by William Henderson, Chief Investment Officer

While domestic resiliency was present last week with strong jobs and earnings numbers, volatility related to the war in Ukraine won the week over and all three major market indexes closed lower. The Dow Jones Industrial Average fell -1.3%, the S&P 500 Index also fell -1.3% and the NASDAQ fell by -2.8%. Year-to-date returns continue to be unfavorable across all sectors and indexes. Year-to-date, the Dow Jones Industrial Average is down -7.2%, the S&P 500 Index is down -8.9% and the NASDAQ is down -14.8%. As a result of the uncertainty, fear, and volatility the “risk-off” trade occurred in the bond market and the prices of U.S. Treasury bonds moved dramatically higher sending yields sharply lower. The yield on the 10-Year U.S. Treasury fell 23 basis points from last week to close the week at 1.74% – a stunning move considering the path the Fed has laid out this year for interest rates. What this move tells us is that the safety and liquidity of U.S. Treasury bonds currently trumps everything else, including the Fed’s well-telegraphed plan of raising short-term interest rates.

The move in U.S. Treasury yields further “flattened” the yield curve. If the yield curve (the measure of 10-year yields minus two-year yields) is flattening, it indicates the yield spread between long-term and short-term bonds is decreasing. The yield curve is often a reliable indicator of economic and monetary policy conditions. The recent yield curve flattening is a result of two-year Treasury bond rates rising in anticipation of Fed policy rate hikes; while 10-year rates declined, due to the flight to safety trade resulting from increased concerns over the war in Ukraine. (See the chart below from the Federal Reserve Bank of St. Louis showing the 10s – 2s spread and the dramatic decline since mid-year 2021).

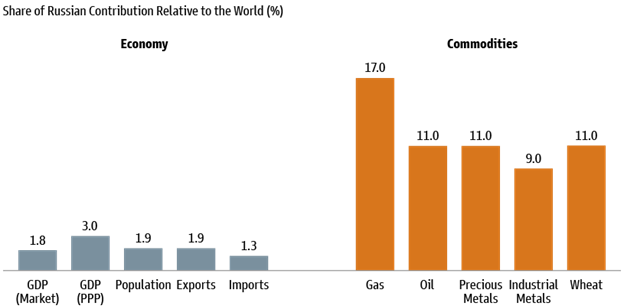

While a downward movement in the 10s – 2s spread has historically preceded an impending recession, we do not believe this to be the case now due to the sound underlying fundamentals of the U.S. economy including strong continued employment gains and near-record profits by corporations. According to FactSet, with the recent fourth quarter 2021 earnings season concluding last week, companies in the S&P 500 recorded average earnings gains of 31% over the fourth quarter of 2020. With such solid underlying economic fundamentals, why are the markets exhibiting such volatility and negative returns year-to-date? Fear and uncertainty! These are and will always be the worst thing for markets. When you cannot measure the risk, the risk-off trade prevails, and investors sell stocks and buy bonds. Additionally, the Ukraine war and resulting severe sanctions on Russia are impacting many commodity prices, further exacerbating already hot-running inflation. This reaction again may be more than necessary, while oil spikes occurring are understood as Russia is a large supplier of oil to the world, their impact on the global economy is much less than one would think. See the chart below from Haver Analytics and Goldman Sachs showing Russia’s contribution to the global economy and Russia’s production percent of important commodities.

Presently, oil is the biggest shock to the market and the price of WTI Crude has spiked to $130/barrel. Oil, as we have stated many times, is a key component in many household and industrial goods way beyond refined fuels for planes, trains, and automobiles. Oil is used in clothing (nylon & polyester), plastics, agriculture (pesticides & fertilizers), tools and toys – frankly – it is everywhere and when the price of oil rises, inflation is the result. These events – global slowdown in activity due to sanctions on Russia and the resulting inflationary impacts – puts the Fed in a quandary. Fed Chairman Jay Powell must raise rates to combat inflation but now he also risks slowing the economy at a time when things are precarious as the Russia/Ukraine war evolves. And thus, we have the uncertainty that the markets hate.

Western nations are united in sanctioning Russia for starting the war with Ukraine. China, a strategic and economic partner of Russia, has not officially condemned the incursion but has stated succinctly that “all sides exercise restraint and avoid escalation.” While not a stern rebuke like the west, it may be the best we can expect from China, who selfishly understands any global economic slowdown will directly hurt their pocketbook. The obvious question is which side yields first – Russia led by Vladimir Putin, a former KGB Officer or Ukraine led by Volodymyr Zelenskyy, a former TV actor and his western “allies.” Again – uncertainty, and again – volatility in the markets. Balanced portfolios with risk management tools like bonds help in times like this. What helps best is a level head and a long-term outlook on investments.