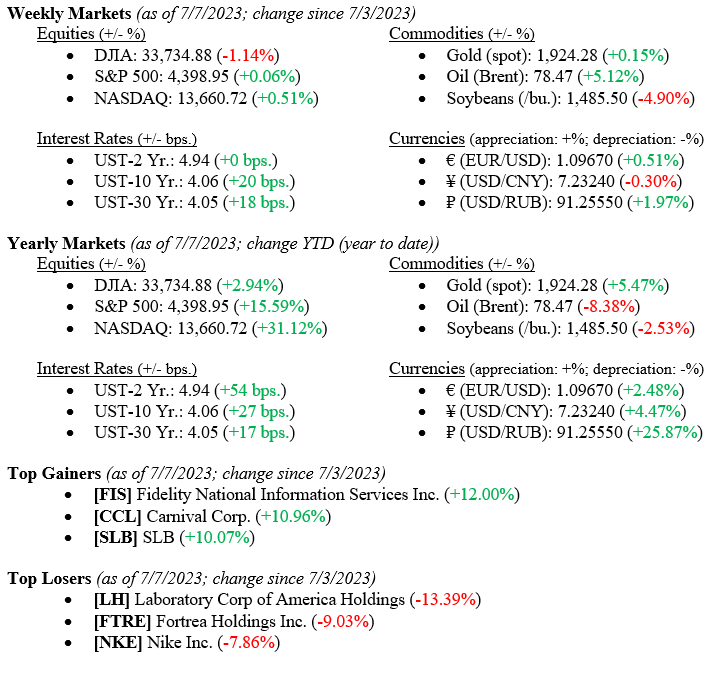

Equity markets were mixed last week, with the Dow Jones Industrial Average falling –1.1% while the S&P 500 Index (+0.1%) and the NASDAQ (+0.5%) posted modest gains. Bond yields rose, and the 10-year US Treasury moved above 4.00% again, closing the week at 4.06%. Strong labor market data released last week and a slight drop in the unemployment rate helped push yields higher. There was a bit of conflicting data, with the ADP jobs report showing +479,000 new jobs and the BLS (Bureau of Labor Statistics) showing +209,000 new jobs. While conflicting data for sure, both figures show that we continue adding jobs while inflation slips downward. This recent data certainly gives the Fed the cushion to continue increasing rates as we move into the summer. See charts and data below.

US Economy

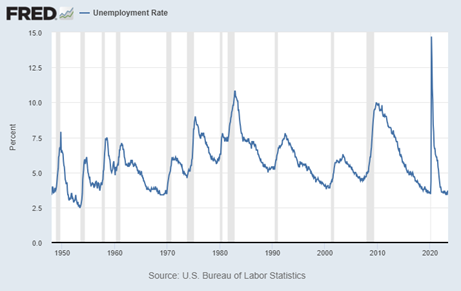

As mentioned above, the US Unemployment Rate continues to fall, hitting 3.6% last week; see Chart 1 below from the Federal Reserve Bank of St. Louis. This is important because it pushes the case for the mythical “soft-landing” every Fed Chair hopes for when raising rates, as Chairman Jay Powell had done over the past 18 months. A “soft-landing” refers to the ability to slow the economy by raising rates just enough to kill inflation but not destroy demand so much that the economy rolls into a recession. Thus far, Chairman Powell is succeeding. An unemployment rate of 3.6% shows that the labor market remains resilient.

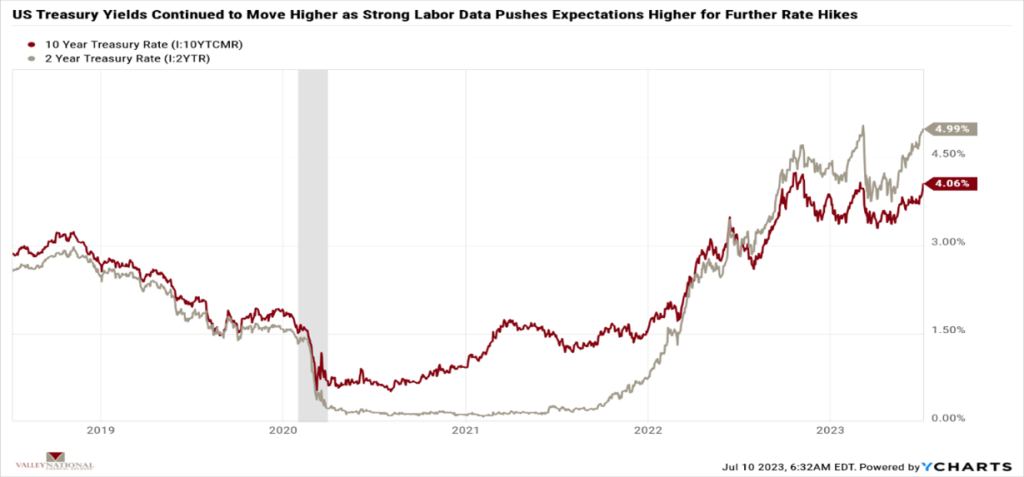

Yields on bonds continued moving higher as markets and investors accepted the fact that higher short-term rates are coming; see Chart 2 below from Valley National Financial Advisors and Y Charts showing the 2-year and 10-year US Treasury yields. The move higher last week in bond yields confirmed expectations that the Fed will raise rates by +0.25% at their next two meetings. While higher rates will continue to slow the economy, we doubt an additional +0.50% will do much, given that markets have already easily digested +5.25% in rate hikes. This is the “soft-landing” Chairman Powell is shooting for – lowering inflation, keeping the labor market alive, and not pushing the economy into a recession.

What to Watch

- Monday, July 10th

- U.S. Retail Gas Price at 4:30PM (Prior: $3.643/gal.)

- Wednesday, July 12th

- U.S. Inflation Rate at 8:30AM (Prior: 4.05%)

- U.S. Core Consumer Price Index MoM/YoY at 8:30AM (Prior: 0.44% / 5.33%)

- Thursday, July 13th

- U.S. Initial Claims for Unemployment Insurance at 8:30AM (Prior: 248,000)

- Natural Gas Storage Change at 10:30AM (Prior: 72.00B cf.)

- 30 Year Mortgage Rate at 12:00PM (Prior: 6.81%)

- Friday, July 14th

- U.S. Export Prices MoM/YoY at 10:00AM (Prior: -1.85% / -10.13%)

- U.S. Import Prices MoM/YoY at 10:00AM (Prior: -0.64% / -5.94%)

- U.S. Index of Consumer Sentiment at 10:00AM (Prior: 64.40)

This week we will get a fresh look at the U.S. Inflation Rate (prior 4.05%) to see if we are moving closer to the Fed’s 2.00% target rate. While most economists have finally walked away from their predictions of a recession in 2023, they have now moved into 2024. We are watching important consumer data as consumer and consumer spending makes up 65-75% of the U.S. economy. Importantly, small indicators like restaurant activity and credit card delinquencies are showing signs of weakening. While certainly expected in a slowing economy, it remains important to us to watch this data. We remain cautiously optimistic about the markets and economy for 2023, hoping like Chairman Powell, that we see a “soft landing.” Contact anyone at Valley National Financial Advisors with questions about this report.