by William Henderson, Vice President / Head of Investments

U.S. equities sold off last week as a double dose of poor economic data hit the markets: inflation and consumer sentiment (more on that below). Last week, the Dow Jones Industrial Average rose fell -0.6%, the S&P 500 Index decreased by -0.3% and the NASDAQ dropped by -0.7%. Fortunately, year-to-date returns across all major markets remain strong so last week’s modest sell off did not materially impact returns thus far in 2021. Year-to-date, the Dow Jones Industrial Average has returned +19.8%, the S&P 500 Index +26.2% and the NASDAQ +23.8%. The 10-Year U.S. Treasury moved higher by two basis points closing the week at 1.55% and still well below the 1.74% level reached in March of this year.

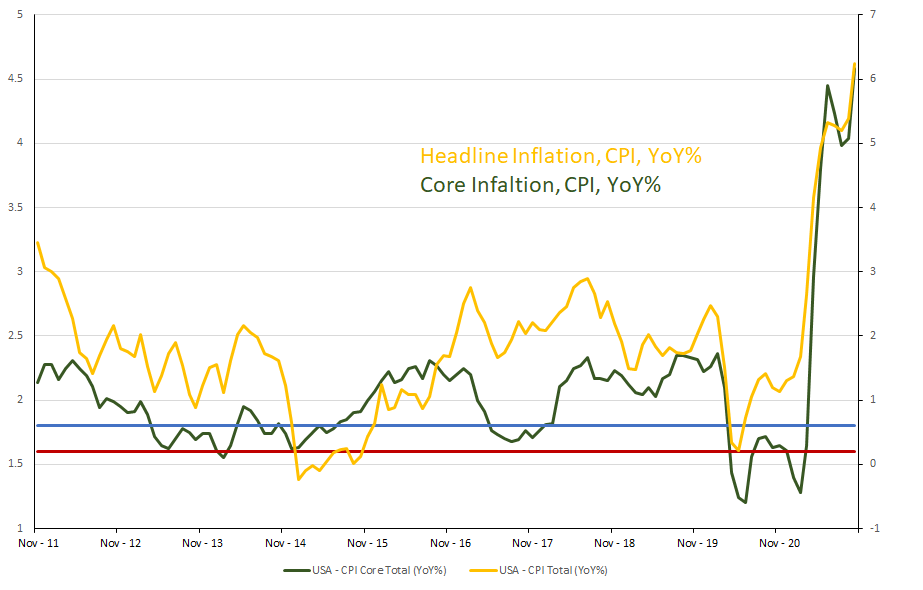

As mentioned, inflation indicators released last week showed the economy continued to signal higher prices for many goods and services. Both the Producer Price Index (PPI) and Consumer Prices Index (CPI) came in well above economists’ expectations and reached multidecade highs. The CPI reading was +6.2%, the highest level since 1991, while the PPI reading was +8.6%, the highest level since 2010. Some economists shrugged the news off noting that the data was largely driven by “transitory” factors like energy and auto prices but other less transitory factors such as rent, and wages also showed significant price increases. The markets and consumers may not like higher inflation, but this is what the Fed ordered and remember, prior the pandemic for nearly 10-years, inflation had averaged a paltry +1.6%, well below the Fed’s mandated target of +2.0%. (See the chart below from FactSet).

While inflation commonly hangs an anchor on consumption and growth, we expect higher inflation to moderate next year as supply chain disruptions, labor shortages and strong consumer demand eventually fall back to pre-pandemic, manageable levels. Further, the flexible or transitory components of inflation, energy, autos, and food, have been hardest from supply problems and should reverse once global pressures ease. However, the stickier parts of inflation such as wages, rent and healthcare are not likely to reverse, for example, it is usually very difficult to reverse salary increases, once implemented. If the Fed manages its mandate well, there will be a balance of prices between transitory and sticky that allow inflation to average their +2.0% goal.

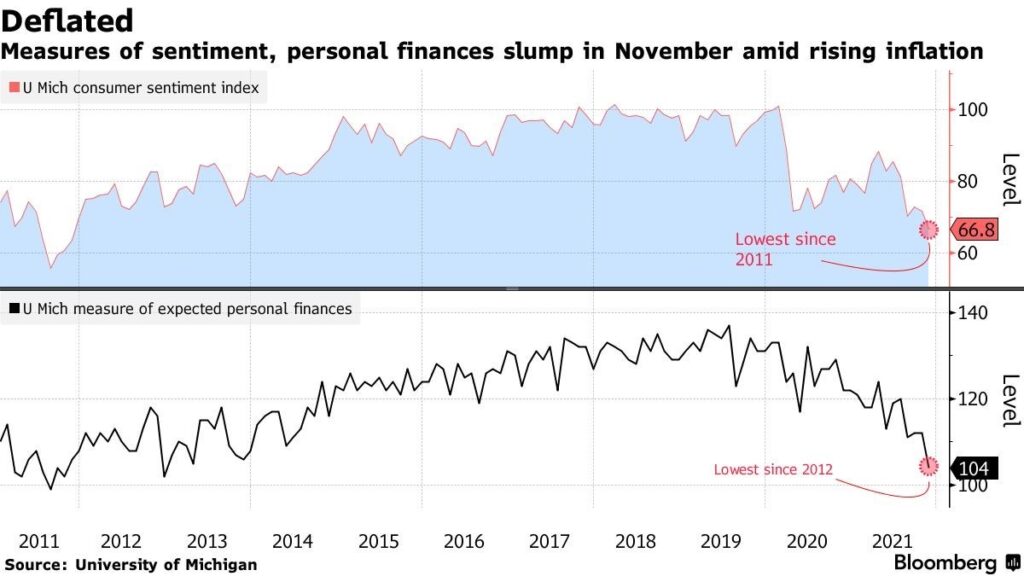

One number released last week that is worrisome was U.S. Consumer Sentiment (previously called Consumer Confidence). The U.S. Consumer Sentiment, as measured by the University of Michigan unexpectedly fell in early November as Americans grew understandably concerned about rising prices and the inflationary impact on their finances. The University of Michigan’s preliminary sentiment index decreased to 66.8 from 71.7 in October. The November figure was well below all Wall Street Economists’ expectations according to a survey by Bloomberg which had called for an increase of 72.5. (See chart below from U Michigan and Bloomberg).

As we have stated many times, the consumer is the most important factor in the U.S. economy as consumption makes up approximately 68-70% of GDP in any given year. A worried consumer is not what an economic doctor would ever order. With the holiday season kicking off in about one week, or earlier if you believe TV ads, it will be interesting to see if the pent up, cash-flush consumer gets out there and spends money this year. If there is another twist to this story, it will certainly be what impact the supply chain disruptions and clogged ports will have on holiday shopping and Santa Wish Lists. From an investors point of view, a perfect hedge against inflation, and a way to protect one’s portfolio from the impact of rising prices is to invest in equities, which generally outpace inflation over time. 2021 is a perfect year to demonstrate this. While expert economists are crowing about the +6.2% inflation rate this year, the S&P 500 Index is up a stunning +26.2%. Always remain focused on the big picture.