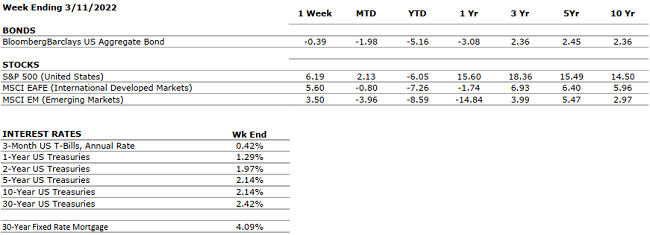

THE NUMBERS

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

POSITIVE |

U.S. Real GDP growth for Q4 2021 increased at an annual rate of 7.0% compared to 2.3% in Q3 (according to second estimate). The acceleration was driven primarily by private inventory investment. Real GDP increased by 5.7% in 2021 versus a decrease of -3.4% in 2020. Disposable income saw a slight increase of 0.3% and personal saving rate decreased to 7.4% in Q4 from the previous 9.5% in Q3 highlighting increased consumer spending. |

|

CORPORATE EARNINGS |

POSITIVE |

Fourth quarter earnings showed strong results with 76% of S&P500 companies beating estimated earnings and 78% of companies reporting revenues in excess of forecasts. The blended growth rate for 2021 was 30.7%. For Q1 2022 the estimated earnings growth rate is 4.8% – the lowest since Q4 2020 (3.8%). So far, three out of seven companies reported a positive EPS surprise and six beat revenue expectations. |

|

EMPLOYMENT |

POSITIVE |

Total nonfarm payroll employment rose by 678,000 in February, and the unemployment rate edged down from 4% to 3.8%. Job growth was widespread, led by gains in leisure and hospitality, professional and business services, health care, and construction. |

|

INFLATION |

NEGATIVE |

CPI rose 7.9% year-over-year in February 2022, the highest increase since 1982, driven by the global supply chain backlog and continued consumer pent up demand. Inflation concerns are clearly impacting the markets, the FED and consumer behavior. |

|

FISCAL POLICY |

NEUTRAL |

Congress passed a $1.5 trillion spending package expected to be signed into law next week. Republicans rejected any additional COVID-19 related aid, which was removed from the bill. $13.6 billion aid package to help Ukraine saw strong bipartisan support. The Violence Against Women Act was reauthorized and Democrats pushed for a 6.7% increase in domestic spending. |

|

MONETARY POLICY |

NEUTRAL |

The Fed raised rates by the expected 25 bps last week and Jay Powell projected a clear path for 2022 with as many as 6 additional rate hikes bringing short-term rates to 1.75-2.00% by year end 2022. Reduction of the Fed’s balance sheet was not mentioned. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

The conflict between Russia and Ukraine keeps worsening as negotiations are not leading to any solutions and attacks by Russia do not cease. Russia requested China’s military and economic assistance as the U.S., E.U., and U.K. continue to support Ukraine and sanction Russia. COVID -19 restrictions are easing across the world. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but the rising cost of oil due to the Russian- Ukraine war is likely to cause additional inflationary pressures not only on gasoline prices but also on many other goods and services. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.