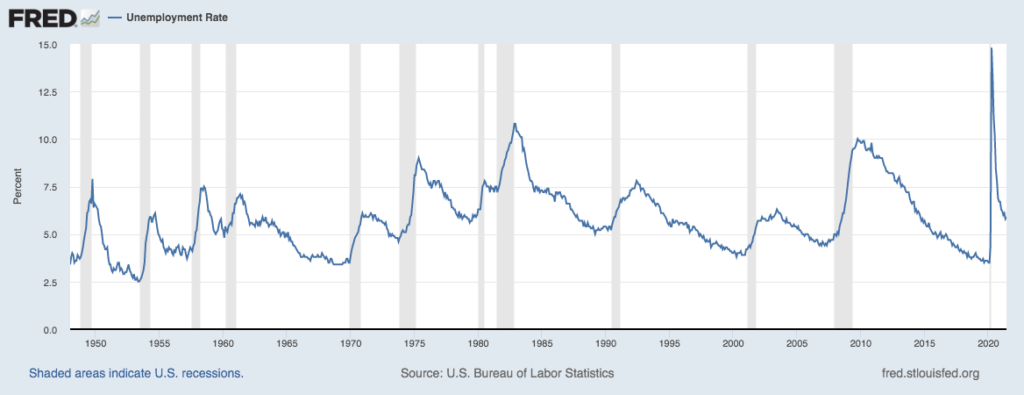

As mentioned, we saw a broad rally in the markets last week. This was in stark contrast to concerning news around the spread of the Delta Coronavirus. The markets seem to be signaling that the spread will be contained and strength in many other sectors of the economy will continue to fuel a strong recovery. Among the positive economic indicators is the falling unemployment rate and strong corporate earnings. (See chart below from the Federal Reserve Bank of St. Louis)

Unemployment continues to fall and the initial supply of labor and demand for labor imbalance seems to be abating a bit; especially as unemployment benefits taper off. Most earning releases for the second quarter exceeded analysts’ expectations but remember the results were compared to 2020’s drastically reduced earnings as a result of the pandemic. Third and fourth quarter results will prove to be a more important indicators of a true earnings recovery.

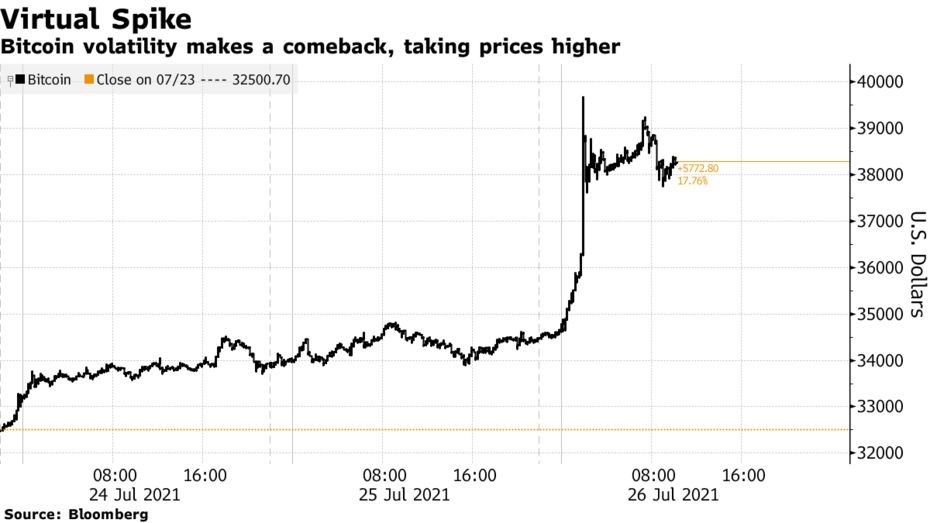

There was an interesting twist thrown into the always fun cryptocurrency market as Bloomberg reported seeing Amazon’s “Job Vacancy” website listing an advertisement for a “digital currency and blockchain product lead.” The news sent many cryptocurrencies higher after being battered for several weeks. Bitcoin surged to a six-week high just below $40,000, (see chart below from Bloomberg).

The possibility of the world’s largest internet retailer accepting cryptocurrency for payment or even creating their own Amazon specific cryptocurrency has breathed some life into the recently faltering market. If nothing else, this market is exciting to follow.

As stated above, the Federal Reserve meets this week to discuss monetary policy, inflation expectations and unemployment concerns. Most economists do not see this as being a pivotal meeting. According to Bloomberg, three-quarters of economists they surveyed expect the Fed to hold off on signaling a tapering of asset purchases or an increase in rates until the at least the Jackson Hole, Wyoming Fed Retreat Meeting in August, or the September 21-22 meeting. That said, watch for any signal from Chairman Powell at the press conference where he could hint to a change no one expects.

We believe the economy is well under way for its recovery, vaccines exist for COVID-19 and its variants, and corporations and consumers are in excellent financial shape. Healthy markets always have pull backs and sell offs during an extended bull rally and we expect the same in 2021.

The Numbers & “Heat Map”

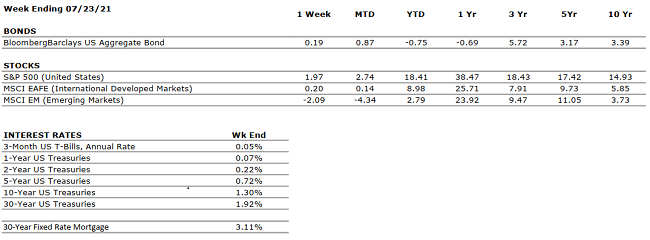

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

The OECD forecasts that the global economy will grow 5.6% and 4.4% in 2021 and 2022, respectively. |

|

CORPORATE EARNINGS |

POSITIVE |

With about 1/4 of S&P 500 constituents having reported Q2 results, sales and earnings growth are running at an astonishing 21% and 74% pace when compared to the heavily depressed figures from Q2 2020. |

|

EMPLOYMENT |

POSITIVE |

In June, the U.S. economy added 850,000 jobs, beating expectations handily. The unemployment rate is 5.9%, well within normal parameters. |

|

INFLATION |

NEUTRAL |

Inflation accelerated to 5.4% in June. Jay Powell, Federal Reserve Chair, believes that the recent uptick in inflation is primarily attributable to global supply chain constraints, and that inflation will slow as such constraints resolve through the remainder of the year. |

|

FISCAL POLICY |

POSITIVE |

President Biden recently unveiled a stimulus package directed towards infrastructure that would total more than $2 trillion over eight years. President Biden is also considering a significant capital gains tax increase. |

|

MONETARY POLICY |

POSITIVE |

The Federal Reserve indicated this week that it plans to hike rates twice in 2023. Previously, the Fed had suggested it would not raise rates until 2024. Nonetheless, the monetary stance is accommodative in the near future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

With multiple vaccines in distribution and accommodative fiscal and monetary policies in place, 2021 may be one of the strongest economic years on record. If a risk is present, it may be that the economy will overheat, thereby leading to inflation and higher interest rates. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“If you are not willing to risk the unusual you will have to settle for the ordinary.” – Jim Rohn

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM. Laurie will discuss:Children – Investment and Tax Considerations for Them & You

Laurie can address question on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Current Market Observations

by William Henderson, Vice President / Head of Investments

With second quarter earnings season well under way, last week saw a slight retreat in all three major indexes as stocks sold off a bit from their previous highs. The Dow Jones Industrial Average fell (-0.5%), the S&P 500 Index lost (-1.0%) and the NASDAQ sold off by (-1.9%). Regardless of last week’s modest sell off, year-to-date returns remain strong across all three indexes. Year-to-date, the Dow Jones Industrial Average has returned +14.5%, the S&P 500 Index +16.1% and the NASDAQ +12.3%; representing a broad rally across industries and sectors. Bonds continued to be torn between inflation-related news and Federal Reserve Chairman Powell’s commitment to keeping rates lower for longer. Confounding bond bears, yield on the 10-Year U.S. Treasury dropped an additional nine basis points last week to close at 1.25%, a full 49 basis points lower than the 1.74% yield level hit in March of this year.

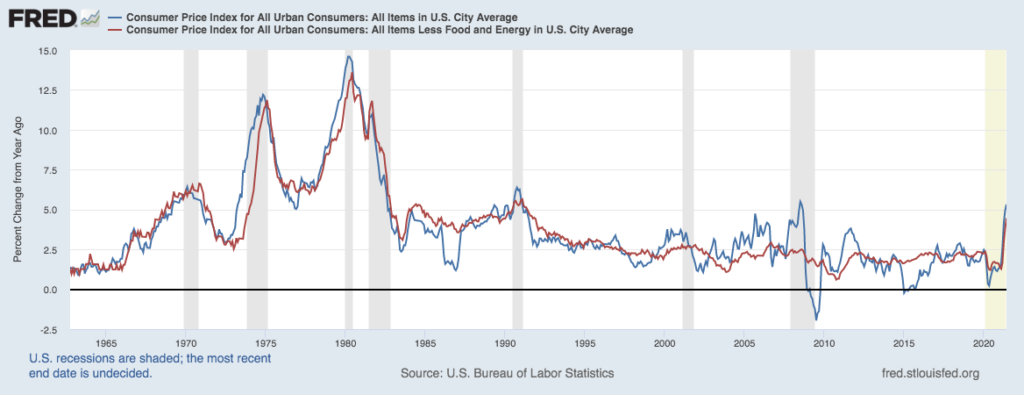

Inflation news was all the rage last week when a monthly measure of U.S. consumer prices rose at the fastest pace since 2008. June’s Consumer Price Index rose 5.4% from the same period a year earlier, which surprised most economists who expected the recent spike in inflation to begin to moderate. (See chart below from the Federal Reserve Bank of St. Louis.)

While the spike in inflation was much larger than expected, breaking down the results revealed that about 1/3 of the increase was due to increases in used-car prices. Inflationary pressures were certainly broadly felt by consumers elsewhere, as food prices increased 0.8% in June and gasoline prices rose by 2.5%. In his report to a U.S. Congressional Panel, Powell repeatedly stated two things: 1) He would not hesitate to raise interest rates if needed to control runaway inflation; and 2) He expects consumer prices to ease later this year. However, Powell firmly believes significant progress in terms of employment and inflation is still needed before short-term interest rates are increased.

Wall Street analysts are expecting strong earnings results from companies focused on technology, materials, and healthcare as final 2Q results are announced. Looking beyond 2Q, companies will have to deal with increases in prices of materials and labor and this could certainly impact earnings, especially in firms where their ability to pass on costs to consumers is limited. Conversely, we have seen some modest price declines in materials like copper and lumber. The overall supply/demand mismatch is abating and these factors will assist companies going forward.

The moves in U.S. Treasury Bond prices as noted above with the 10-year note falling to 1.25% seem to harken back to the early trading patterns when the pandemic first struck in 2020. Surging cases of the new Delta variant of the COVID-19 virus in many parts of the world, including highly vaccinated countries such as the U.K., could be prompting a flight to quality by investors. Lastly, any impediment to a continued re-opening of the global economy will impact future economic growth and concomitant earnings results for equities. Concerns abound and markets are a tricky business. Modest pull backs in equity markets like last weeks and even larger corrections in bull markets are healthy and expected. Equity prices never go straight up, they go up and down and up; generally going from the lower left of a chart to the upper right. Keep focused on long-term trends and a Federal Reserve that is committed to a healthy recovery.

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

The OECD forecasts that the global economy will grow 5.6% and 4.4% in 2021 and 2022, respectively. |

|

CORPORATE EARNINGS |

POSITIVE |

Q2 earnings season is just getting underway. Corporate results are likely to be very strong throughout 2021 on a “year-over-year” basis as companies compare their results to depressed 2020 numbers. |

|

EMPLOYMENT |

POSITIVE |

In June, the U.S. economy added 850,000 jobs, beating expectations handily. The unemployment rate is 5.9%, well within normal parameters. |

|

INFLATION |

NEUTRAL |

Inflation accelerated to 5.4% in June. Jay Powell, Federal Reserve Chair, believes that the recent uptick in inflation is primarily attributable to global supply chain constraints, and that inflation will slow as such constraints resolve through the remainder of the year. |

|

FISCAL POLICY |

POSITIVE |

President Biden recently unveiled a stimulus package directed towards infrastructure that would total more than $2 trillion over eight years. President Biden is also considering a significant capital gains tax increase. |

|

MONETARY POLICY |

POSITIVE |

The Federal Reserve indicated this week that it plans to hike rates twice in 2023. Previously, the Fed had suggested it would not raise rates until 2024. Nonetheless, the monetary stance is accommodative in the near future. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

There are few, if any, looming geopolitical risks that could upset the economic recovery. |

|

ECONOMIC RISKS |

NEUTRAL |

With multiple vaccines in distribution and accommodative fiscal and monetary policies in place, 2021 may be one of the strongest economic years on record. If a risk is present, it may be that the economy will overheat, thereby leading to inflation and higher interest rates. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“If I had to embrace a definition of success, it would be that success is making the best choices we can… and accepting them.” – Sheryl Sandberg

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” show on WDIY 88.1FM. Laurie and her guest, William Henderson, VP / Head of Investments at Valley National Financial Advisors will discuss: Q2 Market Review.

Read the written Q2 Commentary released from our Investment Department at valleynationalgroup.com/quarterly-commentary-q2-2021/

Laurie and her guest can address question on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.