by William Henderson, Vice President / Head of Investments

All three major market indexes closed lower last week as a poor jobs report on Thursday added to hawkish comments by Fed Chair Jay Powell suggesting a more aggressive pace of bond purchase tapering and sooner rate hikes than previously announced. The market also continued to react to the implications of the new omicron variant of COVID-19. The Dow Jones Industrial Average fell by -0.9%, the S&P 500 Index dropped by -1.2% and the NASDAQ lost -2.6%. While a poor week overall, major indexes remain in positive territory for the year. Year-to-date, the Dow Jones Industrial Average has returned +15.1%, the S&P 500 Index +22.5% and the NASDAQ +17.8%. Even in the face of potential monetary tightening, the U.S. Treasury market rallied and forced bond yields lower. The 10-year U.S Treasury ended the week at 1.40%, a full 13 basis points lower than last week and confoundingly lower than the 1.74% level reached in March of this year. Bonds continue to offer safety and risk management when risk assets (e.g., equities) sell off.

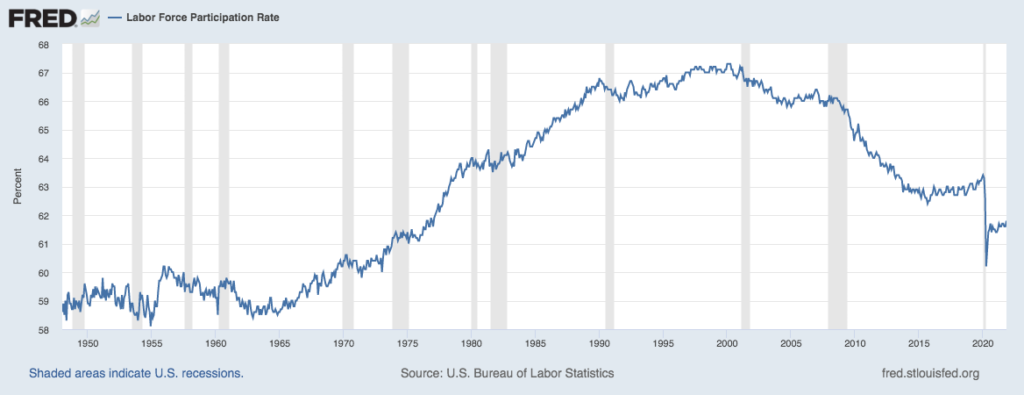

As mentioned above, according to Bloomberg, the employment report showed only +210,000 new jobs were created in November 2021 vs. economists’ expectations of +550,000. On the surface this number is bad news, but this data point is sometimes unreliable and often subject to revisions in later months. If you unpack last week’s economic releases, we believe there is strong forward momentum in the employment situation and the economy. First, the unemployment rate plunged to 4.2% vs. expectations of 4.5%, clearly suggesting more people are returning to the workforce. Second, the Labor Force Participation rate moved to a post-pandemic high of 61.8%. (See the chart below from the Federal Reserve Bank of St. Louis).

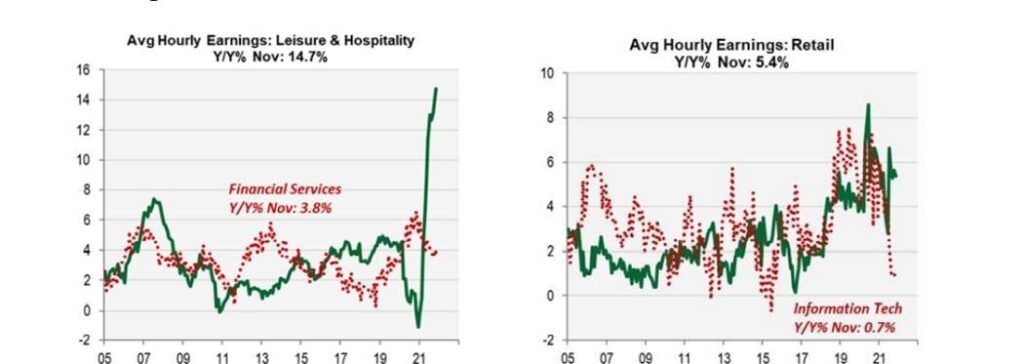

A report by Cornerstone Macro last week pointed to two articles that highlighted teenagers and retirees might be lured back to the workforce soon: “Teen Hiring is Snowballing Amid Staffing Crisis, Rising Entry-level Pay “(USA Today 12/1/21). And “Short on Transit Workers, Cities Pay Bonuses to Lure Back Retired Staff” (NY Times 12/1/21). (See the charts below from Cornerstone Macro showing significant improvements in average hourly earnings for employees in the Leisure, Hospitality and Retail sectors – all classic places for younger and / or newly retired workers.)

Lower unemployment and wage growth will continue to act as an economic tailwind and propel the recovery farther and longer.

While the impact of the new omicron variant is still being digested, the markets are not yet panicking. More specific information about omicron’s transmissibility, virulence and resistance to vaccines needs to be discovered. However, early reports suggest while more contagious, omicron has relatively mild symptoms and the widely available booster shots could offer a considerable degree of protection. Lastly, biotech and medical developments over the past year give us some degree of confidence that the latest setback will not lead to a repeat of the early-2020 pandemic days and resultant economic lockdowns. As we move to the close of 2021, let’s keep the important things in focus: the economy is clearly on a path to a strong recovery, employment activity is healthy and growing broadly across all sectors, corporations remain strong and continue to invest in capital expenditure and finally the consumer remains the backbone of the economy and is poised to continue to offer support well into 2022. Market selloffs and setbacks are to be expected, especially at year end as trading desks are thinly staffed and investment banks are reluctant to offer liquidity. Here at VNFA, we are already focused on 2022 and long-term returns.