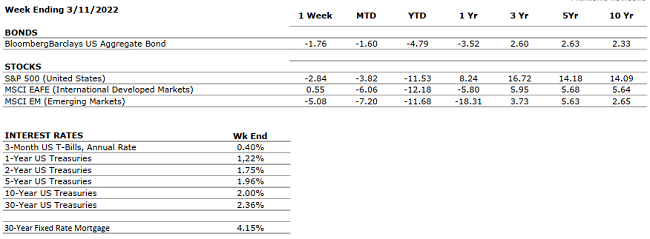

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. Real GDP growth for Q4 2021 increased at an annual rate of 7.0% compared to 2.3% in Q3 (according to second estimate). The acceleration was driven primarily by private inventory investment. Real GDP increased by 5.7% in 2021 versus a decrease of -3.4% in 2020. Disposable income saw a slight increase of 0.3% and personal saving rate decreased to 7.4% in Q4 from the previous 9.5% in Q3 highlighting increased consumer spending. |

|

CORPORATE EARNINGS |

POSITIVE |

Fourth quarter earnings are showing strong results with 76% of companies that reported earnings so far beating estimates by an average of 8.2%. Revenues also well above estimates with 78% of S&P 500 companies reporting actual revenue above forecasts. Blended earnings growth rate for 2021 was 30.7%. So far, 99% of S&P500 companies have reported earnings. |

|

EMPLOYMENT |

POSITIVE |

Total nonfarm payroll employment rose by 678,000 in February, and the unemployment rate edged down from 4% to 3.8%. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, health care, and construction. |

|

INFLATION |

NEGATIVE |

CPI rose 7.5% year-over-year in January 2022, the highest increase since 1982, driven by the global supply chain backlog and continued consumer pent up demand. Inflation concerns are clearly impacting the markets, the FED and consumer behavior. February inflation numbers to be released on March 10th. |

|

FISCAL POLICY |

NEUTRAL |

President Biden is shifting from the Build Back Better Bill to a four-point economic rescue plan. Emphasis on reducing deficits and containing inflation will be critical to sway Senator Manchin. The four points will be: moving goods cheaper and faster, reducing everyday costs, promoting competition, and eliminating job barriers. |

|

MONETARY POLICY |

NEUTRAL |

Fed discussed a triple threat of tightening: raise interest rates, halt purchases, and reduce its balance sheet (reducing holdings of Treasurys and mortgage-backed securities). Gradual and steady reduction of liquidity will be key in preserving market performance (fast and sudden changes would most likely result in panic-driven sell offs). Upcoming Fed meeting on March 15- 16. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

The Russian invasion into Ukraine has now turned into a full-blown global event. US, UK and EU authorities are taking many steps to cripple Russia including closing their access to SWIFT. Commodity prices are spiking along with Oil. COVID-19 concerns continue to abate and re- openings are more the norm than closures and lockdowns. The CDC is easing rules. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but the rising cost of oil due to the Russian-Ukraine war is likely to cause additional inflationary pressures not only on gasoline prices but also many other goods and services. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.