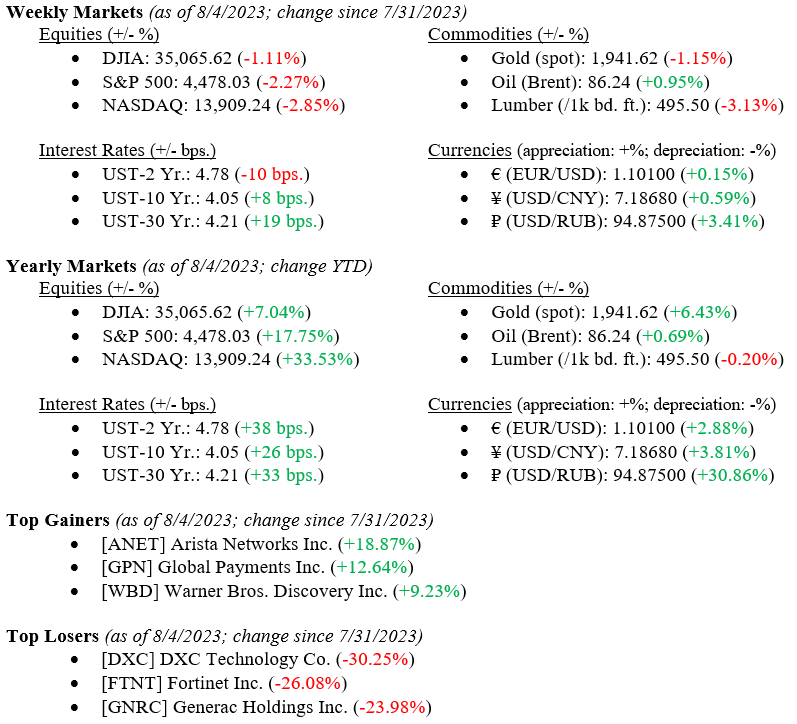

Markets ended the previous week lower overall, with the DJIA down 1.11%, the S&P down 2.27%, and the NASDAQ down 2.85%. Despite these slight moves downward, year-to-date equity indices are trying to make up for a weak 2022, with the Dow up 7.04%, S&P up 17.75%, and NASDAQ up 33.53%–they still have a way to go before breaking even. Still, at least this is a move in the right direction as the Fed continues to work towards avoiding a recession. Last week, U.S. recession probability dropped by about 2% to 66.01%, while unemployment fell to another record low of 3.50%. We are in the camp that the Fed will avoid a recession with its current path of interest rate hikes. While a recession is possible, we still believe that the Fed is well on its way to pulling off its “soft landing, Goldilocks” scenario.

Global Economy

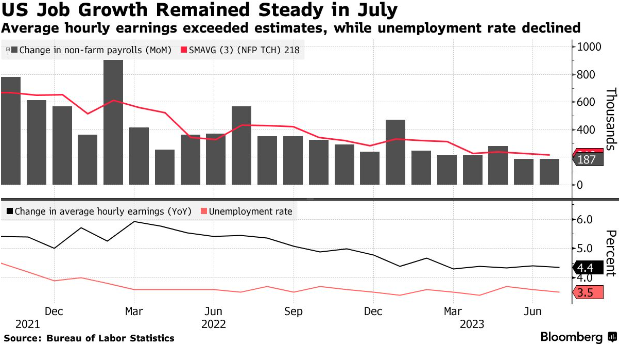

U.S. employment showed strong growth in July, accompanied by higher-than-anticipated wage increases, reflecting ongoing labor demand that is driving the economy’s renewed momentum. Nonfarm payrolls rose by 187,000, following a similar increase in June, with the unexpected decline in the unemployment rate to 3.5%, among the lowest in decades. The robust job and income gains suggest the economy can withstand rapid interest rate hikes aimed at curbing inflation, boosting consumer confidence, and potentially supporting spending and growth. Despite signs of wage growth slowing down due to labor supply and demand balancing after pandemic-related shortages, service providers, particularly in healthcare, financial activities, and construction, saw increased employment. The data, combined with relatively low inflation, suggest the Federal Reserve can manage price pressures without triggering a recession, influencing its upcoming decisions on interest rates. However, challenges remain, including potential future rate hikes and managing inflation, especially with the impending resumption of student loan payments. While President Biden’s policies have spurred growth, rising debt prompted a credit rating downgrade by Fitch Ratings.

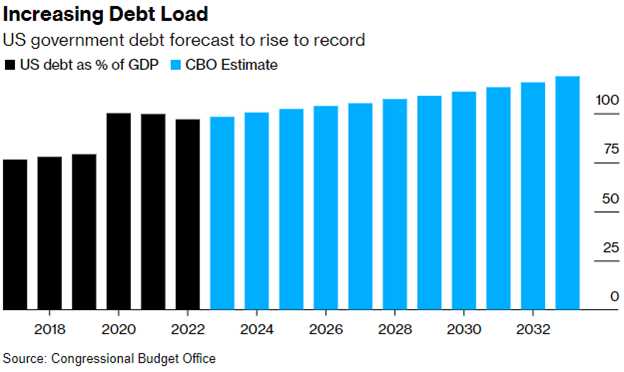

Fitch Ratings’ downgrade of U.S. government debt from AAA to AA+ has elicited criticism from both Washington and Wall Street, despite concerns over the nation’s swelling fiscal deficits and their potential impact on markets, the economy, and the upcoming presidential election. The downgrade comes after Fitch had previously warned of such a move due to debates over raising the debt limit. The downgrade was attributed to the expectation of deteriorating finances over the next few years due to tax cuts, new spending, economic shocks, and political gridlock. Treasury Secretary Janet Yellen criticized the timing and called the downgrade “arbitrary” and “outdated,” while market reactions were mixed, with bonds staying relatively stable but risk-sensitive assets taking a hit. The downgrade underscores the worsening U.S. fiscal outlook, although investors are likely to view it as a medium-term concern. The political fallout and debates over the downgrade are expected to continue through the 2024 election. Fitch’s action increases the U.S.’s debt vulnerability and projected debt-to-GDP ratio, raising concerns about the nation’s resilience to economic shocks. Despite this, the market’s reaction remains uncertain, as the downgrade could lead to increased safe-haven buying of U.S. Treasuries and the dollar.

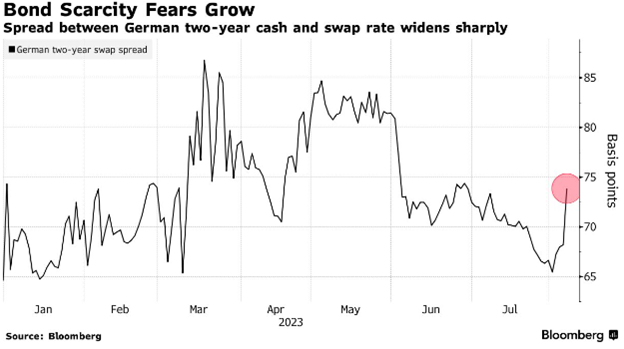

A surge in government bond selling intensified on Monday due to concerns about potential further interest rate hikes, leading to a rise in 30-year German bond yields to their highest level since 2014 and a six-basis point increase in similar-maturity Treasury yields. Although US equity futures saw a modest increase, investors remained wary as Federal Reserve Governor Michelle Bowman’s comments over the weekend hinted at the necessity of additional rate hikes to curb inflation. Anticipation for upcoming US inflation data added to market uncertainty, with the consumer price index reading expected to show a 0.2% rise in July, marking the smallest consecutive gains in 2.5 years. Despite this, stock trading remained relatively subdued, with European stocks retreating and German industrial output hitting a six-month low, signaling economic weakness.

What to Watch

- Monday, August 7th

- U.S. Retail Gas Price at 4:30PM (Prior: $3.869/gal.)

- Tuesday, August 8th

- U.S. Trade Balance on Goods and Services at 8:30AM (Prior: -68.98B USD)

- Wednesday, August 9th

- U.S. Crude Oil Stocks WoW at 10:30AM (Prior: -17.05M bbl.)

- Thursday, August 10th

- U.S. Consumer Price Index MoM/YoY at 8:30AM (Priors: 0.18% / 2.97%)

- U.S. Inflation Rate at 8:30AM (Prior: 2.97%)

- U.S. Initial Claims for Unemployment at 8:30AM (Prior: 227,000)

- 30 Year Mortgage Rate at 12:00PM (Prior: 6.90%)

- Friday, August 11th

- U.S. Producer Price Index MoM/YoY at 8:30AM (Priors: 0.14% / 0.13%)

- U.S. Index of Consumer Sentiment at 10:00AM (Prior: 71.60)