Our CFO, Elizabeth Wilson will be a panelist for Adapt+Grow on November 17, 2022, for a 360 Tactical Business Prep for 2023. She will be in front of business owners around the U.S./ Tri State to show them how they can level up their business for 2023. With economic uncertainty ahead, the key to success is preparation and execution. Experts will touch on Finance, Legal, Executive Coaching, and Marketing. Get your ticket to event at: https://adaptingsocial.com/adapt-grow-2022/#

Daily Archives: November 15, 2022

VNFA In the Community

Team VNFA wants to thank Apollo Grill for including us in their Breast Cancer Awareness Running/Walking Challenge. Our run/walk team was able to complete 10 miles each over seven days. Apollo and VNFA will donate $3,000 to Cancer Support Community of the Lehigh Valley. Thank you also to everyone who dined at Apollo in October for which the restaurant donated 5% of their food sales. Coming up on Thursday, November 17, Apollo is hosting a Dine to Donate benefit for Victory House. Call for your reservations today!

Current Market Observations

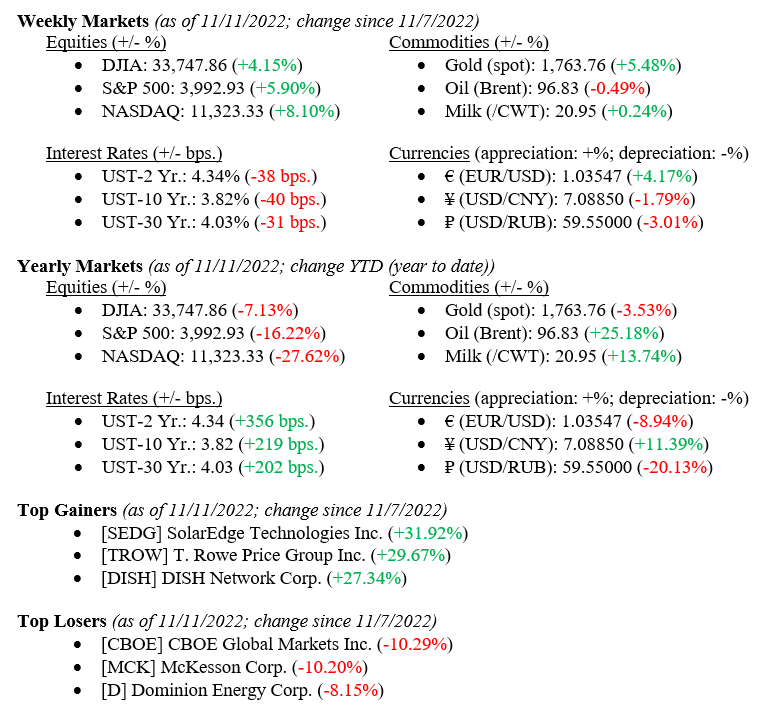

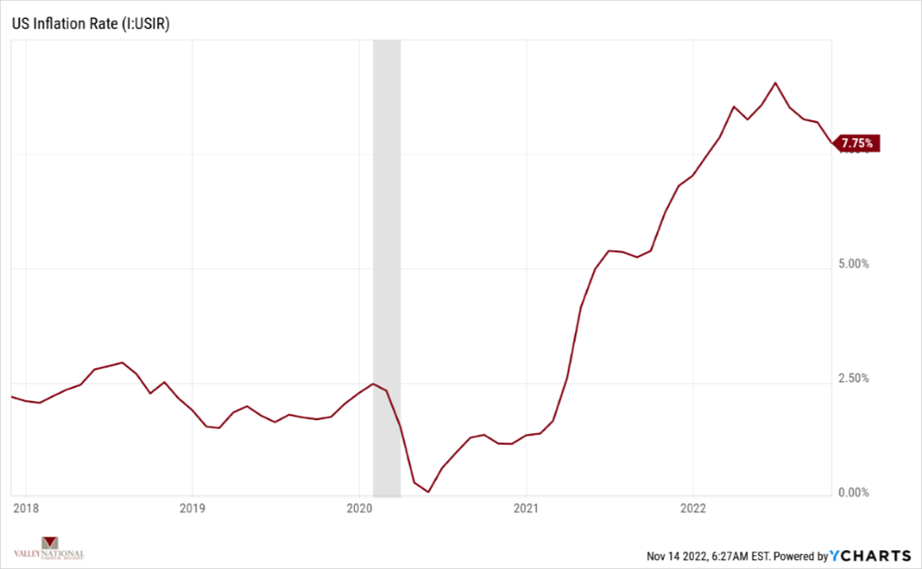

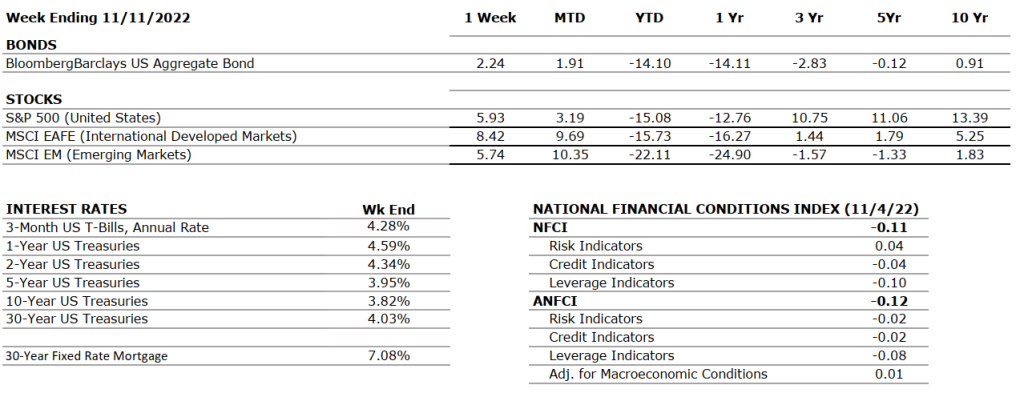

Financial markets got a triple dose of good news immediately before the Veteran’s Day holiday weekend. On Thursday, the U.S. Inflation report for October 2022 showed a drop in the rate to 7.75% from 8.20% the prior month (See Chart 1). Further, a reasonable cessation in the Russia/Ukraine war seems imminent as Russia retreated from the Kherson region of Ukraine. Lastly, China announced a sweeping overhaul to its “zero-tolerance” practice regarding COVID-19 rules allowing the country to truly reopen its economy. Equity markets rallied (higher prices) sharply on the news, especially the NASDAQ (+8.10% on the week) which reacted favorably to lower interest rates (10-Year U.S. Treasury dropped 40 basis points to 3.82%) which help growth and technology companies as borrowing rates decrease. It would not be prudent of us to ignore another big story last week as Cryptocurrency trading giant FTX collapsed wiping out a $32 billion company overnight.

US Economy

Chart 1 below from Valley National Financial Advisors and Y Charts shows the U.S. monthly inflation rate. The sharp drop in the rate is the first tangible evidence that the Federal Reserve Bank’s tight monetary policy is finally curbing inflationary pressures.

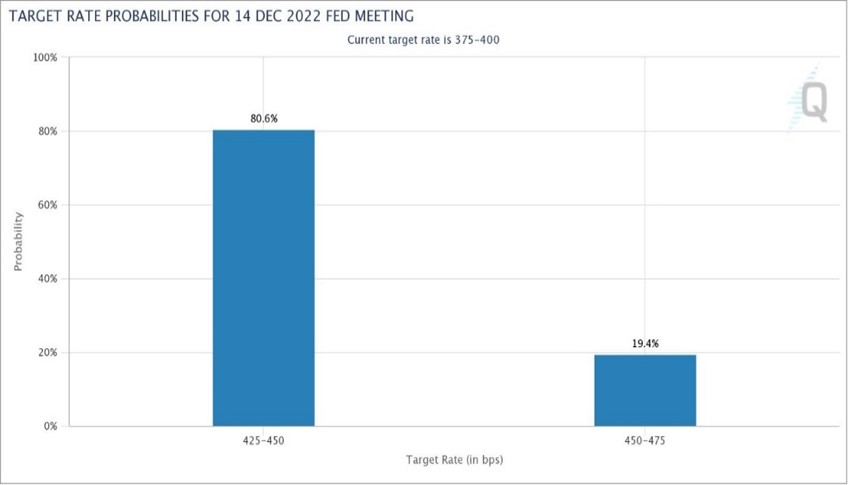

The move in the inflation data immediately impacted financial markets. The CME Group (Chicago Mercantile Exchange) Fed Watch Tool (Chart 2 below) now shows an 80% probability of “only” a +50 basis point rate hike at the December Federal Open Markets Committee meeting rather than a +75 basis point hike, which had been priced into the markets prior the lates inflation report. Chart 2shows the probabilities of changes to the Fed rate and U.S. monetary policy, as implied by 30-day Fed Funds futures trading data.This is a meaningful change in the futures markets as it shows that the end of the Fed’s current interest rate hiking cycle is nearing an end. The question remains around whether Chairman Powell can deliver the mythical “soft-landing” (slowing the economy to combat inflation but not slowing it so much that the economy falls into a recession).

Policy and Politics

The midterm election has concluded, and the results give us a weakly divided government with the Democrats maintaining control of the Senate and the Republicans gaining control of the House. As we have stated many times, financial markets appreciate a divided government because it ties the hands of any one party and prevents “unknown” events from impacting the markets. Overall, gridlock works – oddly, but truthfully.

President Biden is meeting with Chinese leader Xi Jinping today, marking the first time the two leaders have met since Joe Biden took office. While more of a political show, the event does mark a time when relations between the U.S. and China are at a relative low point due to tensions between China and Taiwan. Any warming between the two countries will be viewed as a net positive for global markets.

What to Watch

As mentioned above, FTX, previously one of the world’s largest cryptocurrency exchange platforms, collapsed into bankruptcy wiping out a $32 billion company overnight. When we have discussed cryptocurrencies and we have always told investors to understand and research what you are buying. FTX is only one company in the swiftly growing world of cryptocurrencies but the old Wall Street adage “there’s never just one cockroach” rings true right now and we implore our readers to continue to exercise caution in this market. One thing for sure is that regulators and law makers will take a much greater interest in the crypto market.

RELATED VIDEO: CIO Bill Henderson on Cryptocurrency

Last week we saw some great news around the Fed, Russia/Ukraine War and China. Softening inflation data gives the Fed some room to slow down its interest rate hiking cycle, which growth stocks (NASDAQ) view favorably. We are cautiously optimistic that we have seen the peak in inflation. Remain vigilant nonetheless and watch events unfold around the cryptocurrency markets, the Russia/Ukraine war and whether President Biden and Xi Jinping announce any actual results of their meeting.

From the Pros… VIDEO

Chief Investment Officer, William Henderson, talks about the realities of Cryptocurrency and the need for investors to do thorough research.

The Numbers & “Heat Map”

THE NUMBERS

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

According to the second estimate, real GDP for Q2 2022 decreased at an annual rate of 0.6% (up from the first estimate of -0.9%) marking the second consecutive quarter of declining GDP. The advance estimate for Q3 2022 shows Real GDP to have increased by an annual rate of 2.6%. |

|

CORPORATE EARNINGS |

NEUTRAL |

The estimated growth rate for Q3 2022 is 2.2%, which was adjusted downward from 9.8% in June and 2.4% three weeks ago. So far, with 85% of S&P500 companies reporting actual results, 70% of them reported a positive EPS surprise and 71% beat revenue expectations. |

|

EMPLOYMENT |

NEUTRAL |

U.S. Nonfarm Payrolls for October 2022 increased by 261,000 and the unemployment rate rose from 3.5% in September to 3.7%. October’s gains were broad-based but primarily driven by manufacturing and healthcare sectors which added 32,000 and 53,000 jobs respectively. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the U.S. increased by 8.2% for September 2022 — down slightly from 8.3% in August but still a stubbornly high result and above expectations. Core CPI increased by 6.6% year-over-year marking the highest gain since August 1982. CPI for the month of October will be released on Thursday morning and it is expected to come in at 7.9%. Core CPI is projected to be6.5%. |

|

FISCAL POLICY |

NEUTRAL |

Senator Manchin and Majority Leader Schumer reached an agreement on the latest tax and energy bill with incentives for green energy, electric cars, and conversely oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The bill has been officially passed by the Senate. President Biden announced student loan forgiveness of up to $20,000 subject to income limitations. |

|

MONETARY POLICY |

NEGATIVE |

The Fed approved a fourth consecutive 75 bps hike last week which took its target range to 3.75%- 4.00% – the highest it has been since 2008. The Fed hinted at potentially reducing the magnitude of future rate increases from 75 to 50 bps but also mentioned the possibility of a new higher target range closer to 5%. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

Russia held controversial referendums for the annexation of four Ukrainian regions and the Russian Parliament unanimously recognized these regions as part of Russia. Ukraine and Western countries have condemned these actions by Russia by declaring them illegitimate and illegal. Additional sanctions are being imposed on Russia by many countries. |

|

ECONOMIC RISKS |

NEGATIVE |

COVID-19 lockdowns in China are persistent and the ongoing Russian-Ukraine war is causing a major energy crisis in Europe. Gas supplies from Russia to Europe have decreased by 88% over the past year and EU countries have agreed to cut gas usage by 15% as gas prices have more than doubled. The U.S. is now dealing with a major diesel shortage with national reserves at their lowest levels since 1951 and a ban on Russian products that will intensify the issue. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“If opportunity doesn’t knock, build a door.” -Milton Berle

“Your Financial Choices”

Tune in Wednesday, 6 PM for “Your Financial Choices” on WDIY 88.1FM. Laurie will discuss: Year-end Tax Planning Odds and Ends.

Questions can be submitted at yourfinancialchoices.com during or in advance of the live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.