by William Henderson, Vice President / Head of Investments

Last week’s rollercoaster ride in the markets ended with the Bulls taking command by the end of the week with each of the major stock market indexes finishing well into positive territory. For the week, the Dow Jones Industrial Average gained +1.1%, the S&P 500 Index added +2.0% and the tech-heavy NASDAQ gained an impressive +2.8%. Weekly gains added to an already strong year of returns across all three indexes. Year-to-date, the Dow Jones Industrial Average has returned +15.7%, the S&P 500 Index +18.4% and the NASDAQ +15.5%. Treasury Bonds rallied for another week, with the yield on the 10-year U.S. Treasury Bond falling by 2 basis points to close at 1.23%. Bonds continue to puzzle investors as most traders expected yields to rise this year as the Fed started to taper its bond purchases. The Fed meets this week and perhaps during Chairman Powell’s press conference after the meeting we will get some direction. The bellwether 10-year U.S. Treasury Bond dropped more than a quarter percentage point since the Fed’s last policy meeting, and at that meeting we saw the U.S. central bank officially kick off discussions about a timeline for reducing asset purchases (tapering) and lifting interest rates from their current 0-0.25% range.

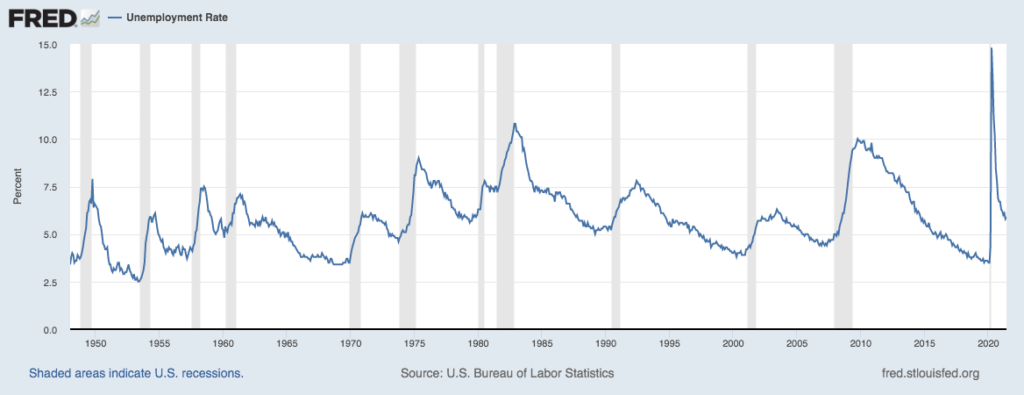

As mentioned, we saw a broad rally in the markets last week. This was in stark contrast to concerning news around the spread of the Delta Coronavirus. The markets seem to be signaling that the spread will be contained and strength in many other sectors of the economy will continue to fuel a strong recovery. Among the positive economic indicators is the falling unemployment rate and strong corporate earnings. (See chart below from the Federal Reserve Bank of St. Louis)

Unemployment continues to fall and the initial supply of labor and demand for labor imbalance seems to be abating a bit; especially as unemployment benefits taper off. Most earning releases for the second quarter exceeded analysts’ expectations but remember the results were compared to 2020’s drastically reduced earnings as a result of the pandemic. Third and fourth quarter results will prove to be a more important indicators of a true earnings recovery.

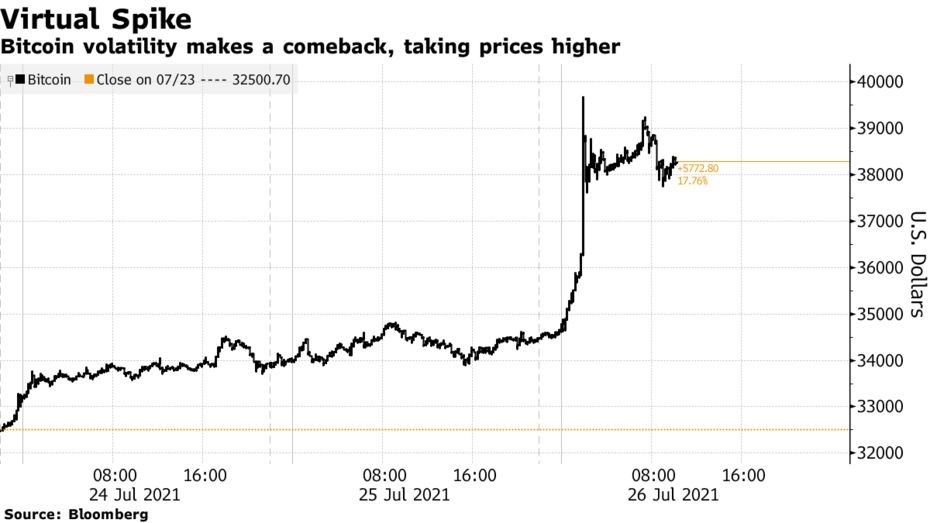

There was an interesting twist thrown into the always fun cryptocurrency market as Bloomberg reported seeing Amazon’s “Job Vacancy” website listing an advertisement for a “digital currency and blockchain product lead.” The news sent many cryptocurrencies higher after being battered for several weeks. Bitcoin surged to a six-week high just below $40,000, (see chart below from Bloomberg).

The possibility of the world’s largest internet retailer accepting cryptocurrency for payment or even creating their own Amazon specific cryptocurrency has breathed some life into the recently faltering market. If nothing else, this market is exciting to follow.

As stated above, the Federal Reserve meets this week to discuss monetary policy, inflation expectations and unemployment concerns. Most economists do not see this as being a pivotal meeting. According to Bloomberg, three-quarters of economists they surveyed expect the Fed to hold off on signaling a tapering of asset purchases or an increase in rates until the at least the Jackson Hole, Wyoming Fed Retreat Meeting in August, or the September 21-22 meeting. That said, watch for any signal from Chairman Powell at the press conference where he could hint to a change no one expects.

We believe the economy is well under way for its recovery, vaccines exist for COVID-19 and its variants, and corporations and consumers are in excellent financial shape. Healthy markets always have pull backs and sell offs during an extended bull rally and we expect the same in 2021.