We Are Hiring!

Team VNFA is seeking a Relationship Manager to work as part of our Client Service Team. Read more about this opportunity:Relationship Manager- Valley National Financial Advisors

We Are Hiring!

Team VNFA is seeking a Relationship Manager to work as part of our Client Service Team. Read more about this opportunity:Relationship Manager- Valley National Financial Advisors

Cupid began as a Greek God. The Cupid we know and always associate with Valentine’s Day was once known to the ancient Greeks as Eros, the god of love.

According to History.com, Eros, the son of the Greek goddess Aphrodite, would use two sets of arrows. One arrow for love and another for hate. He used his arrows to play with the emotions of his targets. It wasn’t until Romans told stories of his mischief that he adopted the childlike appearance we recognize today.

To learn more interesting facts about Valentine’s Day, visit History: Valentine’s Day Facts.

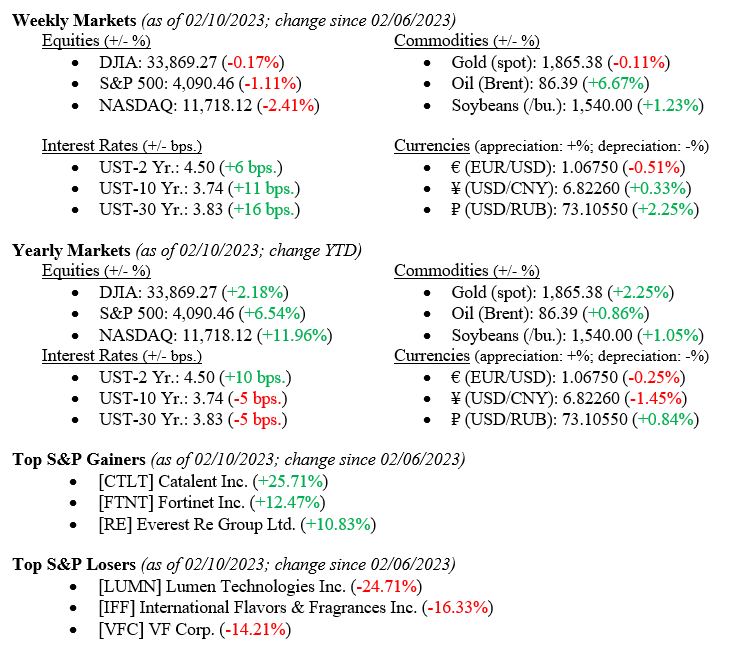

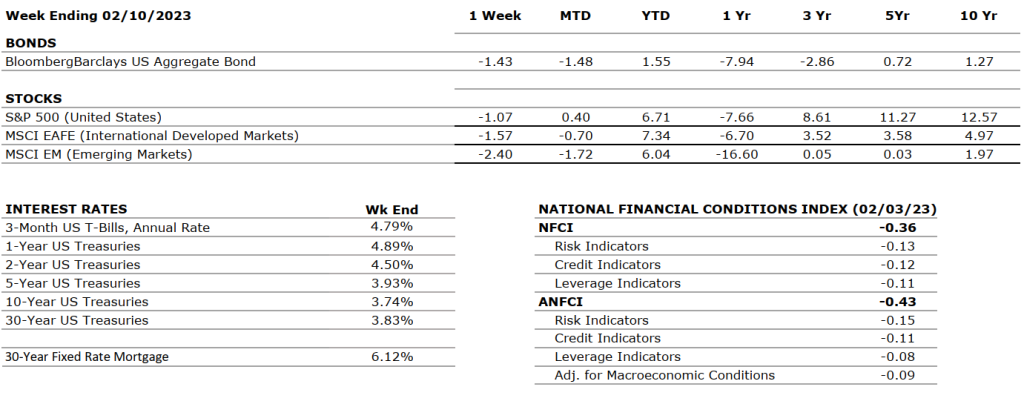

Equity markets moved slightly lower last week, with the Dow Jones Industrial Average down -0.17%, S&P 500 down -1.11%, and NASDAQ down -2.41%. On the other hand, mortgage rates have plateaued at approximately the 6% level, posting a slight average increase to 6.12% from 6.09%. Additionally, consumer sentiment increased slightly to 66.40, from 64.90—a 2.3% change from prior and up over 5% from this time last year. Pending the inflation numbers coming this week (currently 6.45%), the data could be painting the picture of an improving economy. As mentioned last week, this comes on the back of shockingly positive job numbers and the lowest unemployment rate in over 50 years. The Federal Reserve is sure to be weighing these data points heavily as it plans for the future of this tightening cycle.

Global Economy

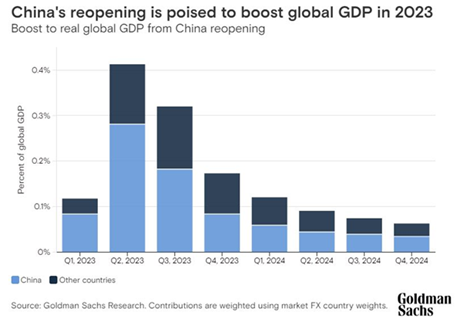

China has begun its reopening process and is doing so at a much faster pace than anticipated, causing some analysts to forecast a 6.5% GDP growth rate for the country in 2023. There are three core pillars of China’s reopening and its impact on the rest of the world. First, there is likely to be an increase in domestic demand, causing an increase in core goods exports from China’s foreign trade partners. Secondly, China’s rescission of the zero-Covid policies that have been in effect for the last three years will allow for a significant increase in travel to and from the country. Finally, commodity demand and prices may rise, especially for oil, and help to lift other net exporters up during potentially rough economic times.

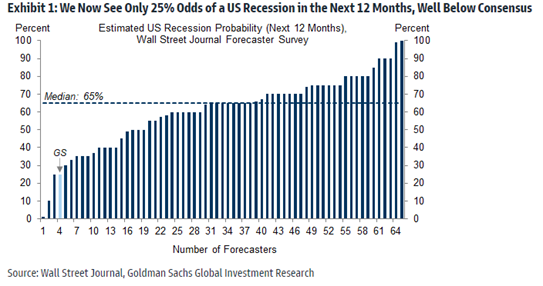

Based on the recent Wall Street Journal survey of recession expectations, firm economists forecast a median recession probability of 65%. However, the range of predictions is incredibly vast, as seen in the chart below. The thesis for those forecasting a lower-than-median recession probability is that labor markets continue to show signs of strength, and GDP growth is expected to increase beginning in the spring. However, it is worth noting that the rebalancing of the labor market is far from complete, although it is, in fact, on its way there, as indicated by the pullback in wage growth.

What to Watch

THE NUMBERS

The Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five and ten year returns are annualized. Interest Rates: Federal Reserve, Mortgage Bankers Association.

MARKET HEAT MAP

The health of the economy is a key driver of long-term returns in the stock market. Below, we assess the key economic conditions that we believe are of particular importance to investors.

|

US ECONOMY |

||

|

CONSUMER HEALTH |

NEUTRAL |

Real gross domestic product (GDP) increased at an annual rate of 2.9 percent in the fourth quarter of 2022 after increasing by 3.2 percent in the third quarter. The increase in the fourth quarter primarily reflected increases in inventory investment and consumer spending that were partly offset by a decrease in housing investment. |

|

CORPORATE EARNINGS |

NEUTRAL |

The earnings growth rate for Q3 2022 was 2.4%. For Q4 2022, earnings are expected to decline by -4.9%, up from the previous estimate of -5.3%. This would be the first negative growth since Q3 2020 (-5.7%). So far, 69% of S&P 500 companies have reported actual results — 69% of companies beat EPS estimates and 63% beat revenue expectations. |

|

EMPLOYMENT |

POSITIVE |

U.S. Nonfarm Payrolls for January 2023 increased by 517,000, almost three times the expected number of 187,000. The unemployment rate fell to 3.4% from 3.5% and is now the lowest in 50 years. Leisure and hospitality, health care, professional services, and government were among the sectors with the most notable gains. |

|

INFLATION |

NEGATIVE |

The annual inflation rate in the U.S. increased by 6.5% for December 2022 compared to the November reading of 7.1%. This is the lowest CPI value since October 2021. Core CPI increased at a rate of 5.7% versus 6.0% in November. Most prices fell during the last month of the year, including food, used cars, and most energy sources. Electricity and shelter still saw an increase from the previous month. |

|

FISCAL POLICY |

NEUTRAL |

A few weeks after taking control of the chamber, GOP lawmakers are pushing for austerity measures in hopes of improving the nation’s fiscal health. The primary areas of focus are federal health care, education, science and labor programs, and Social Security. Democrats have responded with harsh criticism, and President Biden has stressed that he will not negotiate a deal with Republicans involving reductions of benefits. |

|

MONETARY POLICY |

NEGATIVE |

Two weeks ago, the Fed approved a 25-bps rate hike taking its target range to 4.50%-4.75%. Although the magnitude of rate hikes has been decreased, rates are likely to be kept higher through 2023 with no reductions until 2024. The FOMC has also reiterated its strong commitment to return inflation to its 2% objective. |

|

GLOBAL CONSIDERATIONS |

||

|

GEOPOLITICAL RISKS |

NEGATIVE |

While the Russian-Ukraine conflict does not show signs of abating, additional geopolitical issues have arisen in South America with the violent protests that hit the capital of Brazil last week. Following the October 2022 elections won by the left party, Jair Bolsonaro’s far-right supporters stormed Brasilia accusing the winning candidate and party of corruption. Bolsonaro is currently in Florida and has communicated little publicly. |

|

ECONOMIC RISKS |

NEUTRAL |

Although the afore-mentioned geopolitical risks remain prevalent in everyday news, their effects on the global economy seem to have subsided. China abandoned its zero-Covid policy, which will positively impact the supply chain and the economy as a whole. The European economy also seems to be healthier than expected, partly due to an unusually warm winter that has provided some relief from increasing energy prices. |

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

“So much of what is best in us is bound up in our love of family, that it remains the measure of our stability because it measures our sense of loyalty.” – Haniel Long

Tune in Wednesday, 6 PM “Your Financial Choices” on WDIY 88.1FM. Laurie will be discussing: Tax Preparation and Filing Options.

Questions can be submitted at yourfinancialchoices.com during or in advance of the live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.