We Are Hiring!

Team VNFA is looking for a Marketing & Communications Coordinator. Read more about this opportunity:

Marketing & Communications Coordinator – Valley National Financial Advisors (valleynationalgroup.com)

Monthly Archives: June 2022

Current Market Observations

In a reversal of fortunes for investors, the markets, both stock and bond, came roaring back last week with Dow Jones Industrial Average moving higher by +5.3%, the S&P 500 Index moving +6.7% higher and the NASDAQ surging +9.0%. Further, bonds, which have suffered their worst year-to-date start ever, moved higher in price for the week. The yield of the 10-Year U.S. Treasury bond dropped to 3.13% on Friday, down from a recent high on June 14 of 3.48%. These moves were precipitated by comments from Fed Chairman Jay Powell about the continued fight to quell inflation and some major commodity prices such as oil and copper falling during the week.

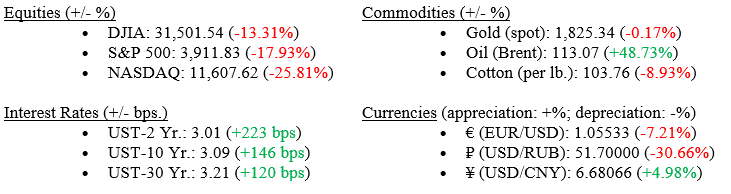

Markets (as of EOD 6/24/22; change YTD)

Global Economy

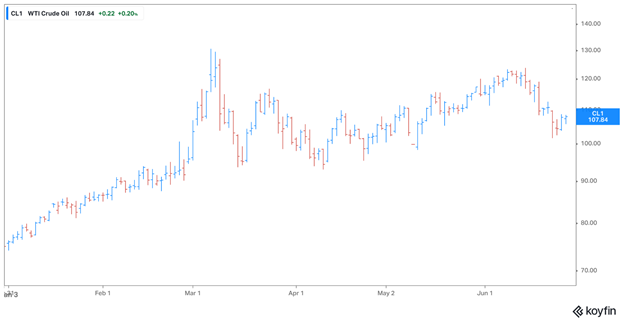

Globally, markets rallied as investors concluded that Central Banks around the world would not need to be as aggressive as originally expected in raising rates but could temper their plans as inflationary pressures have already started to abate. Germany, which had been crimped by energy shortages due to Ukraine/Russia war sanctions, moved to “Alarm Stage” allowing emergency plans for energy production and procurement. This would allow, for example, the opening of previously closed coal plants. As a result, crude oil prices continue to fall. (See Chart 1 below from Koyfin). Russia is widely expected to default on their bonds this week, adding one more negative implication resulting from their attack on Ukraine.

Chart 1: West Texas Intermediate (WTI) Oil Price at $108/barrel down from $120/barrel

Policy and Politics

Powell spent two days testifying to the U.S. House of Representatives and the U.S. Senate. When pressed, he confirmed that the Fed is committed to combat inflation and is confident their actions are already having an impact. Further, Powell pointed to their own projections that show continued Gross Domestic Product (GDP) growth rather than a recession, for which several Wall Street prognosticators are calling. See Chart 2 below from Bloomberg & the Federal Open Market Committee (FMOC) showing Fed projections for GDP out through 2024. Historically, weakness in the labor market proceeded a recession and we are far from labor weakness in the U.S. In fact, all typical labor indicators: the unemployment rate, job openings vs available workers, and the labor force participation rate are all solidly strong; thereby in our opinion, weakening the argument for an upcoming recession.

Chart 2

What to Watch

We have a big week ahead for economic indicators including the Fed’s preferred measure of inflation U.S. Core PCE (Personal Consumption Expenditures) on Thursday, June 30. Further, watch for housing related data on Tuesday, June 28 with the Case-Shiller Home Price Index.

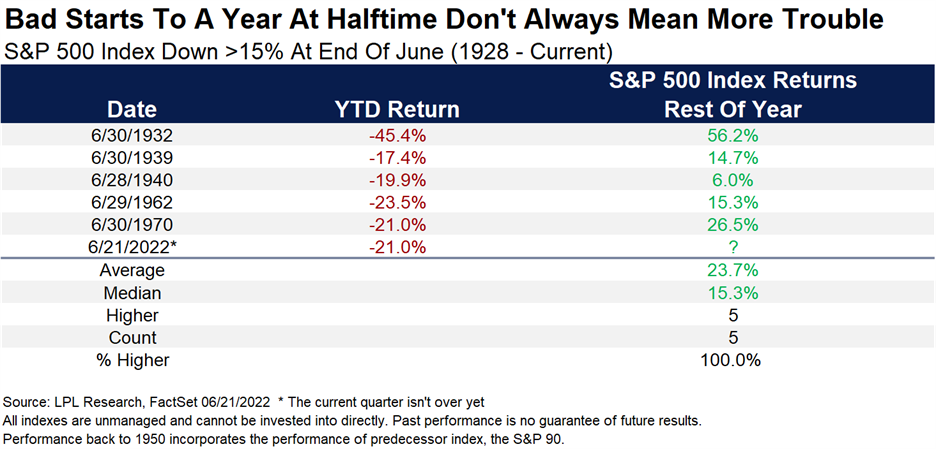

It is important to take a long-term perspective on investing. A recent chart by LPL Research and FactSet helped cement our opinions. 2022 has been a horrible start to the year for both the stock and bond markets with double-digit negative returns in both the S&P 500 Index (-17.3%) and the Bloomberg U.S. Aggregate Bond Index (-10.7%). However, history has shown us the benefit of waiting it out and staying invested. See Chart 3 below showing that every time since 1928 (almost 100 years) when the S&P 500 Index was down at least -15% in the first half of the year, returns were positive in the final six months, with an average of +24%. 2020 was the most recent year. We leave you with that timely and prescient thought and to invite you to reach out to your advisor at Valley National Financial Advisors at any time.

The Numbers & “Heat Map”

THE NUMBERS

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Q1 2022 Real GDP shrunk at a 1.5% annual rate according to the second estimate. This is the first contraction since the beginning of the pandemic. The main factors that resulted in a decrease in GDP were a surge in imports and trade deficit highlighting that the U.S. is buying more goods from foreign countries. This may be an indication that the U.S. economy has recovered faster than other countries. |

|

CORPORATE EARNINGS |

NEUTRAL |

The earnings growth rate for Q1 2022 was 9.2% — the lowest since Q4 2020 (3.8%). This estimate was revised upward from the previous forecast of 7.1% in April. All S&P500 companies have reported earnings — 77% reported a positive EPS surprise and 73% beat revenue expectations. The estimated growth rate for Q2 2022 is now 4.3% which would mark a new post-pandemic low. |

|

EMPLOYMENT |

POSITIVE |

Total nonfarm payroll employment rose by 390,000 in May and the unemployment rate remained constant at 3.6%. Job growth was widespread, led by gains in leisure and hospitality, manufacturing, and transportation and warehousing. Employment in retail trade declined. |

|

INFLATION |

NEGATIVE |

CPI rose 8.6% year-over-year in May2022, the largest increase since December 1981. Core CPI recorded a 6.0% increase (down slightly from April). The increase in CPI was driven by energy, food, and shelter. After declining in April, energy increased by 3.9% over May and gasoline rose by 4.1%. |

|

FISCAL POLICY |

NEUTRAL |

After passing a $13.6 billion package to support Ukraine a few weeks ago, the House approved an additional $40 billion military and humanitarian package for Ukraine. The bill was passed with 368 votes against 57 votes. The total of the two packages ($53 billion) is the largest foreign aid moved through Congress in over 20 years. |

|

MONETARY POLICY |

NEUTRAL |

The Fed responded to the persistent inflation numbers by raising rates by 75 basis points, the highest hike since November 1994. Powell mentioned that another 50 to 75 bps hike is likely for July. The next decisions by the Fed will be data-driven based on future inflation numbers and estimated economic growth. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia has defaulted on its debt as of Sunday, June 26th when the 30-day grace period on $100 million of interest payments expired. This is the first Russian default since 1918. Sanctions imposed by Western powers effectively isolated Russia and its financial system from Europe and the U.S. making it much harder for Russia to complete international financial transactions. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but the rising cost of oil due to the Russian- Ukraine war is likely to cause additional inflationary pressures not only on gasoline prices but also on many other goods and services. Starting in June, China has started to remove some restrictions in major cities to end the COVID-19 lockdown. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Progress only starts when you get clear on where you are right now.” – Michael Hyatt

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” with Laurie Siebert on WDIY 88.1FM. Laurie will discuss: Considerations for Successful Retirement Lifestyle

Laurie can address questions on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA In the Community

Team VNFA joins the Lehigh Valley community in welcoming the 42nd U.S. Senior Open to Saucon Valley Country Club this week. Tickets to the USGA Championship are still available at Tickets: 42nd U.S. Senior Open Championship (usga.org). All parking is free of charge. General Admission parking is located at Lehigh University’s Goodman Campus. Shuttle transportation is provided by the USGA to and from the main entrance. Juniors aged 18 and under can request a complimentary Gallery ticket for any day of the event at the Ticket Office with a ticketed or credentialed adult.

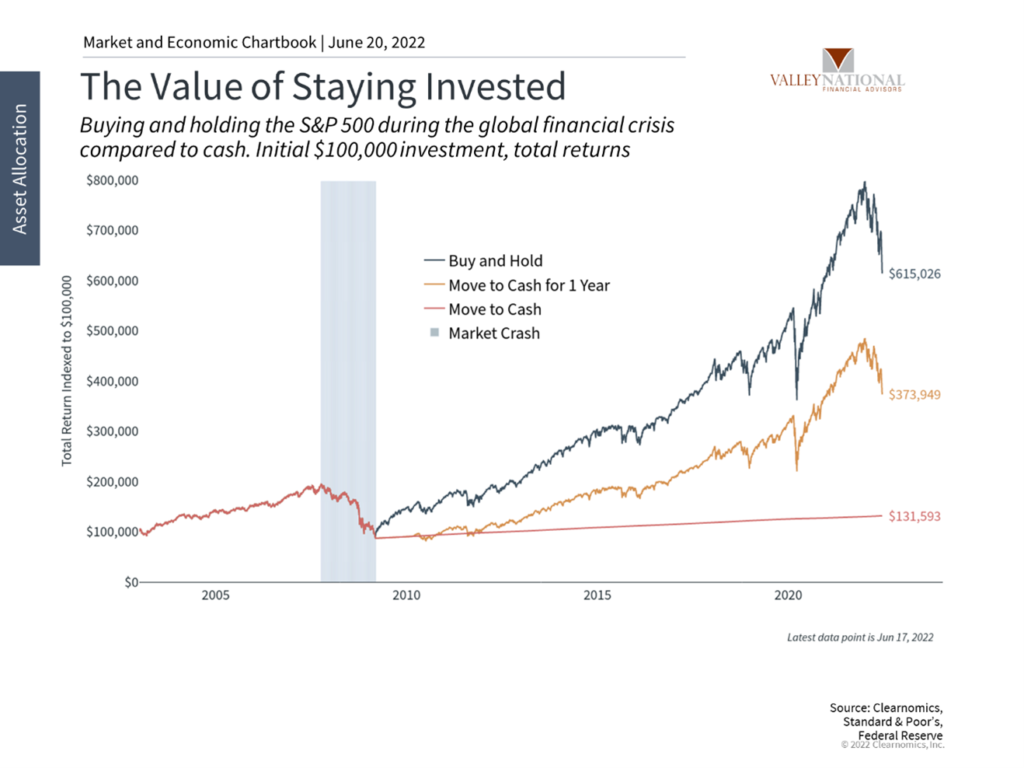

Current Market Observations

The hope for some immediate relief to investors faded as on as the markets faced their worst week since March 2020, with the S&P entering bear market territory early in the week. Consumers are not in a much better situation, as inflation lingers on the budgets of Americans everywhere and the summer saga of travel-related increased gasoline consumption will be met with rising energy prices. Regardless of the current market and economic environment, we must remember the value of staying invested and opportunities presented during periods of turmoil.

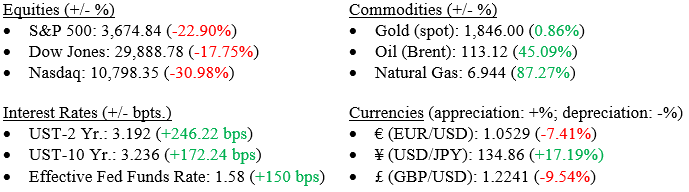

Markets (as of 6/19/22; change since 1/1/22)

Global Economy

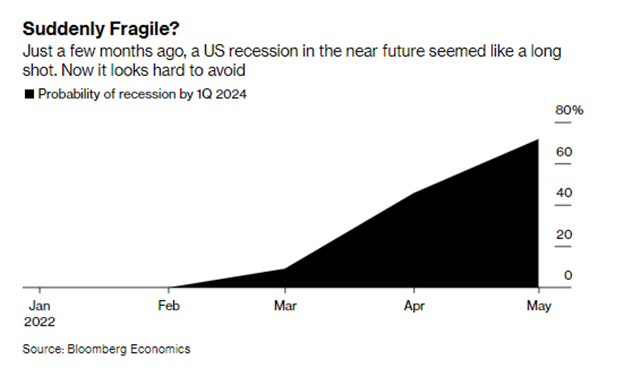

Treasury Secretary Janet Yellen provides little relief on the inflation front, stating that high prices are expected to continue rising for the remainder of the year, coupled with a prediction of slowed economic growth. Chart 1 depicts the probability of a U.S. recession.

Chart 1: Probability of U.S. Recession

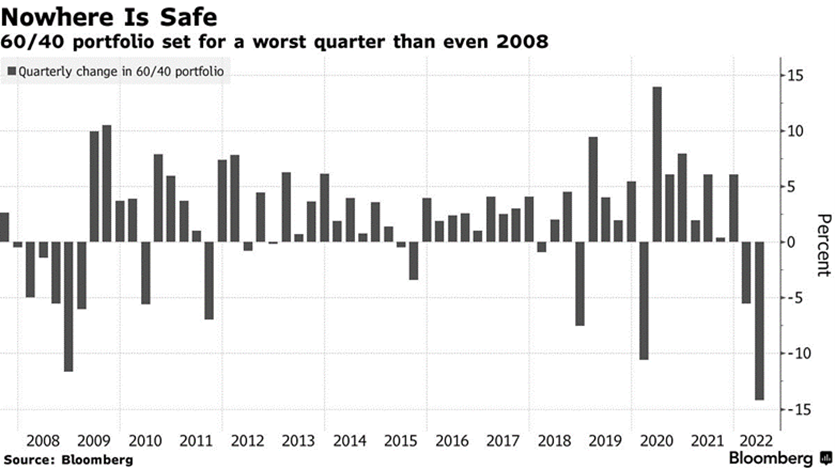

The tried and true “balanced” portfolio allocation model (60% stocks and 40% bonds) is set to endure a worse quarter than any during the bear market of 2008 (Chart 2). Unlike the era of the Global Financial Crisis, bonds are offering little relief to the sharp pains of the equities markets. The top 1% of wealth in the U.S. lost over $1.5 trillion this quarter, as they own more than half of all equities held in America.

Chart 2: Quarterly Change in 60/40 Portfolio

Policy and Politics

- Concerns are growing over the international status of the Taiwan Strait, as the Biden Administration interprets the assertive language used by Chinese officials in Beijing to describe the nautical powerhouse.

- Colombia has followed in the footsteps of previous Latin American countries before them and elected their first radical leftist, President Gustavo Petro, in a close race with his corporate-centered opponent Rodolfo Hernandez. Investor concerns around the situation are growing as Petro’s plans include phasing out oil production/consumption, tax increases on the wealthy, and creating a stronger bond with its neighbor, Venezuela.

What to Watch

- Fed Chair Jerome Powell’s semi-annual Congressional testimony begins on 6/22/22 at 9:30am EST and continues 6/23/22 at 10:00am EST.

- Initial Jobless and Continuous Claims report will be released on 6/23/22 at 8:30am EST.

- The final Michigan Consumer Sentiment report will be released on 6/24/22 at 10:00am EST.

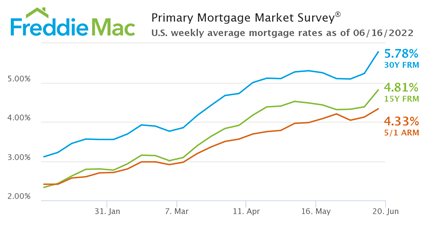

Chart 3: Primary Mortgage Market Survey

The Numbers & “Heat Map”

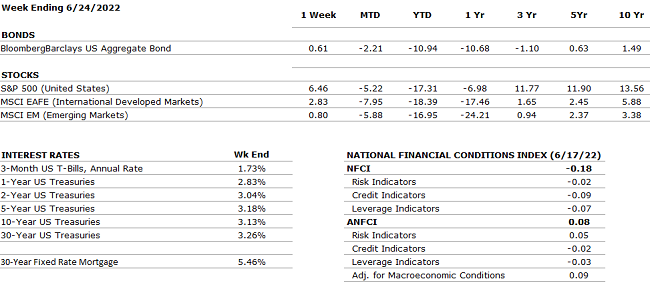

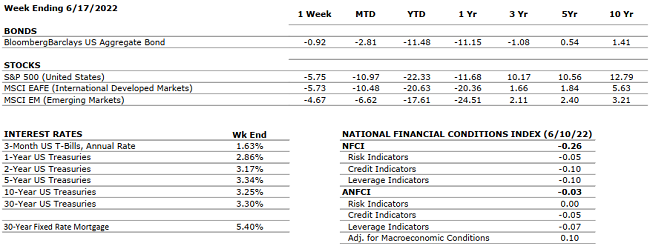

THE NUMBERS

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Q1 2022 Real GDP shrunk at a 1.5% annual rate according to the second estimate. This is the first contraction since the beginning of the pandemic. The main factors that resulted in a decrease in GDP were a surge in imports and trade deficit highlighting that the U.S. is buying more goods from foreign countries. This may be an indication that the U.S. economy has recovered faster than other countries. |

|

CORPORATE EARNINGS |

NEUTRAL |

The earnings growth rate for Q1 2022 was 9.2% — the lowest since Q4 2020 (3.8%). This estimate was revised upward from the previous forecast of 7.1% in April. All S&P500 companies have reported earnings — 77% reported a positive EPS surprise and 73% beat revenue expectations. The estimated growth rate for Q2 2022 is now 4.0% which would mark a new post-pandemic low. |

|

EMPLOYMENT |

POSITIVE |

Total nonfarm payroll employment rose by 390,000 in May and the unemployment rate remained constant at 3.6%. Job growth was widespread, led by gains in leisure and hospitality, manufacturing, and transportation and warehousing. Employment in retail trade declined. |

|

INFLATION |

NEGATIVE |

CPI rose 8.6% year-over-year in May2022, the largest increase since December 1981. Core CPI recorded a 6.0% increase (down slightly from April). The increase in CPI was driven by energy, food, and shelter. After declining in April, energy increased by 3.9% over May and gasoline rose by 4.1%.

|

|

FISCAL POLICY |

NEUTRAL |

After passing a $13.6 billion package to support Ukraine a few weeks ago, the House approved an additional $40 billion military and humanitarian package for Ukraine. The bill was passed with 368 votes against 57 votes. The total of the two packages ($53 billion) is the largest foreign aid moved through Congress in over 20 years. |

|

MONETARY POLICY |

NEUTRAL |

The Fed raised rates by the expected 25 bps in March and 50 bps in May. Jay Powell projected a clear path for 2022 with as many as five additional rate hikes. The next decisions by the Fed will be data-driven based on future inflation numbers and estimated economic growth. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia was able to avoid default so far by making the required payment on its debt however, the U.S. has imposed additional sanctions barring Russia from using U.S. banks to make debt payments. The next coupons worth $400 million will be due on June 23rd and 24th and Russia is trying to leverage resources outside the Western financial infrastructure to make these payments. |

|

ECONOMIC RISKS |

NEUTRAL |

Supply chain disruptions in the U.S. are waning but the rising cost of oil due to the Russian-Ukraine war is likely to cause additional inflationary pressures not only on gasoline prices but also on many other goods and services. Starting in June, China has started to remove some restrictions in major cities to end the COVID-19 lockdown. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“A good golfer has the determination to win and the patience to wait for the breaks.” – Gary Player

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” with Laurie Siebert on WDIY 88.1FM. Laurie will discuss: Gifting and Inheriting.

Laurie can address questions on the air that are submitted either in advance or during the live show via yourfinancialchoices.com. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.