Last week, we saw diverging pressures on the markets resulting in diverging results on equity indexing. Hopes of a FED slowing their aggressive interest rate hikes moved equity markets higher across the board and bond yields lower, but weak earnings releases from “Big Tech” equities (AMZN, GOOG, META) weighed heavily on the tech-heavy NASDAQ. Still, all major indexes moved higher for the week (see details below) and the 10-Year US Treasury ended the week at 4.02%, 23 basis points lower than the previous week.

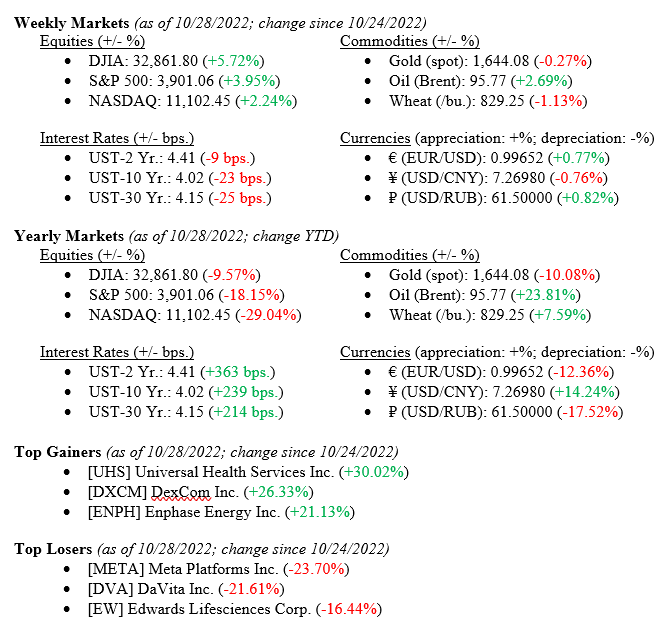

Weekly Markets (as of 10/28/2022; change since 10/24/2022)

Global Markets

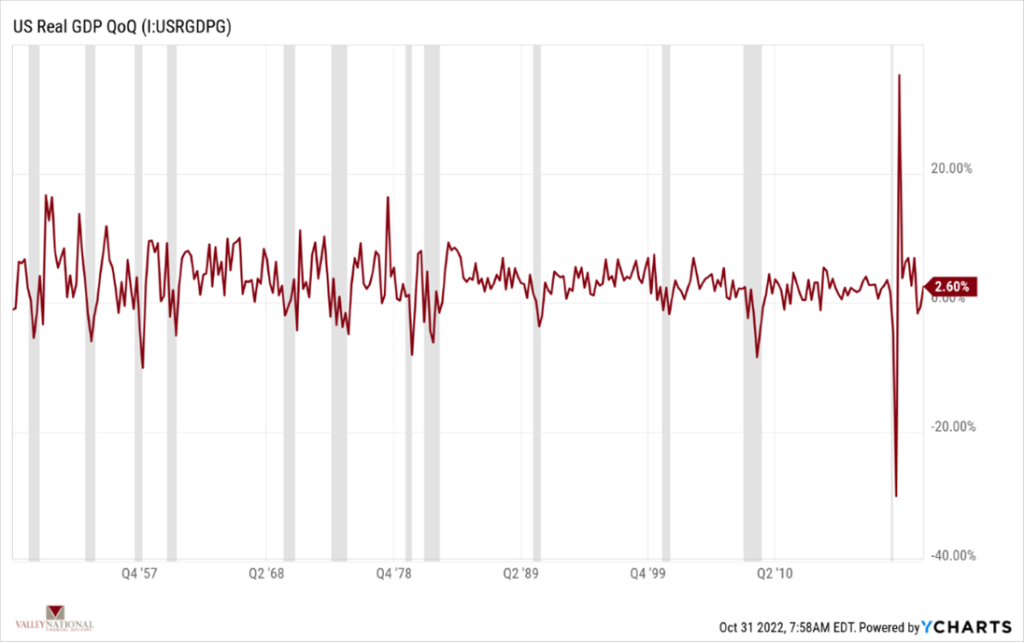

As noted above, weekly returns were favorable across all major indexes and returns for the full month of October 2022 are shaping up to be some of the best monthly returns in decades. Solid consumer spending, as evidenced by earnings releases from Visa and American Express, continue to fuel economic growth. Last week, U.S. Real GDP (Gross Domestic Product) for the 3rd quarter was released and the number came in at +2.60%, compared to -0.60% for the 2nd quarter of 2022 and +2.70% for the full year 2021. (See Chart 1 below from Valley National Financial Advisors & Y Charts). What we found telling was how GDP has now normalized moving closer to recent historical averages compared to wild pandemic-related swings we saw previously.

Mortgage rates continue to move higher in response to higher interest rates overall. This has had a drastic impact on the housing market. Last week, the National Association of Realtors released U.S. Pending Home Sales data that was significantly below expectations (-10.17% vs expected of –4.0%) (See Chart 2 below from Valley National Financial Advisors and Y Charts showing the 30 Year Mortgage Rate vs U.S. Pending Home Sales).

While not a devastating impact on the economy, housing is a key component of economic growth especially given the knock-on effects of home sales – additional purchases of appliances, home improvements made, sales of replacement furniture and fixtures all contribute to or detract from economic activity.

This week the Federal Reserve meets, and expectations are for another +0.75% rate hike. This is expected so any move higher or lower will have an impact on the markets because, as we all know, markets hate uncertainty. Additionally, about 1/3 of the S&P 500 Index Companies report earnings this week, which will also have a corresponding impact on the markets if the data is more positive or negative compared to Wall Street analysts’ predictions.

What to Watch

- U.S. Job Openings: Total Nonfarm for September 2022, released 11/01/22 (Prior +10.05m)

- Target Federal Funds Rate by Federal Open Markets Committee released 11/02/22, current upper range 3.25%

- U.S. Initial Claims for Unemployment Ins. for week of 10/29/22, released 11/3/11 (prior 217k)

There has been a modest turnaround in equities and the month of October has rewarded patient investors handsomely. 10-Year US Treasury yields have come off their recent highs (4.33%), moving lower to 4.02% but markets have yet to express optimism that yields have peaked. The FED meets this week and markets have priced in a +0.75% bump in the Fed Funds Target. The language around that move and additional directional information from Fed Chair Jay Powell is what we are really waiting for with Wednesday’s announcement. Global uncertainty is focused on the Russian/Ukraine war and Covid related lockdowns in China – thankfully, these are not new uncertainties, and the markets continue to accurately price in the story. Watch for impactful data this week while also remaining focused on the long-term trends. Reach out to us at Valley National Financial Advisors for any additional information.