We are hiring! Team VNFA is seeking an Investment Technology Associate to work as part of our Investment Department. Join Our Team – Valley National Financial Advisors

Daily Archives: March 1, 2022

Current Market Observations

by William Henderson, Chief Investment Officer

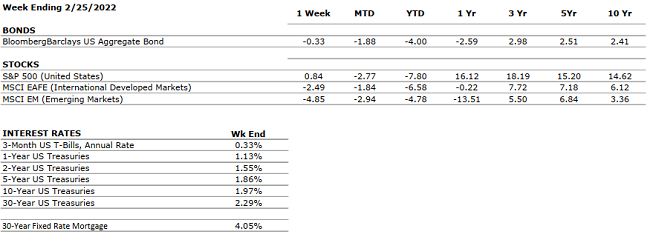

Market volatility prevailed last week as the Russia / Ukraine “crisis” spiraled into a full-scale invasion and war between the two countries. On a continent that has been free of international aggressions of this sort since WWII, Russia acted unilaterally and invaded Ukraine. International reaction was mostly unified with quick condemnation from all countries except China, who remained silent. Markets ended the week on a mixed note, but wild price swings of 500 and 1000 points (on the Dow Jones Industrial Average) were common all week. The Dow Jones Industrial Average fell -0.7%, the S&P 500 Index gained +0.1% and the NASDAQ lost -0.2%. Year-to-date returns remain well in negative territory for all three major indexes. Year-to-date, the Dow Jones Industrial Average is down -6.0%, the S&P 500 Index is down -7.8% and the NASDAQ is down -12.4%. Even bonds were not spared last week in the modest sell-off as the yield on the 10-Year U.S. Treasury rose five basis points week-over-week to end at 1.97%.

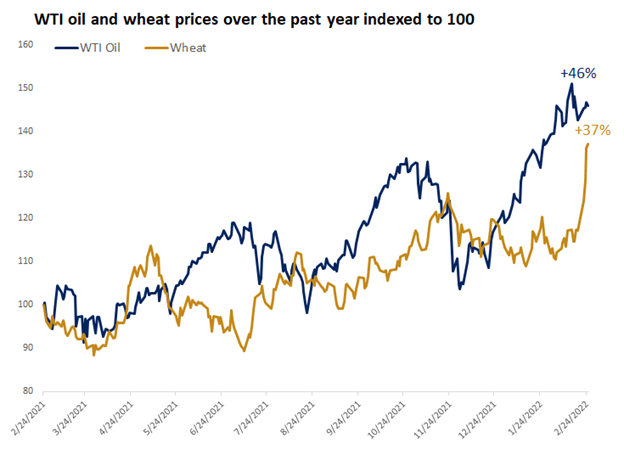

The Russian invasion has spiked market volatility, increased uncertainty around the pace of the global recovery from the pandemic and thankfully brought unilateral financial sanctions to Russia. Volatility results simply from the uncertainty surrounding the duration of the Russia / Ukraine war and the impacts it is having on commodity prices; as Russia is a significant producer of several major global commodities such as oil, wheat, and palladium (a critical rare earth used in catalytic converters). See the chart below from FactSet showing the recent spikes in prices of oil and wheat.

Thankfully, the reaction from the global community to the Russian invasion has been dramatic and financial sanctions such as limiting access to SWIFT banking channels and freezing of $630 billion of foreign reserves have already had an impact. Russia has closed its stock market, and the Russian Central Bank raised short-term rates from 9.5% to 20% to defend the tumbling Ruble. Of course, the reaction by the Russian people was a run on banks and ATMs in a last dash effort to get hard currency before an expected crash. Beyond financial sanctions and hardship on Russians themselves the international community has been swift in condemning Vladmir Putin personally and supporting Ukraine as much as possible. Given Ukraine is not a NATO country but borders several including Poland and Romania actual military support will be precarious and certainly measured baring a full-scale global conflict.

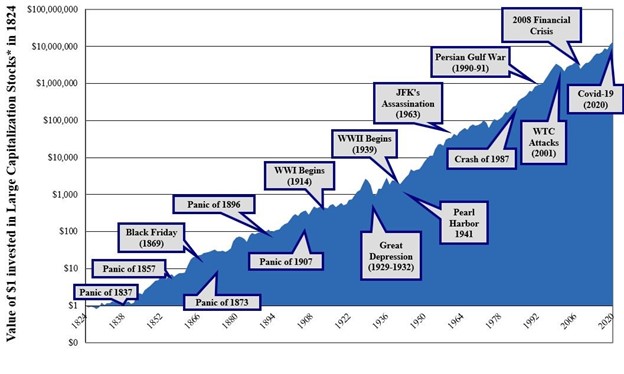

As mentioned, fear, uncertainty and volatility are never associated with good times in markets – in fact quite the opposite. However, historically, markets look past geopolitical events and move higher over extended periods of time; and that alone should be an investors’ focus. (See the chart below from Haverford Trust & Ibbottson. Associates showing major geopolitical events and the increase in $1 invested in Large Cap Equities).

While the underlying strength in the U.S. economy and thereby the markets exist, the current global uncertainty will prevail and grab all headlines. Higher commodity prices, specifically oil, have the propensity to impact the recovery and ongoing growth in the economy. Whether sanctions will prevail, and Russia retreats or U.S. policy makers impact markets by releasing strategic petroleum reserves, opening the Keystone XL pipeline or allow fracking again, we shall have to see. Typically, sell-offs in markets are short-lived and offer buying opportunities for longer-term investors. This week Fed Chairman Jay Powell reports to Congress and we may hear comments around the pace of rate hikes and balance sheet reduction in 2022. That story is significantly more important than what we are hearing from our national news media. Lastly, on Friday we will get another reading on U.S. employment conditions as the February jobs data is released.

The Numbers & “Heat Map”

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. Real GDP growth for Q4 2021 increased at an annual rate of 6.9% compared to 2.3% in Q3 (according to advance estimate). The acceleration was driven primarily by private inventory investment. Real GDP increased by 5.7% in 2021 versus a decrease of -3.4% in 2020. Disposable income saw a slight increase of 0.3% and personal saving rate decreased to 7.4% in Q4 from the previous 9.5% in Q3 highlighting increased consumer spending. |

|

CORPORATE EARNINGS |

POSITIVE |

Fourth quarter earnings are showing strong results with 76% of companies that reported earnings so far beating estimates by an average of 8.2%. Some notable positive (Amazon) and negative (Facebook) surprises in big tech. Revenues also well above estimates with 77% of S&P 500 companies reporting actual revenue above forecasts. Blended earnings growth rate for 2021 was 47%. |

|

EMPLOYMENT |

POSITIVE |

U.S. Payroll Report for January U.S. added 467,000 jobs in January, beating estimates of 125,000. Red-hot private sector hiring drives the payrolls surge. Revisions add 709,000 jobs in prior two months. Unemployment rate rises to 4% from 3.9%. |

|

INFLATION |

NEGATIVE |

CPI rose 7.5% year-over-year in January 2022, the highest increase since 1982, driven by the global supply chain backlog and continued consumer pent up demand. Inflation concerns are clearly impacting the markets, the FED and consumer behavior. |

|

FISCAL POLICY |

NEUTRAL |

The Build Back Better Bill has been scaled back from $2.2 trillion to a $1.8 trillion version as Senator Manchin continues to hold back support. President Biden has mentioned the idea of breaking up the BBB Bill into smaller pieces to be able to pass fractions at a time. The economy seems to be digesting a new world where fiscal policy is no longer considered an economic stimulus. |

|

MONETARY POLICY |

NEUTRAL |

Fed discussed a triple threat of tightening: raise interest rates, halt purchases, and reduce its balance sheet (reducing holdings of Treasurys and mortgage-backed securities). Gradual and steady reduction of liquidity will be key in preserving market performance (fast and sudden changes would most likely result in panic-driven sell offs). |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

The Russian invasion into Ukraine has now turned into a full-blown global event. US, UK and EU authorities are taking many steps to cripple Russia including closing their access to SWIFT. Commodity prices are spiking along with Oil. COVID-19 concerns continue to abate and re- openings are more the norm than closures and lockdowns. The CDC is easing rules. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but now there are trucker protests on the Canadian / U.S. border. Canada is the second largest trading partner with the U.S. (after China) but our largest export market. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Peace cannot be kept by force; it can only be achieved by understanding.” – Albert Einstein

Tax Corner

The IRS warned earlier this month to stay vigilant as scammers work year-round: https://www.irs.gov/newsroom/irs-warning-scammers-work-year-round-stay-vigilant

If you receive an e-mail from CCH-ReturnNotification@wolterskluwer.com with the subject: “2021 Electronic Return Accepted by the IRS” – it is a real confirmation and not a scam. This e-mail message is generated from our tax software provider to let you know that the IRS has received your return. There is no action required.

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” with Laurie Siebert on WDIY 88.1FM. Laurie will discuss: Talking to Children About Finances

Laurie can address questions on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.