by Jonathan Susser, Investment Technology Associate

Markets notch first positive week in eight weeks. Fed takes a dovish pivot with two Federal Reserve Bank Presidents walking back an aggressive Fed.

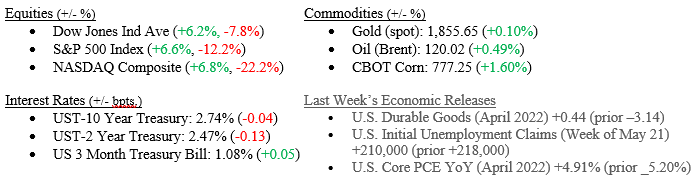

Markets (as of May 27, 2022, Weekly Returns, Year-To-Date Returns)

Global Economy

- U.S. allies are pushing back against a Chinese proposal for deeper security and trade ties in the Pacific, a region that has long been a point of contention between Washington and Beijing. They warn this is an attempt by China to gain control over the region and wrest loyalties from the U.S.

- The U.S. Central Bank is weighing the possibility of introducing digital currency to provide consumers safety amidst a sea of cryptocurrency stable coins.

Policy and Politics

- Robert Califf, head of the U.S. Food and Drug Administration proposed a national stockpile of baby formula in order to better prepare for potential future shortages.

- Antony Blinken reiterated that the Biden administration is committed to bolstering domestic investment and strengthening ties with allied countries in order to counter China via an inclusive, transparent international policy.

What to Watch

- Case-Shiller Home Price Index: National figures are set to release on Tuesday, May 31st at 9:00 AM EST.

- U.S. Crude Oil production figures are being released on Tuesday, May 31st at 3:30 PM EST.

- U.S. Recession Probability Index to release latest update on Wednesday, June 1st at 11:00 AM EST.

- ADP Nonfarm Payrolls to be announced on Thursday, June 2nd at 8:15 AM EST. US Nonfarm Payrolls to follow on Friday, June 3rd at 8:30 AM EST.