Senior Vice President, Laurie A. Siebert, CPA, CFP®, AEP®, had the opportunity to present a program for Morningstar Living residents and guests. Laurie introduced the concept of looking beyond the numbers on your tax return with “What Story Does Your Tax Return Tell and What Can We Learn?”. Laurie said, “Knowing your tax return’s story will allow a better understanding of the impact of your financial decisions.” Take the time this year to learn your story and engage with your tax return! You might find opportunities to save taxes!

Monthly Archives: January 2023

Did You Know…?

Each February, NHLBI and The Heart Truth® celebrate American Heart Month. It is a month to celebrate not only life but also a way to motivate Americans to adopt healthy lifestyles. American Heart Month is a great time to think about reducing your cardiovascular disease risk. Start the Seven days of self-care this week and start the road to preventing heart disease.

Want to learn more about American Heart Month? Visit the National Heart, Lung, and Blood Institute.

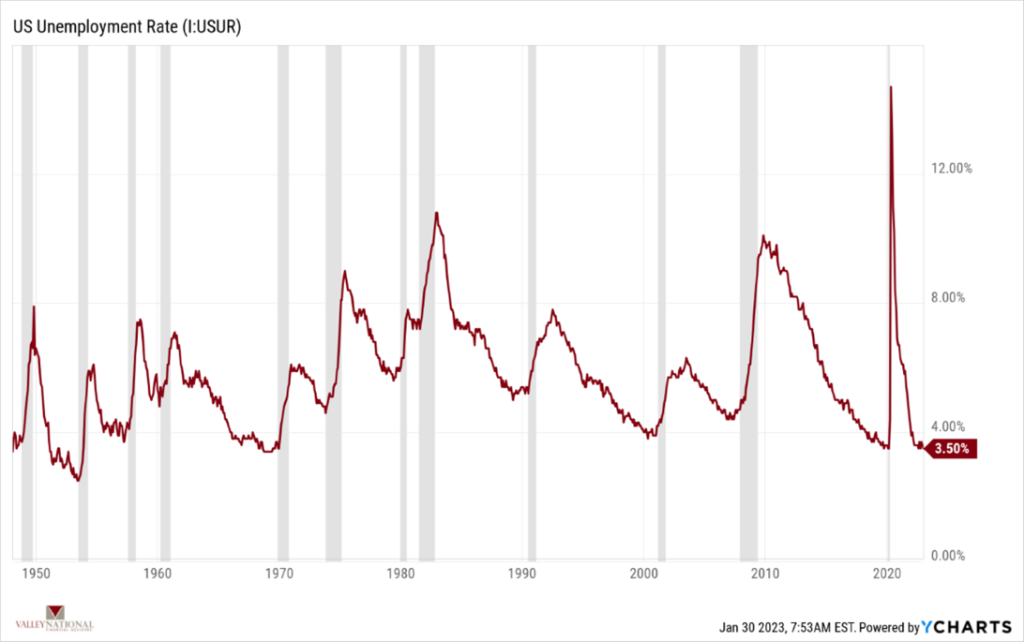

Current Market Observations

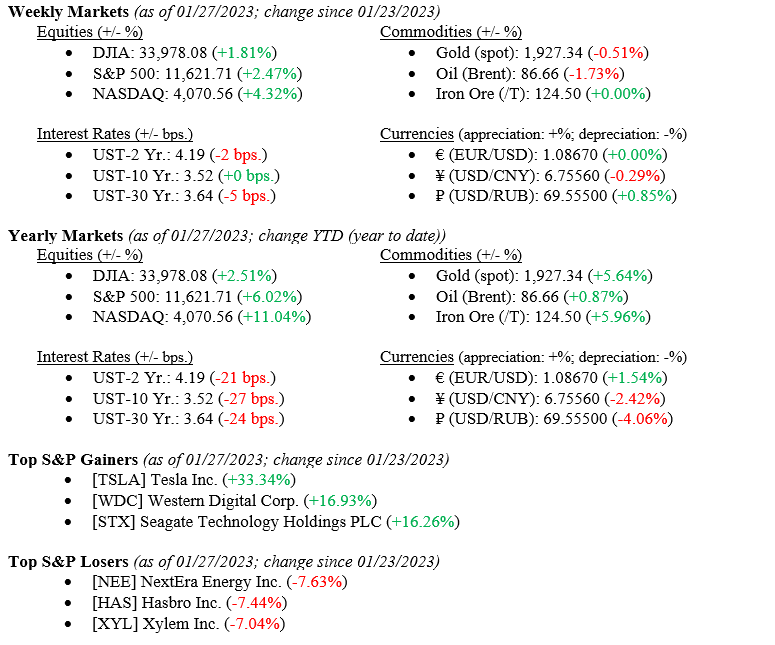

Economists may be predicting a recession in 2023. Still, the markets are certainly telegraphing a different story as last week’s returns marked the 4th week in a row for positive returns across all three major market indexes, with the NASDAQ leading the way, notching an additional +4.3% for the week and sitting at +11.0% so far in 2023. On a year-to-date basis, the Dow Jones Industrial Average is up +2.5%, while the broader S&P 500 Index is up +6.0% thus far in 2023. The markets are focused on three converging events: the Fed wrapping up its aggressive rate hiking policy, inflation finally showing signs of coming down, and a labor market that, despite continued announcements of layoffs, shows no signs of cooling.

Global Economy

As mentioned above, one item where Wall Street economists, strategists, and portfolio managers agree is that the Fed is near the end of its aggressive rate-hiking strategy. The Fed has raised rates by +425 basis points since their zero-interest rate policy was in effect due to the Pandemic. Chart 1 below from the Federal Reserve Bank of St. Louis shows the Effective Fed Funds Rate.

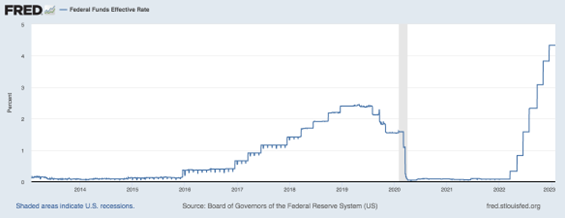

The Fed’s current rate hiking strategy pattern has been one of the steepest and swiftest moves in the Fed’s history, and their goal of cooling the economy and thereby taming inflation is working. Last week, two inflation indicators that Federal Reserve policymakers widely watch and are considered their “favorite” measures of inflation were released, and both showed significant drops. U.S. PCE (Personal Consumption Expenditures) and U.S. Core PCE for December 2022 fell for the third month in a row, as shown in Chart 2 below from Valley National Financial Advisors and Y Charts. The Fed prefers the PCE indicators because this measure responds better to rapidly changing consumer preferences, includes an exhaustive list of typical consumer expenditures, and the Core measure excludes volatile food and energy prices. The drop in these indicators since their peak in July 2022 shows the Fed’s policies are impacting the economy and taming painful inflation numbers impacting consumers and industry.

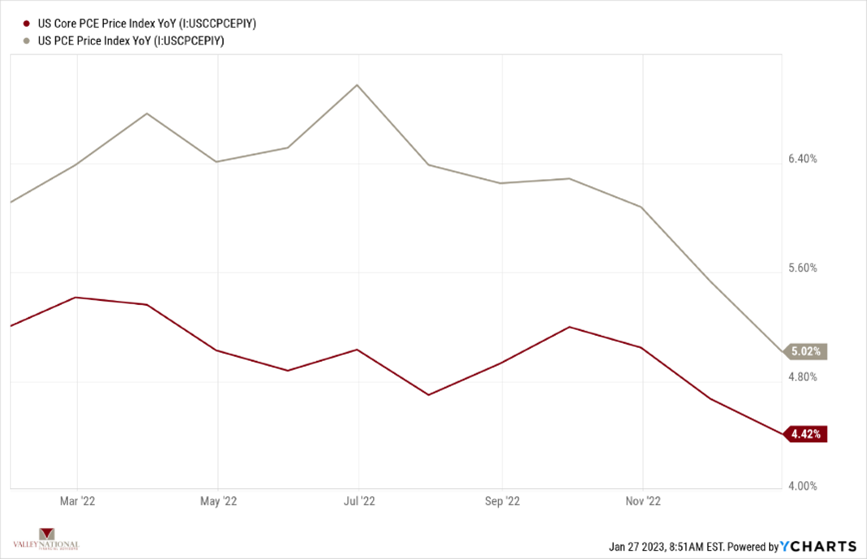

The last point mentioned above was about the strength of the labor market, even in the face of continued announcements of layoffs. Thus far, approximately 40,000 layoffs have been announced by technology companies such as Twitter, Amazon, Google, and Microsoft. We at TWC would never suggest that an engineer or coder from Microsoft is widely more employable than a starting-level service employee, but that seems to be the case as those tech layoffs are not yet showing up in the weekly claims for unemployment insurance, suggesting these coders and engineers found new jobs very quickly. The U.S. Unemployment Rate is at a 50-year low of 3.50%, Chart 3 below from Valley National Financial Advisors and Y Charts. We must go back to 1969 to see a lower level of U.S. Employment than today. Cautiously we watch the labor market, our concerns are that layoffs spread beyond the technology sector.

What to Watch

- U.S. Job Openings: Total Nonfarm for December 2022, released 2/1/2023, prior 10.46 million.

- U.S. Recession Probability for January 2024, released 2/1/2023, prior 47.31%.

- U.S. Initial Labor Force Participation Rate for January 2023, released 2/3/2023, prior 62.30%.

- U.S. Nonfarm Payrolls for January 2023, released 2/3/2023, prior 223,000.

- U.S. Unemployment Rate for January 2023, released 2/3/2023, prior 3.50%.

We are big believers in the “efficient markets hypothesis,” a theory in financial economics that states that asset prices reflect all available information. Simply put: the markets are smarter than investors. Most Wall Street professionals continue to call for a recession in 2023, albeit a shallow or minimally painful and short-lived recession. After digesting current economic conditions and market reactions, some are walking back their predictions for 2023. We look at the data and find it difficult to believe we will have a recession in 2023. The indicators mentioned above are not harbingers of a recession. We are concerned about corporate profits, many of which will be published this week, and whether layoffs are spreading beyond the technology sector. Watch for the Fed’s announcement this week on interest rates, in which they are widely expected to raise rates +0.25% and watch this week’s EPS (Earnings Per Share) releases to offer direction on profits for 2023.

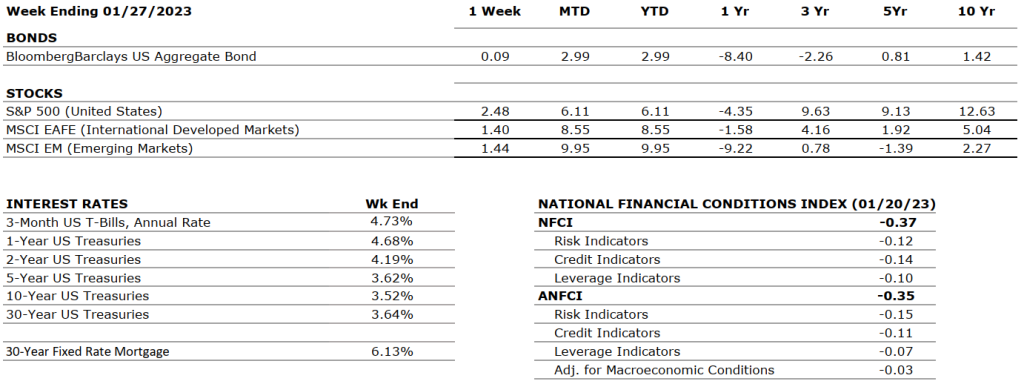

The Numbers & “Heat Map”

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the fourth quarter of 2022 after increasing by 3.2 percent in the third quarter. The increase in the fourth quarter primarily reflected increases in inventory investment and consumer spending that were partly offset by a decrease in housing investment. |

|

CORPORATE EARNINGS |

NEUTRAL |

The earnings growth rate for Q3 2022 was 2.4%. For Q4 2022, earnings are expected to decline by -5.0%, down from the previous estimate of -4.6%. This would be the first negative growth since Q3 2020 (-5.7%). So far, 29% of S&P 500 companies have reported actual results — 69% of companies beat EPS estimates, and 60% beat revenue expectations. |

|

EMPLOYMENT |

NEUTRAL |

U.S. Nonfarm Payrolls for December 2022 increased by 223,000, and the unemployment rate fell slightly to 3.5% from 3.7%. Leisure and hospitality, health care, construction, and social assistance were among the sectors with the most notable gains. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the U.S. increased by 6.5% for December 2022 compared to the November reading of 7.1%. This is the lowest CPI value since October 2021. Core CPI increased at a rate of 5.7% versus 6.0% in November. Most prices fell during the last month of the year, including food, used cars, and most energy sources. Electricity and shelter still saw an increase from the previous month. |

|

FISCAL POLICY |

NEUTRAL |

A few weeks after taking control of the chamber, GOP lawmakers are pushing for austerity measures to improve the nation’s fiscal health. The primary focus areas are federal health care, education, science and labor programs, and Social Security. Democrats have responded harshly, and President Biden has stressed that he will not negotiate a deal with Republicans involving reductions of benefits. |

|

MONETARY POLICY |

NEGATIVE |

Last month the Fed approved a 50-bps rate hike after four consecutive 75-bps hikes taking its target range to 4.25%-4.50%. Although the magnitude of rate hikes has been decreased, rates are likely to be kept higher through 2023 with no reductions until 2024. According to the FOMC’s dot plot, the expected terminal rate is now 5.1%. The next meetings will be held this week. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

While the Russian-Ukraine conflict does not show signs of abating, additional geopolitical issues have arisen in South America with the violent protests that hit the capital of Brazil last week. Following the October 2022 elections won by the left party, Jair Bolsonaro’s far-right supporters stormed Brasilia accusing the winning candidate and party of corruption. Bolsonaro is currently in Florida and has communicated little publicly. |

|

ECONOMIC RISKS |

NEGATIVE |

China seems to have abandoned its zero-Covid policy, which should help the global supply chain recover. Gas supplies from Russia to Europe have decreased by 88% over the past year, and EU countries have agreed to cut gas usage by 15% as gas prices have more than doubled. Nevertheless, an unusually mild winter has helped the majority of Europe dealing with increased energy costs. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“Kindness is spreading sunshine into other people’s lives regardless of the weather.” -Unknown

“Your Financial Choices”

Tune in Wednesday, 6 PM for a Pre-Recorded “Your Financial Choices” on WDIY 88.1FM. Laurie and her guest Joe Goldfeder, Certified Financial PlannerTM and Financial Advisor at Valley National Financial Advisors, will be discussing: Investment Options and Considerations.

Questions can be submitted at yourfinancialchoices.com in advance of the show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Did You Know…?

January has been National Blood Donor Month since 1970. President Richard Nixon proclaimed January 1970 as the first National Blood Donor Month to pay tribute to voluntary blood donors and encourage new donors to join and get more comfortable with donating blood.

Want to learn more about National Blood Donor Month? Visit American Blood Center.

Current Market Observations

U.S. markets have rallied this year, albeit with some pullbacks over the last week. The Dow Jones saw a 2.38% decline, the S&P down 0.27%, and the NASDAQ ended up 1.27% from a week earlier. Additionally, the Federal Reserve is beginning to consider slowing rate hikes as inflation is showing tentative signs of weakening and recession probabilities are gradually declining. This brings us to the U.S. debt ceiling, which is quickly encroaching. Conversations are set to begin in Congress on tackling this, and the Treasury is imploring that they do so urgently. In all, the markets and economy feel as though they’re leveling out to a certain extent—is this the calm before the storm or signs of sustainable healing?

Global Economy

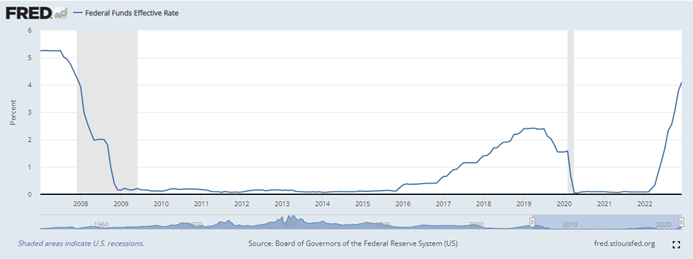

Federal Reserve officials are weighing slowing the pace of interest rate increases yet again from the December hike of 50 basis points, which followed four consecutive months of 75 basis point increases. In recent statements, officials have said that potentially slowing to 25 basis point increases could allow them more time to assess the efficacy of their strategy, as well as determine a reasonable stopping point/pivot. Chart 1 below from the St. Louis Fed’s FRED database shows that the effective federal funds rate is still roughly 100 basis points below rates going into the Global Financial Crisis of 2008/2009. For reference, Goldman Sachs Research is anticipating three more 25 basis point hikes before capping out at the 5.00-5.25% level and holding through year-end.

Chart 1: Effective Federal Funds Rate (01-01-2007 through 12-01-2023)

For the past year, the topics of recessions and inflation have been at the forefront of nearly every conversation surrounding the global economy. In a recent survey conducted by Goldman Sachs Research, which interviewed 400 respondents, 57% expect a recession in 2023. Goldman’s economists, on the other hand, do not expect a recession, citing a 35% chance for 2023. Additionally, there are tentative signs that the sticky inflation from 2022 could be decreasing, though that does not necessarily mean that it will fall evenly across those categories. For example, tight labor markets may be unable to slow increasing wages, and commodity supply shocks are possible. Chart 2 below shows annual core inflation from 2016 through 2023 across several geographical regions.

Chart 2: Annual Core Inflation across geographical regions (2016 through 2023)

Policy and Politics

This week, Congress is returning from its short recess and is expected to focus on the typical partisan issues. A Democratic senate will focus on Pres. Biden’s judicial nominees and a Republican house on investigations into the administration on various topics. However, the most pressing issue on Congress’s plate is the ever-approaching debt ceiling, and a path forward for the U.S. President Biden has reiterated that he will not negotiate on debt limits as “[raising the ceiling is the] obligation of this country and its leaders to avoid economic chaos.” House Speaker McCarthy is willing to use the debt ceiling conversation as leverage toward spending cuts, stating, “[we’ll] discuss a responsible debt ceiling increase to address irresponsible government spending.” Regardless of negotiations and concessions, the debt ceiling conversation needs to be sorted out sooner rather than later, as the Treasury would be unable to prevent default if the limit is breached. According to Janet Yellen, the Treasury’s systems are not designed to give priority to bondholders after borrowing limits are exceeded.

What to Watch

- Monday, January 23rd, 2023

- 4:30PM: U.S. Retail Gas Price (Prior: $3.366/gal.)

- Thursday, January 26th, 2023

- 8:30AM: U.S. Real GDP Quarter over Quarter (Prior: 3.20%)

- 10:00AM: 30 Year Mortgage Rate (Prior: 6.15%)

- Friday, January 27th, 2023

- 8:30AM: U.S. Core PCE Price Index Year over Year (Prior: 4.68%)

- 10:00AM: U.S. Index of Consumer Sentiment (Prior: 64.60)

- 10:00AM: U.S. Pending Home Sales Year over Year (Prior: -37.79%)

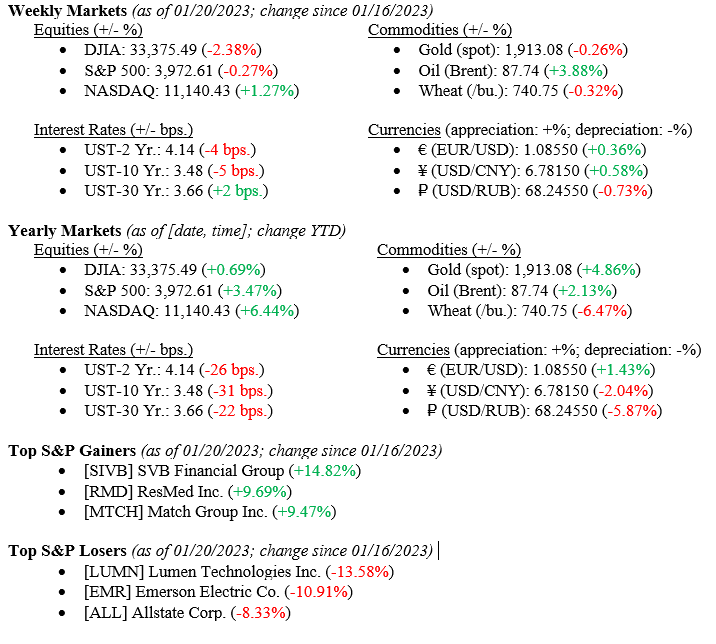

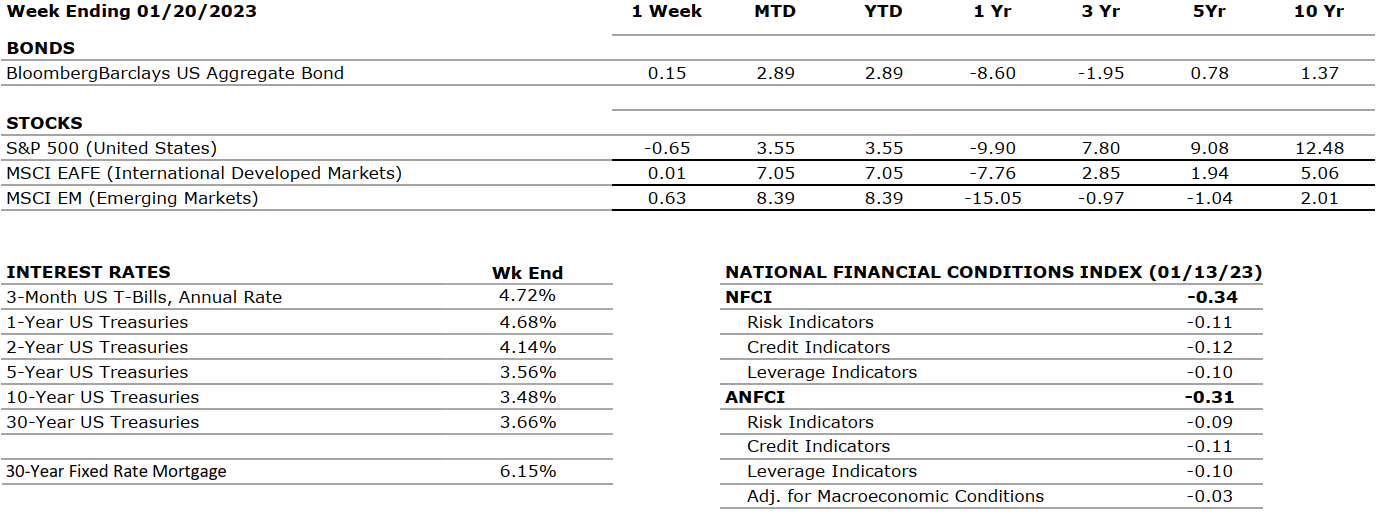

The Numbers & “Heat Map”

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Real gross domestic product (GDP) increased at an annual rate of 3.2 percent in the third quarter of 2022, in contrast to a decrease of 0.6 percent in the second quarter. The third quarter’s increase primarily reflected exports and consumer spending that were partly offset by a decrease in housing investment. The estimated growth rate for Q4 2022 Real GDP is now 3.8%. |

|

CORPORATE EARNINGS |

NEUTRAL |

The earnings growth rate for Q3 2022 was 2.4%. For Q4 2022, earnings are expected to decline by -4.6%, down from the previous estimate of -3.9%. This would be the first negative growth since Q3 2020 (-5.7%). So far, 11% of S&P 500 companies have reported actual results — 67% of companies beat EPS estimates, and 64% beat revenue expectations. |

|

EMPLOYMENT |

NEUTRAL |

U.S. Nonfarm Payrolls for December 2022 increased by 223,000, and the unemployment rate fell slightly to 3.5% from 3.7%. Leisure and hospitality, health care, construction, and social assistance were among the sectors with the most notable gains. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the U.S. increased by 6.5% for December 2022 compared to the November reading of 7.1%. This is the lowest CPI value since October 2021. Core CPI rose at a rate of 5.7% versus 6.0% in November. Most prices fell during the last month of the year, including food, used cars, and most energy sources. Electricity and shelter still saw an increase from the previous month. |

|

FISCAL POLICY |

NEUTRAL |

Senator Manchin and Majority Leader Schumer agreed on the latest tax and energy bill with incentives for green energy, electric cars, and oil & gas companies for exploration. No changes in private equity taxes or higher tax rates for the very wealthy were enacted. The Senate has officially passed the bill. President Biden announced student loan forgiveness of up to $20,000, subject to income limitations. |

|

MONETARY POLICY |

NEGATIVE |

Last month the Fed approved a 50-bps rate hike after four consecutive 75-bps hikes taking its target range to 4.25%-4.50%. Although the magnitude of rate hikes has been decreased, rates are likely to be kept higher through 2023 with no reductions until 2024. According to the FOMC’s dot plot, the expected terminal rate is now 5.1%. The next meetings will be held at the end of January and the beginning of February. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

While the Russian-Ukraine conflict does not show signs of abating, additional geopolitical issues have arisen in South America with the violent protests that hit the capital of Brazil last week. Following the October 2022 elections won by the left party, Jair Bolsonaro’s far-right supporters stormed Brasilia accusing the winning candidate and party of corruption. Bolsonaro is currently in Florida and has communicated little publicly. |

|

ECONOMIC RISKS |

NEGATIVE |

China seems to have abandoned its zero-Covid policy, which should help the global supply chain recover. Gas supplies from Russia to Europe have decreased by 88% over the past year, and EU countries have agreed to cut gas usage by 15% as gas prices have more than doubled. Nevertheless, an unusually mild winter has helped most of Europe deal with increased energy costs. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“The only place success comes before work is in the dictionary.” — Vince Lombardi