by William Henderson, Chief Investment Officer

Continued strong employment data and little movement on inflationary pressures give us no reason to expect the Fed to veer off their hawkish path towards higher interest rates, and prompted stocks and bonds to sell off last week.

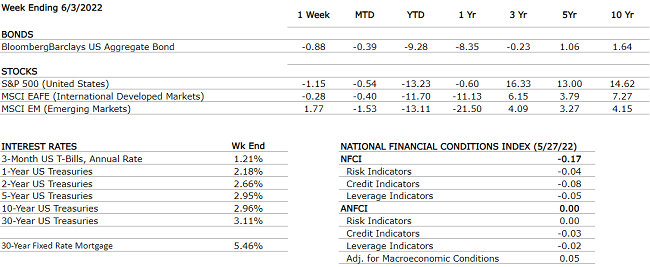

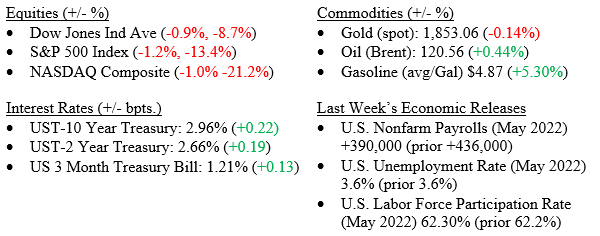

Markets (as of June 3, 2022, Weekly Returns, Year-To-Date Returns)

In any normal economy (over the past 20+ years), near-record low unemployment, strong jobs data and a healthy labor participation rate, would signal a growing economy and give the stock market reason to celebrate. Well, not this year; with inflation running at 40-year highs, a war raging in Europe, supply shortages, and a lingering global pandemic throwing such a pall over the markets that nothing stems their move lower.

The approximately 1% drop in each major stock market index last week came after the previous week’s 7% rally in prices so a modest pullback was not too unexpected. Along with this modest pullback, we have seen a decline in the index that investors use to measure volatility. The Chicago Board of Options Exchange (CBOE) Volatility Index (VIX) moved down to a level of 25 on Friday from a recent high of 35 on May 9. A falling VIX typically points to calming markets rather than the violent 500-point swings we have seen earlier in the year. (See the chart below from the Federal Reserve Bank of St. Louis showing the VIX).

While volatility may be declining several key Wall Street players are sounding the alarm on financial conditions and related market expectations. What puzzles us is that their concerns are not new, unique, or unknown to the markets. They point to supply chain disruptions, global inflation, higher interest rates, Russia/Ukraine war, and China’s COVID lockdowns as major disruptors to the markets and the economy. We would counter that with the strongest labor market we have seen in decades, near-record low unemployment, consumers and corporations that are flush with cash, and a solid housing market that gives the U.S. economy enough protection to weather a financial storm. Recession risks have been mentioned since the yield curve inverted earlier this year but given the labor conditions a recession seems a long way off. Lastly, inflation, while certainly still running hot and impacting consumer confidence, has recently started to temper, and we will get an important indicator this Friday when the Consumer Price Index report is released for May 2022. A month earlier, the government reported that inflation accelerated in April at an 8.3% annual rate—slightly below the previous month’s 8.5% figure, which was the highest since 1981. With such poor returns in stock and bond markets for the year, it is hard to see a calm pathway for the remainder of the year, but our economy is 65-70% consumer-driven and much of that is service related rather than goods related. Inflation has thus far largely impacted goods rather than services. Consumers are showing amazing resilience in service-related spending on things like cruises, movies, and restaurants all while they continue to hoard cash and pay down debt. The market headwinds are neither new nor unknown, but they are persistent and that is what is worrying our friends at the Fed. The Fed will keep raising interest rates as long as inflation is persistent and the impact on the economy from higher rates is nominal. Our objective as investors, not market timers or traders, is to focus on long-term investing and planning and to ignore the noise.