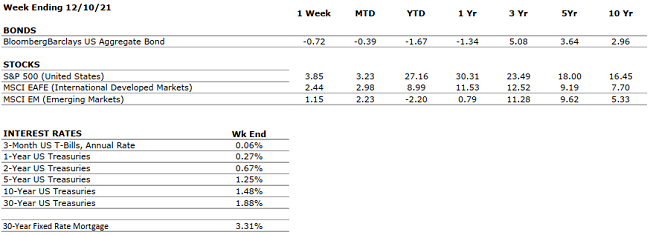

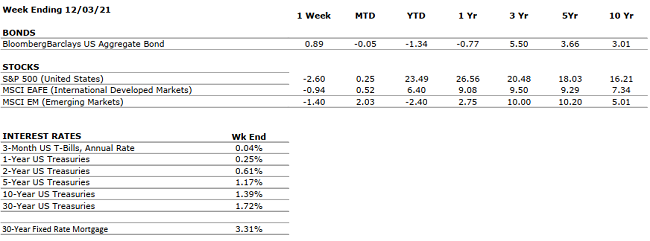

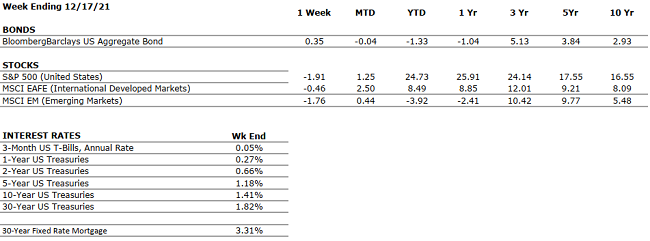

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. GDP growth decelerated to a 2% annualized pace in Q3. The slowdown was driven primarily by supply chain constraints. Economists expect a modest acceleration in Q4. Early high-frequency data (shopping, travel, movie ticket sales) is showing some slowing. |

|

CORPORATE EARNINGS |

POSITIVE |

Huge year-over-year increases in corporate earnings are likely to decelerate in 2022 as CapEx begins to have an impact on income statements. The supply chain disruptions are waning, but we may have to take omicron shutdowns into account. |

|

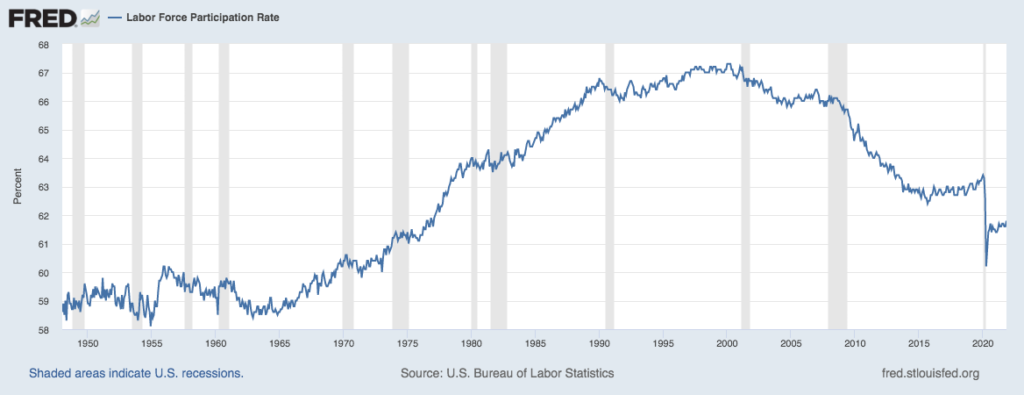

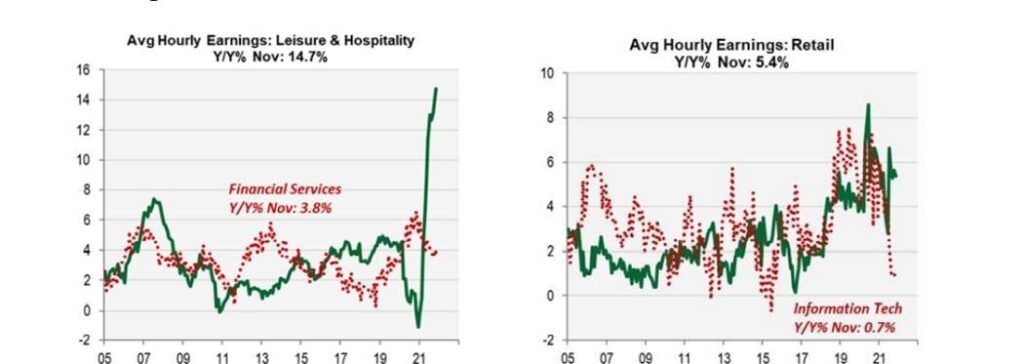

EMPLOYMENT |

POSITIVE |

The unemployment rate is down to 4.2%, as of November. The labor market is very tight at present as many employers, particularly in the Leisure and Logistics sectors, are struggling to fully staff because the labor participation rate remains below pre-COVID levels. The labor shortage is one of the causes of the global supply chain glut. |

|

INFLATION |

NEGATIVE |

CPI rose 6.8% year-over-year in November, the highest increase since 1982, driven by the global supply chain backlog and continued consumer pent up demand. Will inflation be transitory or permanent? |

|

FISCAL POLICY |

NEUTRAL |

The Build Back Better Bill looks to be swamped and pushed into 2022 by Senator Manchin. If the Biden Administration cannot pull the team together now, think about post-mid-term elections. Fiscal stimulus is waning. |

|

MONETARY POLICY |

POSITIVE |

The FOMC meets this week. Watch for wording around “transitory inflation.” By early 2022, all Fed bond purchases will halt. The Fed’s bond-buying program works to keep interest rates low. Once tapering ends, rate hikes follow. Mid-June or sooner for rate hike? |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEUTRAL |

The new omicron COVID-19 variant has shown up in many parts of the world. This strain seems less virulent and more reactive to boosters so its impact it still yet to be calculated. President Biden threatened a 2022 Olympics boycott in China. Russia builds up its border with the Ukraine. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions are hampering the economy; however, demand remains very strong. While global logistics are operating far below normal efficacy, it appears the supply chain is slowly improving and may reach normalcy by mid-to-late-2022. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.