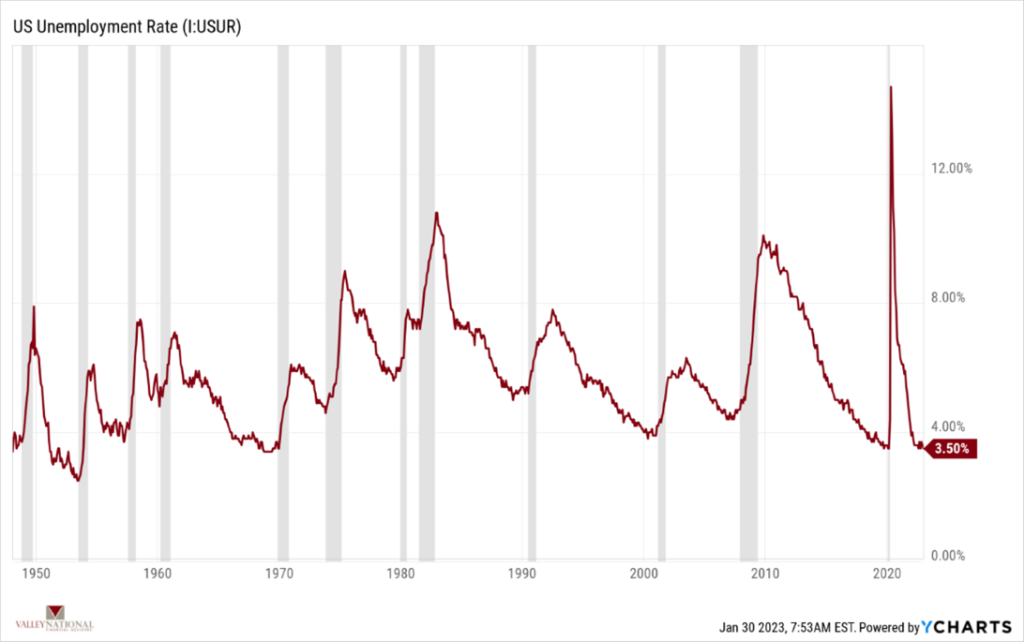

Economists may be predicting a recession in 2023. Still, the markets are certainly telegraphing a different story as last week’s returns marked the 4th week in a row for positive returns across all three major market indexes, with the NASDAQ leading the way, notching an additional +4.3% for the week and sitting at +11.0% so far in 2023. On a year-to-date basis, the Dow Jones Industrial Average is up +2.5%, while the broader S&P 500 Index is up +6.0% thus far in 2023. The markets are focused on three converging events: the Fed wrapping up its aggressive rate hiking policy, inflation finally showing signs of coming down, and a labor market that, despite continued announcements of layoffs, shows no signs of cooling.

Global Economy

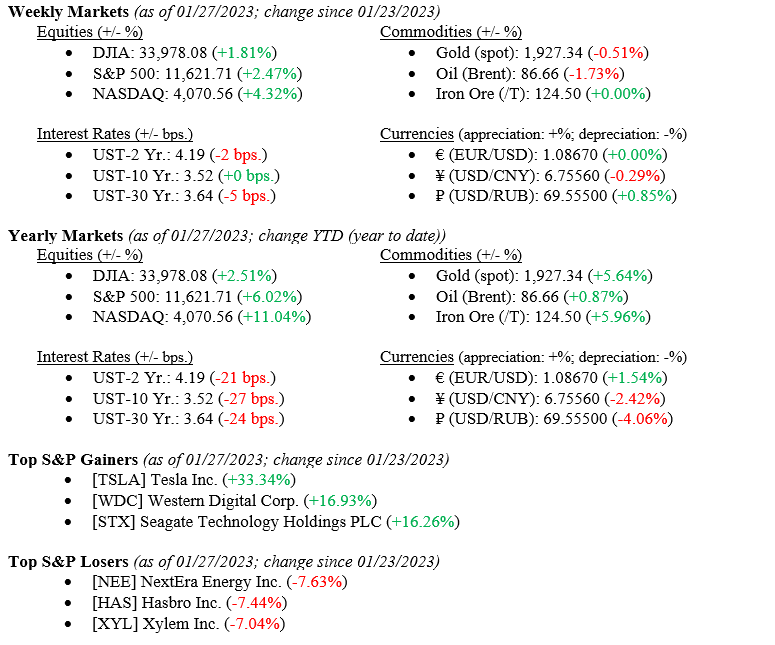

As mentioned above, one item where Wall Street economists, strategists, and portfolio managers agree is that the Fed is near the end of its aggressive rate-hiking strategy. The Fed has raised rates by +425 basis points since their zero-interest rate policy was in effect due to the Pandemic. Chart 1 below from the Federal Reserve Bank of St. Louis shows the Effective Fed Funds Rate.

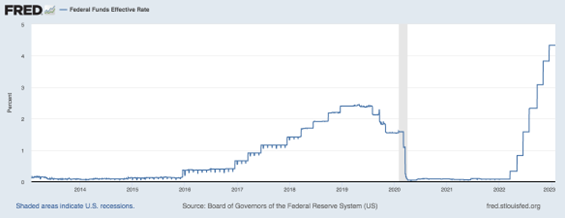

The Fed’s current rate hiking strategy pattern has been one of the steepest and swiftest moves in the Fed’s history, and their goal of cooling the economy and thereby taming inflation is working. Last week, two inflation indicators that Federal Reserve policymakers widely watch and are considered their “favorite” measures of inflation were released, and both showed significant drops. U.S. PCE (Personal Consumption Expenditures) and U.S. Core PCE for December 2022 fell for the third month in a row, as shown in Chart 2 below from Valley National Financial Advisors and Y Charts. The Fed prefers the PCE indicators because this measure responds better to rapidly changing consumer preferences, includes an exhaustive list of typical consumer expenditures, and the Core measure excludes volatile food and energy prices. The drop in these indicators since their peak in July 2022 shows the Fed’s policies are impacting the economy and taming painful inflation numbers impacting consumers and industry.

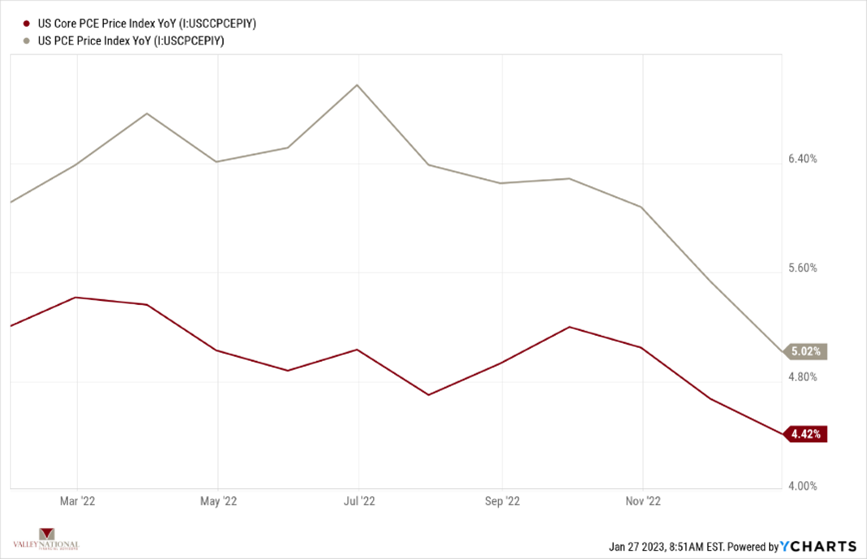

The last point mentioned above was about the strength of the labor market, even in the face of continued announcements of layoffs. Thus far, approximately 40,000 layoffs have been announced by technology companies such as Twitter, Amazon, Google, and Microsoft. We at TWC would never suggest that an engineer or coder from Microsoft is widely more employable than a starting-level service employee, but that seems to be the case as those tech layoffs are not yet showing up in the weekly claims for unemployment insurance, suggesting these coders and engineers found new jobs very quickly. The U.S. Unemployment Rate is at a 50-year low of 3.50%, Chart 3 below from Valley National Financial Advisors and Y Charts. We must go back to 1969 to see a lower level of U.S. Employment than today. Cautiously we watch the labor market, our concerns are that layoffs spread beyond the technology sector.

What to Watch

- U.S. Job Openings: Total Nonfarm for December 2022, released 2/1/2023, prior 10.46 million.

- U.S. Recession Probability for January 2024, released 2/1/2023, prior 47.31%.

- U.S. Initial Labor Force Participation Rate for January 2023, released 2/3/2023, prior 62.30%.

- U.S. Nonfarm Payrolls for January 2023, released 2/3/2023, prior 223,000.

- U.S. Unemployment Rate for January 2023, released 2/3/2023, prior 3.50%.

We are big believers in the “efficient markets hypothesis,” a theory in financial economics that states that asset prices reflect all available information. Simply put: the markets are smarter than investors. Most Wall Street professionals continue to call for a recession in 2023, albeit a shallow or minimally painful and short-lived recession. After digesting current economic conditions and market reactions, some are walking back their predictions for 2023. We look at the data and find it difficult to believe we will have a recession in 2023. The indicators mentioned above are not harbingers of a recession. We are concerned about corporate profits, many of which will be published this week, and whether layoffs are spreading beyond the technology sector. Watch for the Fed’s announcement this week on interest rates, in which they are widely expected to raise rates +0.25% and watch this week’s EPS (Earnings Per Share) releases to offer direction on profits for 2023.