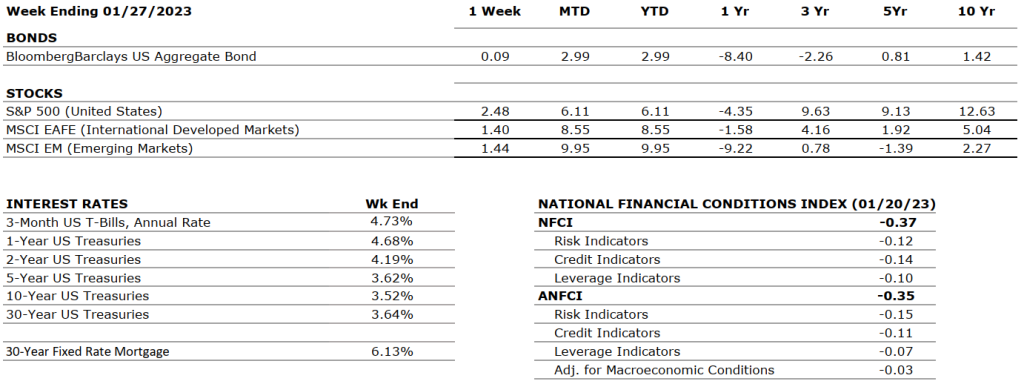

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the fourth quarter of 2022 after increasing by 3.2 percent in the third quarter. The increase in the fourth quarter primarily reflected increases in inventory investment and consumer spending that were partly offset by a decrease in housing investment. |

|

CORPORATE EARNINGS |

NEUTRAL |

The earnings growth rate for Q3 2022 was 2.4%. For Q4 2022, earnings are expected to decline by -5.0%, down from the previous estimate of -4.6%. This would be the first negative growth since Q3 2020 (-5.7%). So far, 29% of S&P 500 companies have reported actual results — 69% of companies beat EPS estimates, and 60% beat revenue expectations. |

|

EMPLOYMENT |

NEUTRAL |

U.S. Nonfarm Payrolls for December 2022 increased by 223,000, and the unemployment rate fell slightly to 3.5% from 3.7%. Leisure and hospitality, health care, construction, and social assistance were among the sectors with the most notable gains. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the U.S. increased by 6.5% for December 2022 compared to the November reading of 7.1%. This is the lowest CPI value since October 2021. Core CPI increased at a rate of 5.7% versus 6.0% in November. Most prices fell during the last month of the year, including food, used cars, and most energy sources. Electricity and shelter still saw an increase from the previous month. |

|

FISCAL POLICY |

NEUTRAL |

A few weeks after taking control of the chamber, GOP lawmakers are pushing for austerity measures to improve the nation’s fiscal health. The primary focus areas are federal health care, education, science and labor programs, and Social Security. Democrats have responded harshly, and President Biden has stressed that he will not negotiate a deal with Republicans involving reductions of benefits. |

|

MONETARY POLICY |

NEGATIVE |

Last month the Fed approved a 50-bps rate hike after four consecutive 75-bps hikes taking its target range to 4.25%-4.50%. Although the magnitude of rate hikes has been decreased, rates are likely to be kept higher through 2023 with no reductions until 2024. According to the FOMC’s dot plot, the expected terminal rate is now 5.1%. The next meetings will be held this week. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

While the Russian-Ukraine conflict does not show signs of abating, additional geopolitical issues have arisen in South America with the violent protests that hit the capital of Brazil last week. Following the October 2022 elections won by the left party, Jair Bolsonaro’s far-right supporters stormed Brasilia accusing the winning candidate and party of corruption. Bolsonaro is currently in Florida and has communicated little publicly. |

|

ECONOMIC RISKS |

NEGATIVE |

China seems to have abandoned its zero-Covid policy, which should help the global supply chain recover. Gas supplies from Russia to Europe have decreased by 88% over the past year, and EU countries have agreed to cut gas usage by 15% as gas prices have more than doubled. Nevertheless, an unusually mild winter has helped the majority of Europe dealing with increased energy costs. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.