“True cyber security is preparing for what is next not what was last.” – Neil Rerup

Monthly Archives: October 2022

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” on WDIY 88.1FM. Laurie and her guest Catherine Bailey of SCORE Lehigh Valley will discuss: Small Business Mentorship

Questions can be submitted at yourfinancialchoices.com during or in advance of the live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Team VNFA Adds Marketing & Communications Coordinator Role

Valley National Financial Advisors (VNFA) has hired Fatima Alba to the newly created position of Marketing & Communications Coordinator. Fatima is a Penn State Lehigh Valley Alumna, where she graduated with a bachelor’s degree in Corporate Communication. Fatima is also the proud recipient of the 2020 Penn State Heart of the Lion Award.

Fatima will work directly with the Chief Marketing Officer (CMO) to coordinate, execute, and monitor marketing and communication efforts. “Fatima is ideally suited to take on this new job, and a welcome addition to the team,” said Judianne Harris, CMO. “I believe she will be able to make an immediate impact by simply lending a fresh perspective to our internal and external communication and branding strategies.”

Originally from New York City, Fatima has lived in the Lehigh Valley for more than 10 years. Outside her professional work, Fatima hikes and loves to spend quality time with her family. Fatima will work on a full-time hybrid schedule based in the firm’s Bethlehem headquarters and she can be reached at 610-868-9000 ext. 115 or falba@valleynationalgroup.com.

Quarterly Commentary: Q3 2022

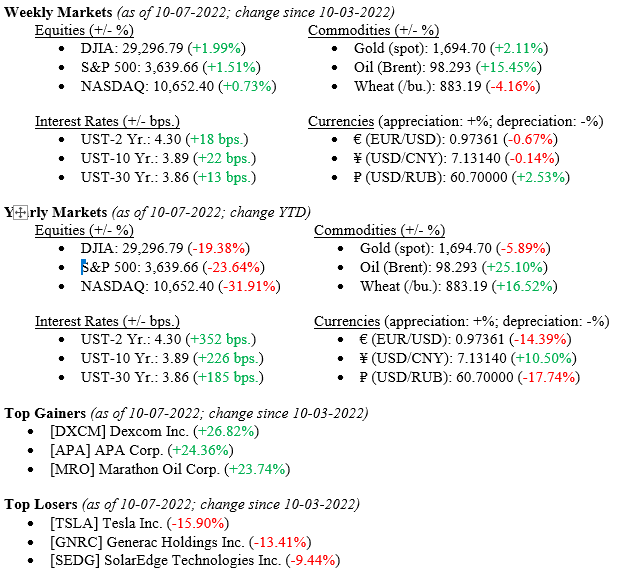

Investors have navigated a difficult market all year and the third quarter was no exception. All major indices ended the quarter in bear market territory with the S&P 500, Dow and Nasdaq declining 5.3%, 6.7%, and 4.1%, respectively, from July to September. With the dollar strengthening and the global economy slowing, the MSCI EAFE index of developed markets fell 10% over the same period in dollar terms, while the MSCI EM index of emerging markets pulled back 12.5%. Interest rates jumped with the 10-Year Treasury yield climbing above 4% on an intra-day basis, the highest level since 2008. The challenges of persistently high inflation and slowing growth have continued to impact the expectations of both investors and policymakers.

In times like these, investors would naturally prefer to wait until it feels comfortable to invest, and even experienced investors may wonder if markets will ever turn around. Therefore, it’s important to remind investors that while bear markets are unpleasant, they also create opportunities for long-term investors. The valuations of major indices, sectors and styles are at their most attractive levels in years, and bond yields are finally at levels that can support portfolio income.

A key principle of investing is that achieving long-term returns doesn’t just involve risk – it requires risk. This is true whether markets are down due to the economy, geopolitics, a pandemic, or any of the hundreds of investor concerns over the past few decades. After all, if staying invested were easy, everyone would do it and there would be no opportunities at all. History shows that those investors who have the discipline and fortitude to handle market pullbacks are often rewarded. So, for those focused on the rear-view mirror, the glass may seem half empty. For those focused on future recovery and growth, the glass is overflowing. Having the right mindset to overcome our own psychology has never mattered more.

At the same time, it’s also important to understand what is driving these market dynamics. Below, we highlight six important insights that will continue to affect markets and the economy through the remainder of 2022 and beyond.

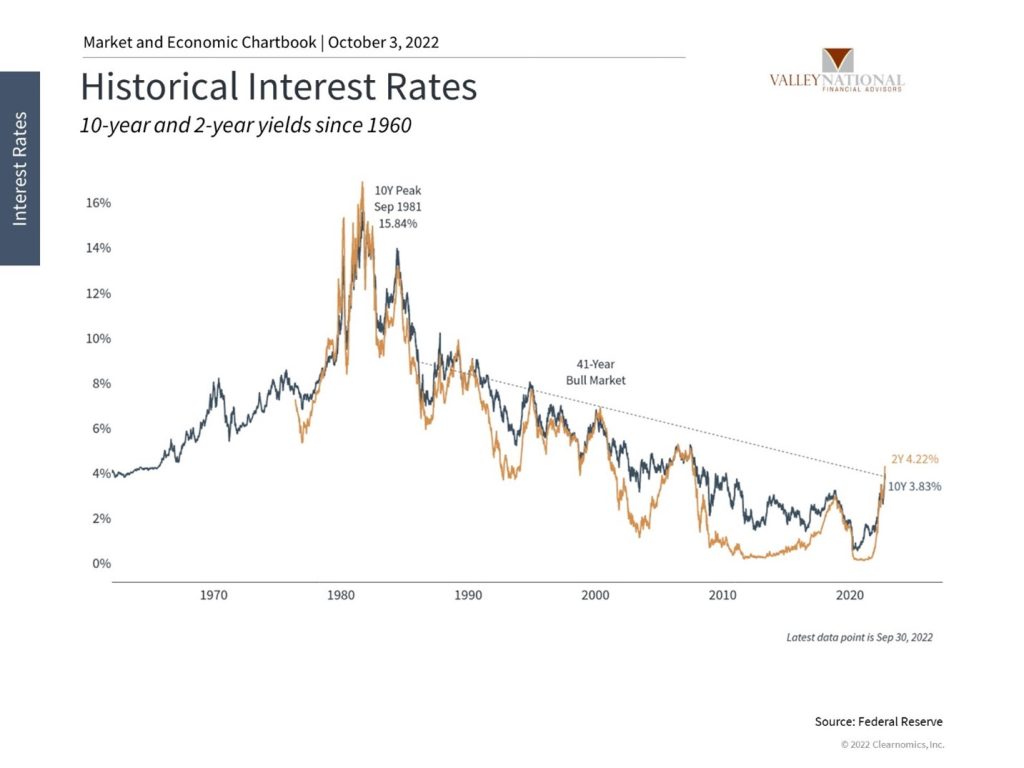

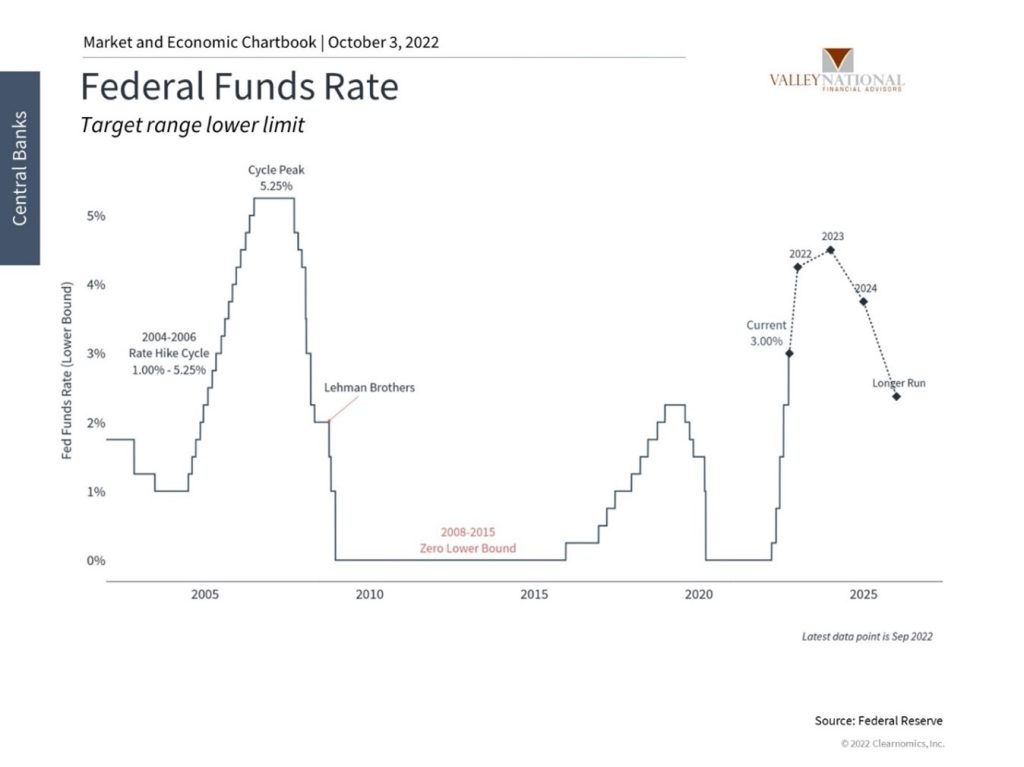

1. Interest rates are rising after declining for 40 years

Markets rallied beginning in June but abruptly reversed course in late August. The turn in the market coincided with Fed Chair Powell’s speech at Jackson Hole during which he emphasized that the Fed would continue to fight inflation by keeping interest rates higher for longer. This message was then reiterated at the Fed’s September meeting with the third 75 basis point hike in a row and higher projections through 2023.

This jump in both policy and market rates is breaking a 40-year pattern of declining interest rates. It’s no wonder that financial markets have been volatile as they adjust to a higher cost of capital and slower economic growth. Regardless, both history and the summer period show that markets can move forward.

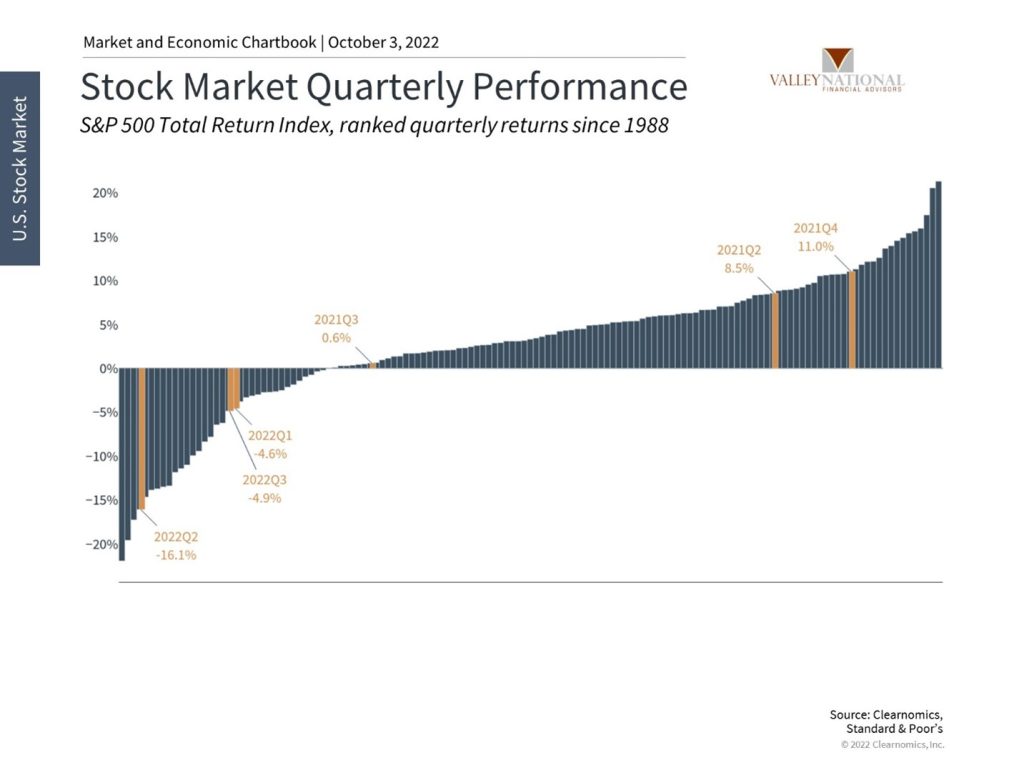

2. The stock market is adjusting to higher inflation and rising rates

While the first three quarters of this year have experienced poor returns, it’s important to maintain perspective on the past few years. Last year experienced some of the best returns as the world emerged from the pandemic. In all, markets are still quite positive since 2020 and the S&P 500 has gained over 40% since the beginning of 2019. Since markets never move in a straight line, it’s important for investors to take the good with the bad in order to not overreact to short-term events.

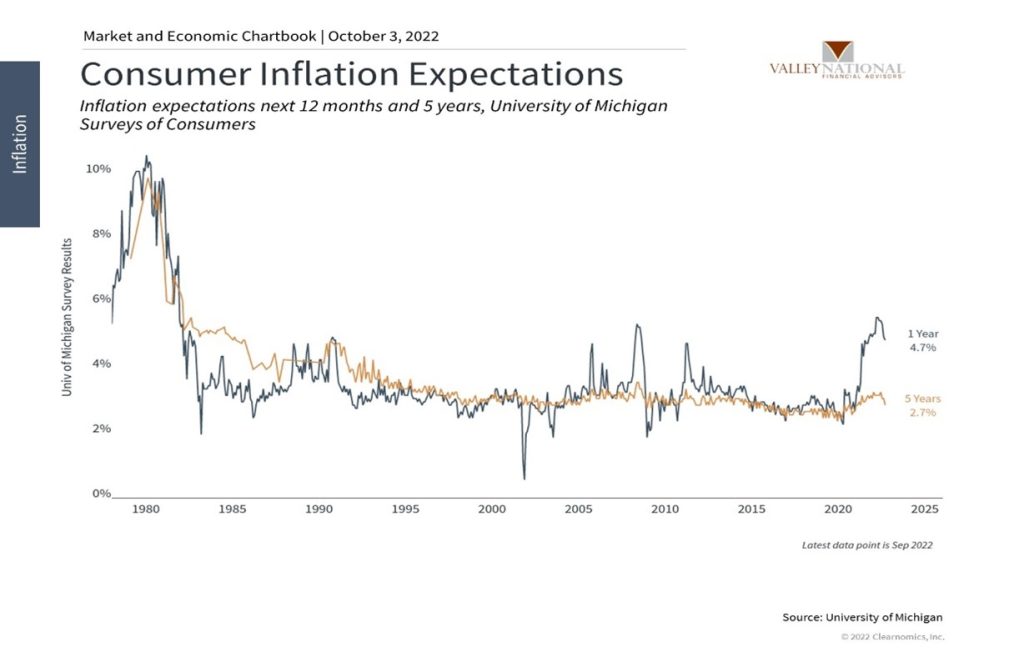

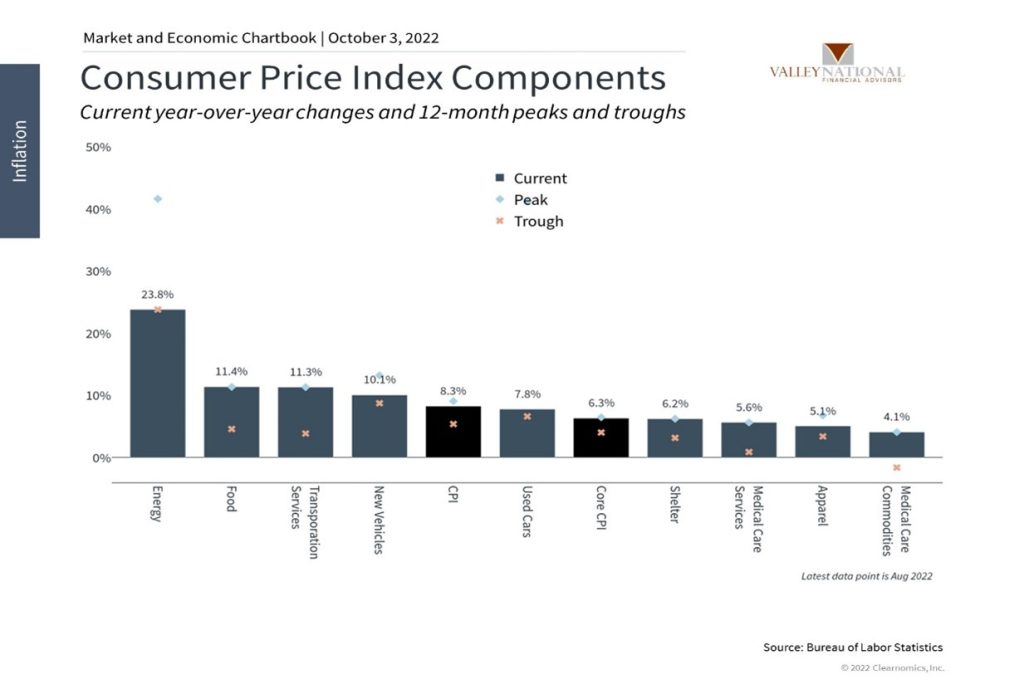

3. Inflation is still elevated despite falling energy prices

Energy prices plummeted throughout the third quarter, reversing much of the effect of Russia’s invasion of Ukraine on oil and gas markets. This helped to bring gasoline prices down, although they are still higher than during any other period over the past decade. Headline inflation – which includes food and energy – has eased as a result.

Economists and policymakers continue to focus on “core” inflation which re-accelerated in August, a sign that price pressures have broadened and continue to hurt consumer pocketbooks. This is a key reason the Fed has doubled down on its inflation fight.

4. The Fed is expecting to keep rates higher for longer

The Fed has communicated that it will keep interest rates higher for longer. This has raised investor concerns over whether the Fed can bring down inflation without creating a deep recession – a so-called “soft landing” versus a “hard landing.” This is a difficult balancing act for the Fed as they try to achieve their dual mandate of both price stability and maximum employment. The markets will continue to adjust to these new expectations in the coming months.

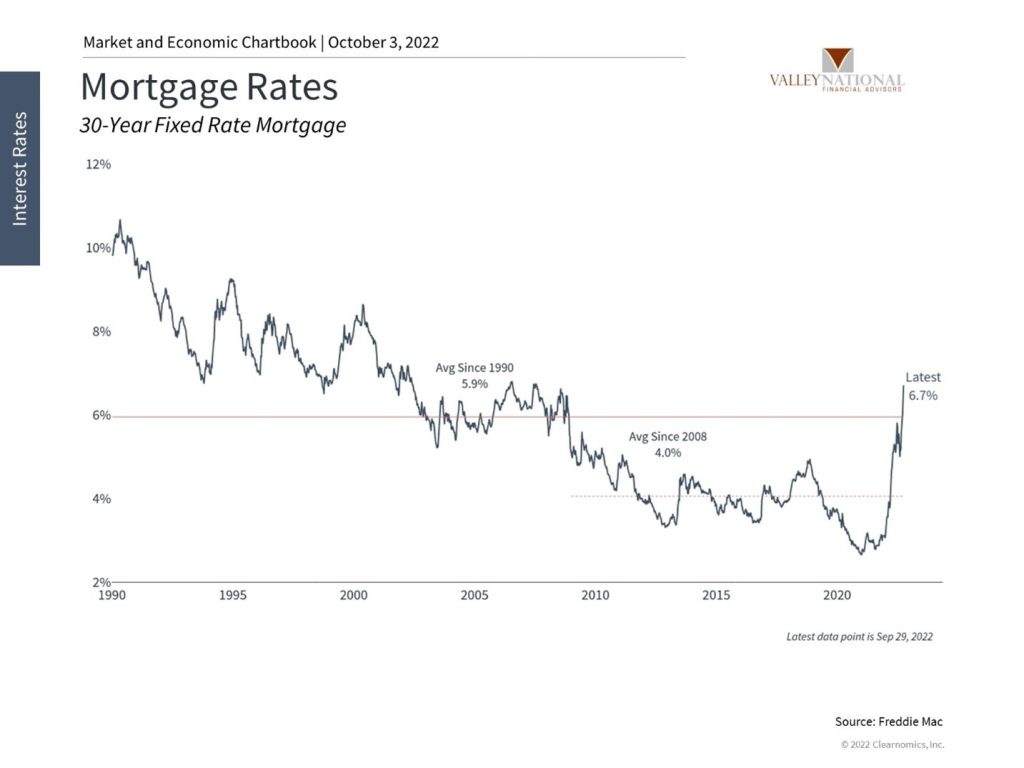

5. Higher mortgage rates have slowed the housing market

One of the main effects of higher interest rates is rising mortgage costs. The average rate on a 30-year fixed rate mortgage is now 6.7% – the highest since the mid-2000s and far above the average of 4% since the last housing bubble. Housing activity is slowing across the board from building permits to housing starts, and from refinancing activity to existing home sales.

While there may be some similarities, this underlying situation is quite unlike the housing bubble of the late 2000s. The key difference is financial leverage across individuals, banks, and throughout the financial system. The underlying fundamentals are much better today than those leading up to 2008. Still, a struggling housing market may impact consumer spending and retail sales as household net worth comes down, at least on paper.

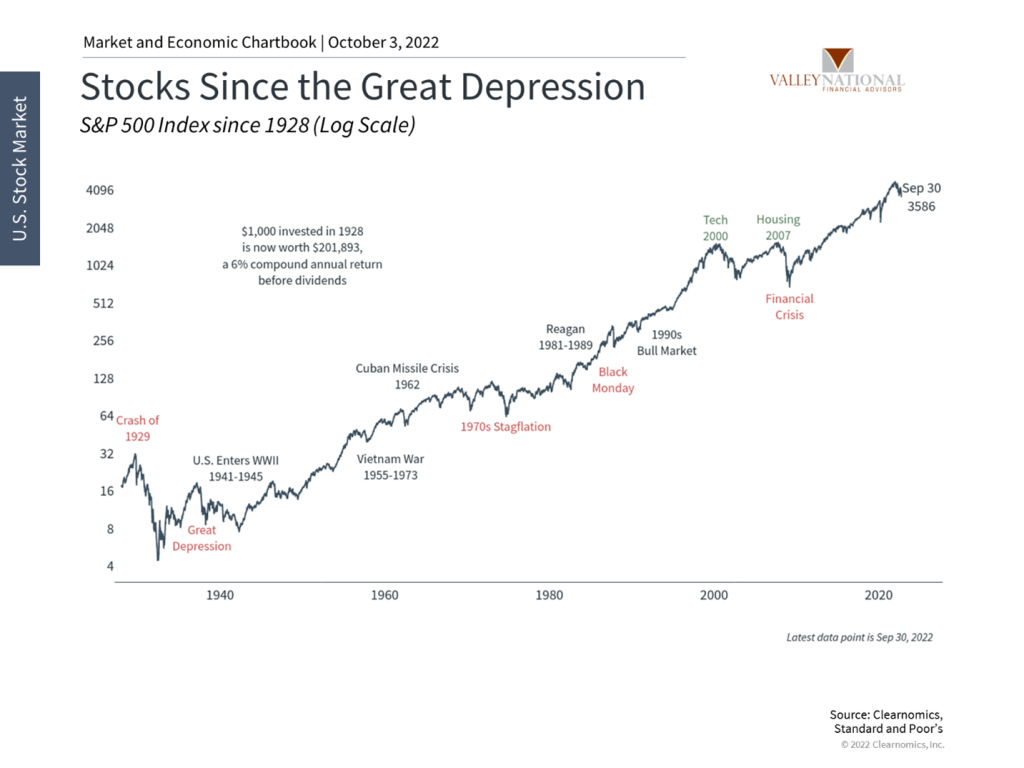

6. Investors should continue to focus on the long run

If history teaches us anything, it’s that fighting the urge to overreact to short-term events is one of the keys to long-term investor success. This chart shows the S&P 500 index going back to before the Great Depression. The fact that the market trends upward over time and follows the path of economic growth is clear. Along the way, there were countless major historical challenges to overcome from wars to bear markets. When zoomed out, these look like blips compared to the gains investors achieved over years and decades.

The bottom line? The ongoing bear market is challenging and unpleasant. However, it is no reason for investors to lose sight of their financial goals. In fact, those investors with the discipline and patience to take advantage of opportunities will likely be rewarded in the long run.

Current Market Observations

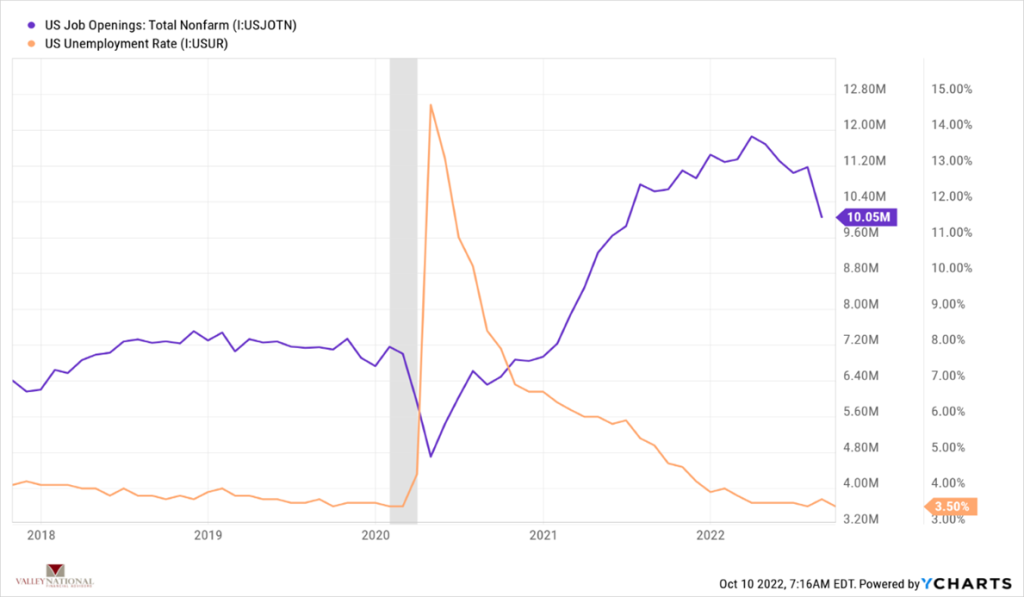

Equity markets posted their first weekly gain in several weeks as a surprise move by the Australian Central Bank to raise rates less than expected sparked a global rally in stocks. As the week progressed, hopes of an earlier “Fed Pivot” were dashed as little economic data released showed signs of a slowing economy or decreasing inflationary pressures. However, one small piece of economic data, Job Openings, released October 5 at 10.05 million vs. 11.17 million in the prior month showed a modest crack in the tight labor market.

U.S. Economy

As mentioned, one piece of economic data from last week, U.S. Job Openings, which is a survey done to assess labor turnover, job openings, hires and separations, showed a decline from the prior month (-10%). Other labor data released last week including new jobs added (+263,000), unemployment (3.5%) and hourly earnings (+5%) all showed continued strength which means jobs data is strong enough to keep the Fed on track to hike interest rates +0.75% next month. The decrease in job openings shows that companies are slowing the pace of hiring before cutting jobs, therefore keeping the unemployment rate low. (See Chart 1 from Valley National Financial Advisors & Y Charts showing U.S. Job Openings and U.S. Unemployment Rate).

Last week’s labor trends were important, but this week’s inflation data is critically important because it will show whether the Fed’s aggressive interest rate tightening is having an impact on prices producers and consumers are paying. This is the critical data the Fed will be watching. Lastly, this week starts the third-quarter earnings season, which provides yet another reading of economic activity.

Policy and Politics

The Russia/Ukraine War is far from over. In fact, last week and this week we are seeing a drastic escalation in fighting with Vladmir Putin again casually mentioning nuclear weapons. We see this escalation as a severe threat to global stability and continued energy uncertainty and shortages for the Euro region. This opens the door (although unlikely to be used) for the U.S. to step up energy production via fracking, drilling or production and shipping of LNG (Liquefied Natural Gas) to Europe, for example.

What to Watch

- U.S. Core Producer Price Index year-over-year for September 2022, released 8:30am 10/12 (prior 7.26%)

- U.S. Producer Price Index year-over-year for September 2022, released 8:30am 10/12 (prior 8.72%)

- U.S. Consumer Price Index year-over-year for September 2022, released 8:30am 10/13 (prior 8.26%)

- U.S. Inflation Rate for September 2022, released 8:30am 10/13 (prior 8.26%)

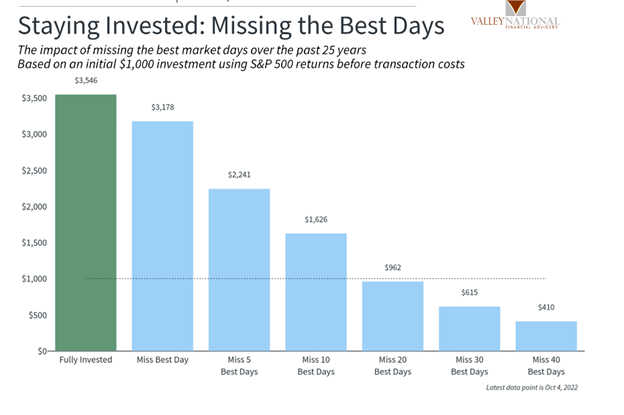

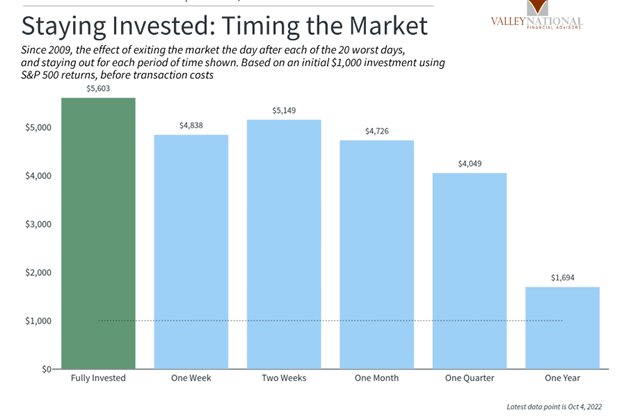

Last week we saw in just two trading sessions, the Dow Jones industrial Average gained over 5% (+1,328 points). An investor missing those two days by casually sitting on the sidelines rather than being invested, missed a major move in the markets which is why we always talk about “Time in the Markets” rather than “Timing the Markets.” Real, transferable, and generational wealth is gathered over extended periods of time by patient and committed investors. We leave you with two classic charts from Valley National Financial Advisors and Y Charts: (Staying Invested: Missing the Best Days and Timing the Market).

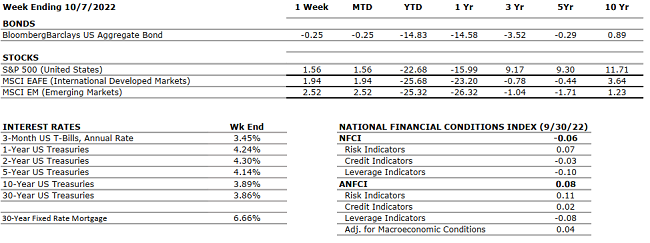

The Numbers & “Heat Map”

THE NUMBERS The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL | Q1 2022 Real GDP shrunk at a 1.6% annual rate. The main factors that resulted in a decrease in GDP were a surge in imports and trade deficit highlighting that the U.S. is buying more goods from foreign countries. According to the second estimate, real GDP for Q2 2022 decreased at an annual rate of 0.6% (up from the first estimate of -0.9%) marking the second consecutive quarter of declining GDP. Some retail outlets are reporting excess inventories which could signify a slowdown in consumer demand. |

|

CORPORATE EARNINGS |

NEUTRAL | The earnings growth rate for Q2 2022 was 6.7% (up from previous estimates of 4.3%) which marked a new post-pandemic low; but still solidly in the “growth” stage. The estimated growth rate for Q3 2022 is 2.4%, which was adjusted downward from 9.8% in June. 14 out of 20 S&P 500 companies that reported earnings beat estimated EPS and 13 beat revenue expectations. |

|

EMPLOYMENT |

NEUTRAL |

U.S. Nonfarm Payrolls for September 2022 increased by 263,000 and the unemployment rate fell back to the June and July level of 3.5% after spiking slightly in August to 3.7%. Professional and business services, health care, and leisure and hospitality were among the sectors with the most notable job gains. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the U.S. increased by 8.3% for August 2022 — below the 8.5% in July but above the expected 8.1%. Food prices saw the largest increases since 1979 (11.4%), shelter and used cars also impacted inflation significantly. Core CPI increased 6.3% year-over-year, the most since March, and up from 5.9% in both June and July. Updated CPI will be released this Wednesday and PPI on Thursday. |

|

FISCAL POLICY |

NEUTRAL | Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill with incentives for green energy, electric cars, and conversely oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. Last week, President Biden announced student loan forgiveness of up to $20,000 subject to income limitations. |

|

MONETARY POLICY |

NEGATIVE | With inflation still running hot, Fed Chairman Jay Powell is clear on his path to slow the economy enough to cool inflation. The Fed raised rates by 0.75% two weeks ago, bringing its target rate to 3.00-3.25%, and suggesting that additional rate hikes are likely in the coming months. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia held controversial referendums for the annexation of four Ukrainian regions and the Russian Parliament unanimously recognized these regions as part of Russia. Ukraine and Western countries have condemned these actions by Russia by declaring them illegitimate and illegal. Additional sanctions are being imposed on Russia by many countries. |

|

ECONOMIC RISKS |

NEGATIVE |

COVID-19 lockdowns in China are persistent and the ongoing Russian-Ukraine war is causing a major energy crisis in Europe. Putin shut down the pipeline that supplies Europe with natural gas indefinitely until all sanctions affecting Russia are lifted. European countries are struggling to find alternative energy resources and are starting to implement significant restrictions on the use of energy in households and businesses. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“A good financial plan is a road map that shows us exactly how the choices we make today will affect our future.” – Alexa Von Tobel

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” on WDIY 88.1FM. Laurie will discuss: What is Financial Planning?

Questions can be submitted at yourfinancialchoices.com during or in advance of the live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Did You Know…?

October is Cybersecurity Awareness Month AND Financial Planning Month

Cybersecurity TIP

by Rob Ziobro, AVP Technology

Last week we learned how to secure our passwords, but do you know how to take your security to the next level? Add MFA to your account. Multifactor Authentication (MFA) is a security feature offered by many websites, applications and devices that dramatically improves account security. Sometimes MFA is also referred to as Two-Factor Authentication or 2FA. MFA refers to a system where there are more than two forms of authentication. MFA increases security because even if one authenticator becomes compromised (recall: brute forced passwords), malicious actors will be unable to meet the second authentication requirement, therefore blocking access to the targeted device, site, or system.

How does it work? Each additional authentication factor added to the login process increases security. A typical MFA login would require the user to present some combination of the following:

• Something you know: like a password or Personal Identification Number (PIN);

• Something you have: like a smart card, mobile token, or hardware token; and,

• Some form of biometric factor (e.g., fingerprint, palm print, or voice recognition).

What can you do? Check the Settings of your apps or the Account Settings and Privacy Settings of your web-based accounts for MFA, then turn it on, if it is offered. If it is not available yet, it most likely will be soon. Taking this extra security measure is a great way to solidify your logins and protect your accounts. Stay Safe!

Financial Planning TIP

by Rod Young, PFS/CPA, CFP® – SVP / Financial Advisor

One common issue I see is people not understanding their 401k plan, and the various options. For example, most do not know if their plan offers a Roth account, and the potential benefits of the Roth versus pre-tax contributions. Perfect example is I just spoke with a client two weeks ago who helped his recently graduated daughter enroll in her employer’s 401k. He did not even think about the Roth option, but when I explained it to him, he was going to have her change her contributions from pre-tax to Roth. So, the planning tips here is: “take the time to learn about your 401k.”

VNFA NEWS

VNFA Partners with WDIY Again to Support Second Harvest Food Bank

This week kicks off WDIY’s Fall Membership Drive during which Valley National Financial Advisors will again donate to provide meals through Second Harvest Food Bank. VNFA has supported the partnership since 2017 and last year was able to fund 12,128 meals for those in need across the Lehigh Valley.

Every dollar donated to WDIY during this year’s Fall Membership Drive will help provide meals to those in need in the Lehigh Valley. For every $100 WDIY receives in donations, Second Harvest Food Bank of the Lehigh Valley will provide 21 meals to individuals and families in our community. READ MORE