In a reversal of fortunes for investors, the markets, both stock and bond, came roaring back last week with Dow Jones Industrial Average moving higher by +5.3%, the S&P 500 Index moving +6.7% higher and the NASDAQ surging +9.0%. Further, bonds, which have suffered their worst year-to-date start ever, moved higher in price for the week. The yield of the 10-Year U.S. Treasury bond dropped to 3.13% on Friday, down from a recent high on June 14 of 3.48%. These moves were precipitated by comments from Fed Chairman Jay Powell about the continued fight to quell inflation and some major commodity prices such as oil and copper falling during the week.

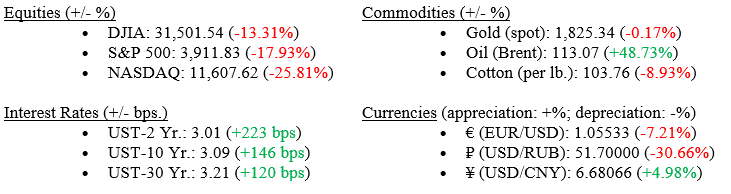

Markets (as of EOD 6/24/22; change YTD)

Global Economy

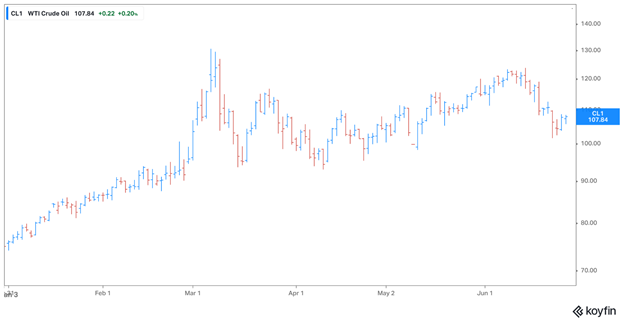

Globally, markets rallied as investors concluded that Central Banks around the world would not need to be as aggressive as originally expected in raising rates but could temper their plans as inflationary pressures have already started to abate. Germany, which had been crimped by energy shortages due to Ukraine/Russia war sanctions, moved to “Alarm Stage” allowing emergency plans for energy production and procurement. This would allow, for example, the opening of previously closed coal plants. As a result, crude oil prices continue to fall. (See Chart 1 below from Koyfin). Russia is widely expected to default on their bonds this week, adding one more negative implication resulting from their attack on Ukraine.

Chart 1: West Texas Intermediate (WTI) Oil Price at $108/barrel down from $120/barrel

Policy and Politics

Powell spent two days testifying to the U.S. House of Representatives and the U.S. Senate. When pressed, he confirmed that the Fed is committed to combat inflation and is confident their actions are already having an impact. Further, Powell pointed to their own projections that show continued Gross Domestic Product (GDP) growth rather than a recession, for which several Wall Street prognosticators are calling. See Chart 2 below from Bloomberg & the Federal Open Market Committee (FMOC) showing Fed projections for GDP out through 2024. Historically, weakness in the labor market proceeded a recession and we are far from labor weakness in the U.S. In fact, all typical labor indicators: the unemployment rate, job openings vs available workers, and the labor force participation rate are all solidly strong; thereby in our opinion, weakening the argument for an upcoming recession.

Chart 2

What to Watch

We have a big week ahead for economic indicators including the Fed’s preferred measure of inflation U.S. Core PCE (Personal Consumption Expenditures) on Thursday, June 30. Further, watch for housing related data on Tuesday, June 28 with the Case-Shiller Home Price Index.

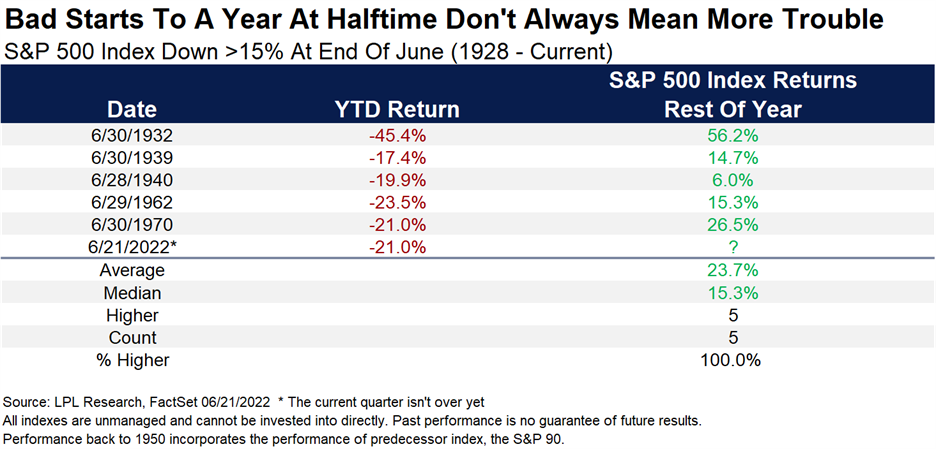

It is important to take a long-term perspective on investing. A recent chart by LPL Research and FactSet helped cement our opinions. 2022 has been a horrible start to the year for both the stock and bond markets with double-digit negative returns in both the S&P 500 Index (-17.3%) and the Bloomberg U.S. Aggregate Bond Index (-10.7%). However, history has shown us the benefit of waiting it out and staying invested. See Chart 3 below showing that every time since 1928 (almost 100 years) when the S&P 500 Index was down at least -15% in the first half of the year, returns were positive in the final six months, with an average of +24%. 2020 was the most recent year. We leave you with that timely and prescient thought and to invite you to reach out to your advisor at Valley National Financial Advisors at any time.