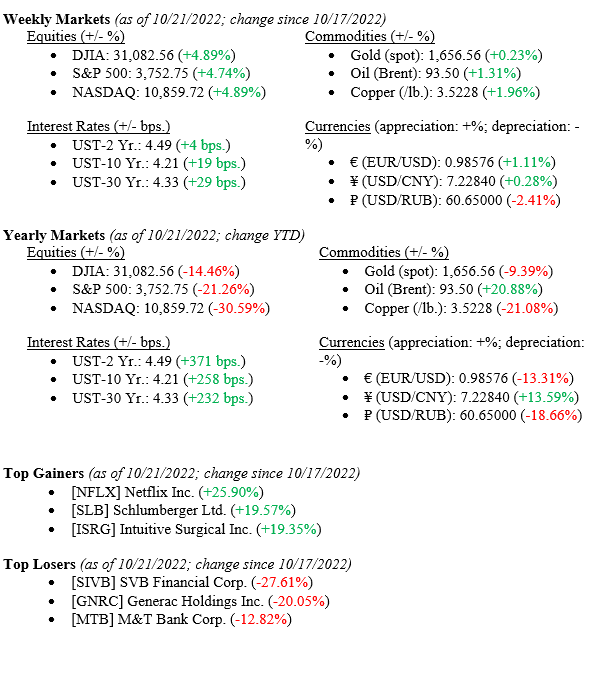

Equity markets reacted favorably across all major indexes to end the week nearly +5% higher. Favorable corporate earnings and FED commentary pushed markets higher. About a fifth of the S&P 500 companies have reported their earnings thus far, with 73% of reported earnings beating estimates. The road to FED hikes remains steady as tightening assumptions dropped at the end of week, but the market is still pricing in a +75bp hike for next week. In the absence of poor information equity markets enjoyed the rally. Bond markets, however, continued to weaken with the 10-Year U.S. Treasury ending the week at 4.21%, 19 basis points higher than the previous week.

U.S. Economy

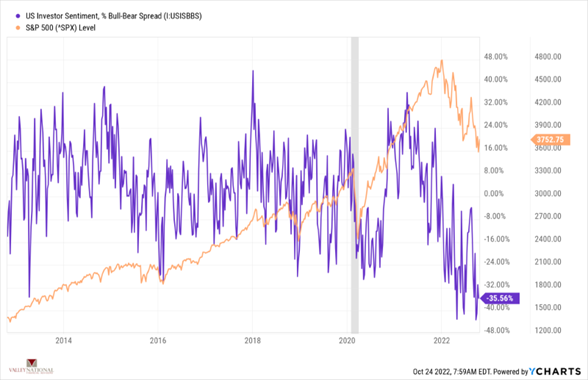

The chart below from Valley National Financial Advisors and Y Charts shows U.S. Investor Sentiment (% Bull-Bear Spread), which measures investors’ overall feelings about the markets. October 14 hit a multi-year low, which some market prognosticators believe is a point that markets are oversold. This is the point which equities become reasonably priced and often signal a ‘BUY.’

The goal across Washington is to avoid a recession at all costs. The Fed is at the forefront of this and continues to gauge the pace/amount of rate hikes according to the economic and financial data released prior to FOMC (Federal Open Markets Committee) meetings. Bond yields and broader markets are driven by the Fed’s narrative and actions that follow, so the Fed may not want to push too hard on markets that are recovering after a tough September.

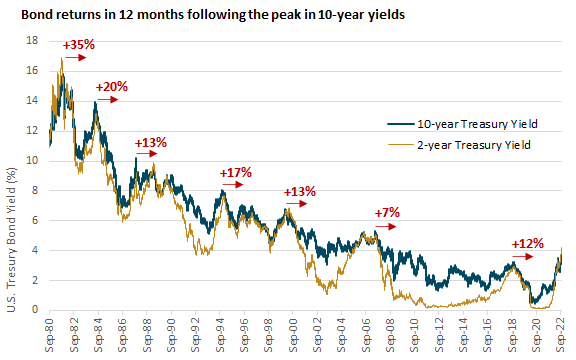

While bond markets continue to post negative returns for the year, the outlook (1-3 years) remains favorable once bond yields peak. (See the Chart below from Edward Jones and FactSet.) This makes clear sense to us when the FED’s path to interest rates and the economy is considered.

Policy and Politics

Political uncertainty continues to affect the United Kingdom as Prime Minister Liz Truss resigned after only 44 days in office. Her replacement is to be determined, with former Prime Minister Boris Johnson taking himself out of the race and former Chancellor of the Exchequer, Rishi Sunak, currently in the lead.

China is on the global radar as anticipated economic data was released last week that showed signs of a mixed economy. While GDP grew in September, retail sales slumped, and the housing market is failing to recover. President Xi was reelected for an unprecedented third term, tightening his grip on China and reinforcing his potential plans for reunification with Taiwan.

What to Watch

- U.S. Initial Claims for Unemployment Insurance; released 10/27 (Prior 214k)

- U.S. Real 3rd Quarter Gross Domestic Product Quarter over Quarter; released 10/27 (Prior –0.60%)

- U.S. Core Personal Consumption Expenditures Price Index Year over Year; released 10/28, (Prior 6.25%)

There is a lot going on globally with China, Ukraine/Russia, the United Kingdom all adding uncertainty to the markets, and we hate uncertainty. However, here in the United States we have our own issues with inflation and the FED understands this and is aggressively raising interest rates to slow the economy down and thereby halt inflation pressures. This will take time as a lot of stimulus has to be let out of the economy and consumers’ pockets but the path to lower inflation has been set. Last week, we saw the FED start to whisper that the end is near for rate hikes. It may not be in 2022, but 2023 should be a pivotal year in all aspects. Investors should remain focused on the long-term economic viability of the U.S. Economy, and it remains favorable.