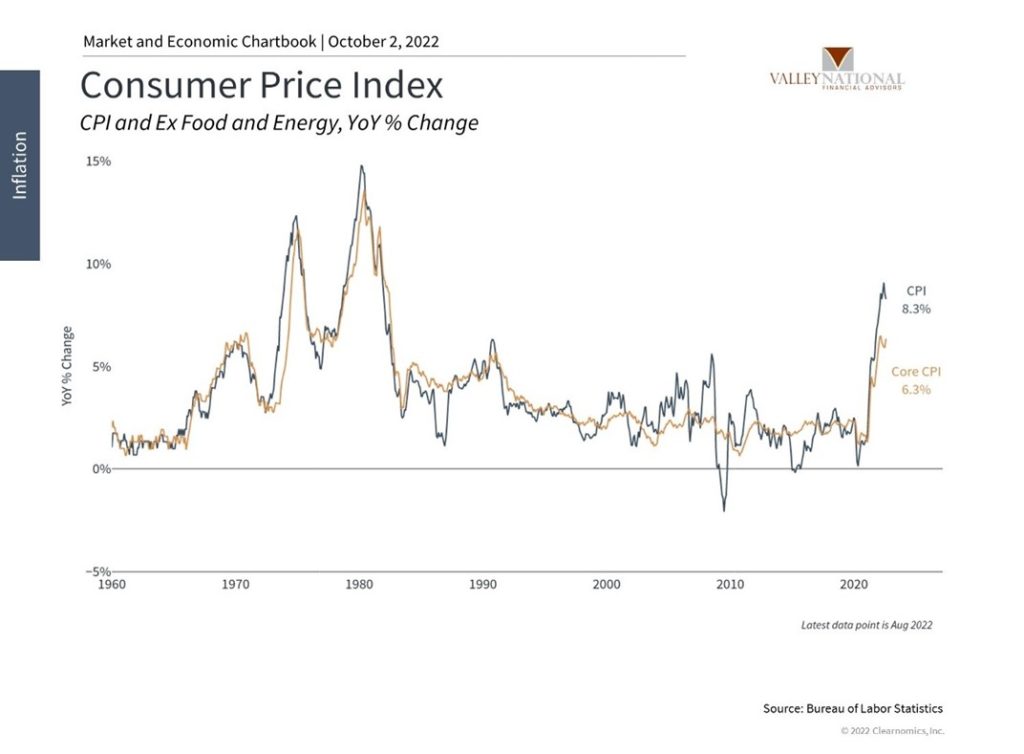

While market volatility was more modest than the previous two weeks, major U.S. stock indexes fell nearly 3%, declining for the sixth time in the past seven weeks. Further, the Dow Jones Industrial Average on Monday joined the S&P 500 and the NASDAQ in bear market territory, as the Dow declined more than 20% from its level of early January. In contrast, U.S. bonds rallied as the yield on the 10-Year U.S. Treasury fell five basis points during the week to close at 3.83% and well off its recent high of 3.95%. Multiple concerns continue to plague markets including lingering inflation, Russia/Ukraine war, impacts of Hurricane Ian in Florida and greater chances of a modest recession.

Global Economy

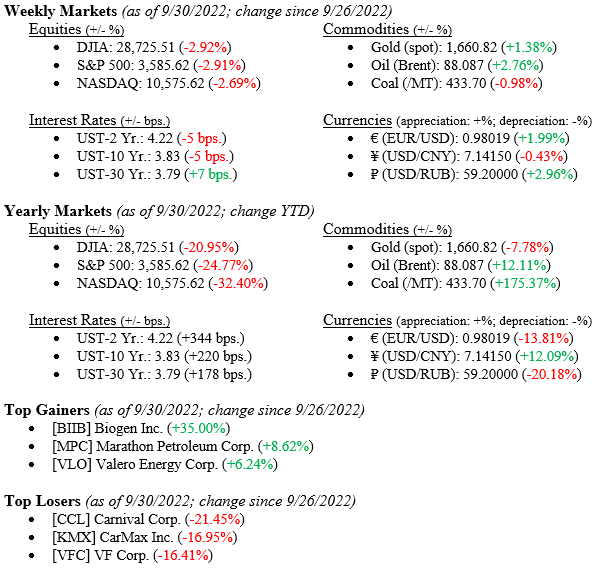

Global inflation certainly is the major issue impacting markets and until we see tangible results of the FED’s interest rate tightening policy on inflation, the market will remain volatile and data dependent from week to week. Massive cash creation at the Federal level, global supply chain issues and pent-up demand as a result of COVID-lockdowns, created inflation in the form of increased prices for goods and services. Inflation got us here; deflation is the cure.

Thankfully, we are starting to see “behind the scenes” deflationary signals. Major commodities, such as lumber, are down in price to pre-pandemic levels, Trans-Pacific shipping rates are down 75% from a year ago, and Oil (as measured by WTI) is down to $83/bbl. from $123/bbl. in March of this year. (See Chart 1 from Valley National Financial Advisors & Clearnomics showing CPI.) As lower prices work their way through the supply chain to producers, prices offered to consumers should decline as well and the FED will start to see tangible results from their inflation combat efforts.

Policy and Politics

The newly elected Prime Minister Truss of the U.K. was forced to do a U-turn on her recently announced plan to scrap the 45% tax rate. The humiliating retracement was due to outrage by Tory MPs at a tax-cut during a time of energy shortages, high prices and market uncertainty.

Russia annexed portions of Ukraine while Vladmir Putin vowed to use all means necessary to assure victory in the war. Meanwhile, Russian forces withdrew from the eastern Ukrainian port city of Lyman, in an obvious defeat. There seems little end to this conflict. Instead, further escalations by both sides does not bode well for Eurozone countries that rely on energy supplies from Russian and Ukraine.

What to Watch

- U.S. Job Openings for August 2022, released 10/4/22 (prior month 11.24M)

- U.S. Initial Claims for Unemployment for Week of October 1, 2022, released 10/6/22 (prior 193k)

- U.S. 30-year Mortgage Rate for Week of October 6, 2022, released 10/6/22 (prior 6.7%)

- U.S. Unemployment Rate for September 2022, released 10/8/22 (prior 3.70%)

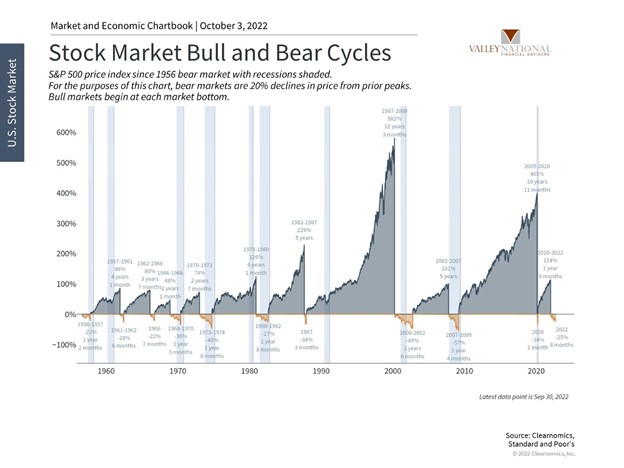

While it seems a tall order to recommend investors “stay the course” or “remain committed” but that remains our recommendation as we advise that true wealth creation happens over long periods of time. Certainly, while being down double-digits across all markets and over nine long months is painful, it is time to steel one’s resolve and stay invested. This tenet is even more relevant when the very definition of a risk-free investment, three-month U.S. Treasuries, are paying 3.23%, and enticing investors to flee the markets rather than stay invested. Bull Markets are always punctuated by Bear Markets and Bear Markets last, on average, 14 months, while Bull Markets last, on average, five years or more (See Chart 2 from Valley National Financial Advisors & Clearnomics showing Stock Market Cycles 1960-current).