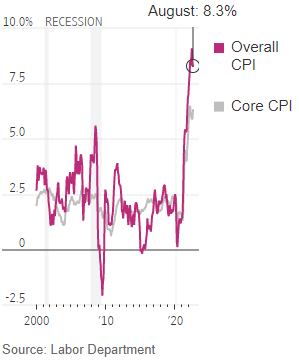

Equity markets logged a poor week of returns mainly due to inflation data surprising slightly to the upside. This was an emotional reaction to counteract widespread optimism.“It’s not timing the markets, it’s time in the markets” is an adage that continues to hold true despite recent volatility and noise. This is when long-term investors with a goal of wealth creation endure.

Global Economy

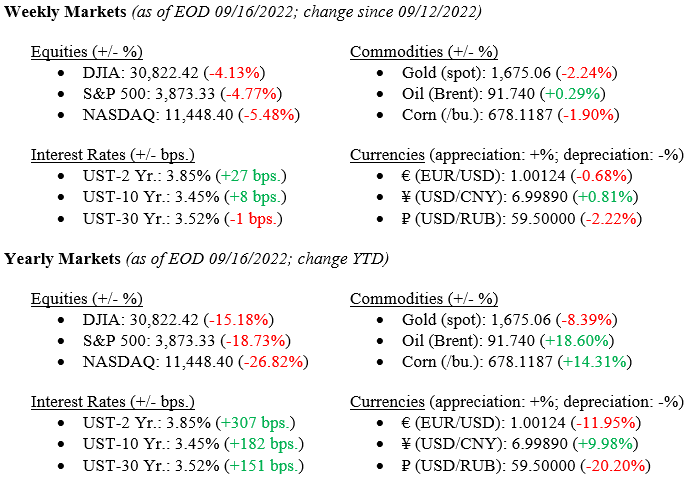

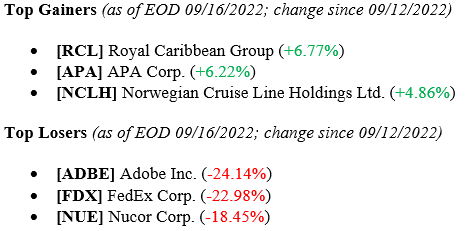

Last week, U.S. inflation came in at an annualized 8.3% versus 8.1% expected. To curb inflation, central banks worldwide have been raising interest rates, with the Federal Reserve expected to raise by 0.75% later this week. Despite good intentions, the World Bank is warning of a potential global recession if rates rise too high, claiming that synchronous tightening could compound effects as each country implements aggressive monetary policy. Please see Chart 1 for historical Core and Overall CPI inflation data, and Chart 2 for contributions to inflation.

Chart 1: Consumer-price index, change from a year earlier.

Chart 2: Contributions to inflation

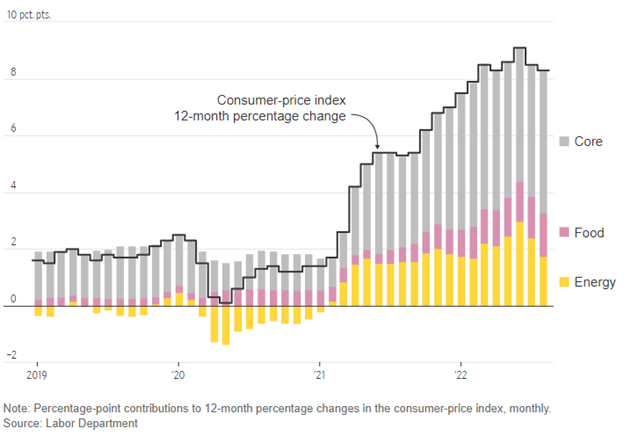

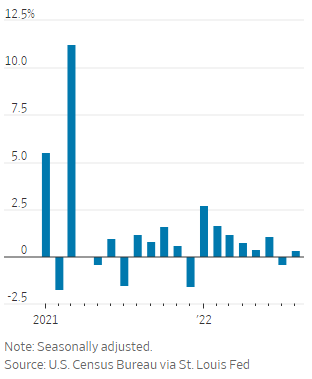

U.S. Retail Sales rose 0.3% in August, which marks a reversal from July’s print of -0.4%. This reversal is likely driven by decreases in gas prices across the country. Remember that gas and oil are inputs for basically every good you can possibly purchase. As prices come down, costs to produce and transport goods do as well, not to mention consumers having more disposable income based on what they save at the pump. For historical month-over-month retail sales data, please see Chart 3.

Chart 3: Month-over-month change in retail sales

What to Watch

- U.S. Retail Gas Price on Sept. 19th at 4:30 PM EST.

- U.S. Housing Starts and U.S. Housing Starts Month over Month on Sept. 20th at 8:30 AM EST.

- U.S. Existing Home Sales and US Existing Home Sales Month over Month on Sept. 21st at 10:00 AM EST.

- Target Fed Funds Rate on Sept. 21st at 2:15 PM EST.

- U.S. Initial Claims for Unemployment on Sept. 22nd at 8:30 AM EST.

- 30-Year Mortgage Rate on Sept. 22nd at 10:00 AM EST.

Summary

Although inflation was higher than expected, it’s important to remember that last week’s print still shows signs of improvement over the prior month. Additionally, global concerns continue to dominate the news, such as Russia/Ukraine, Chinese quarantined cities, and the energy crisis in Europe. While there are concerns of a global recession, the United States still exhibits a strong labor market and healthy consumer financials which should help maximize economic rebound potential through the end of the year.