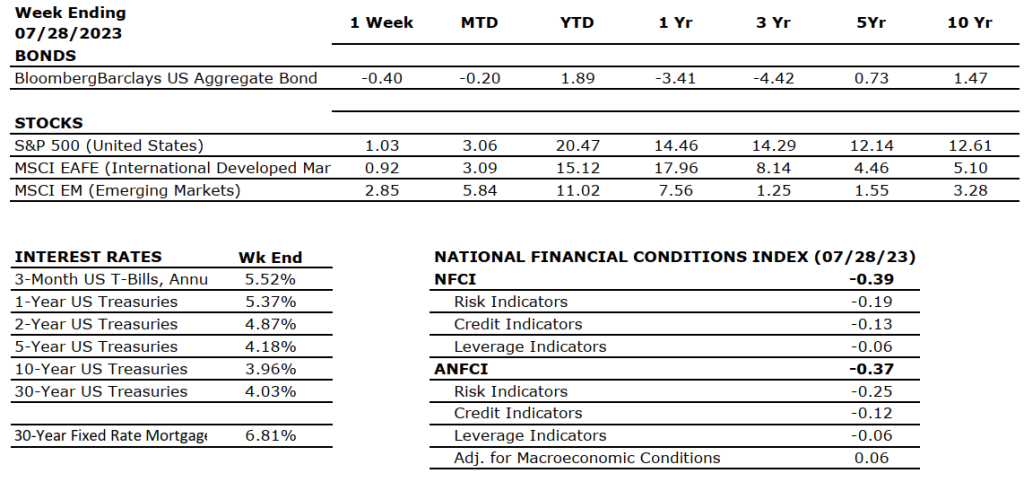

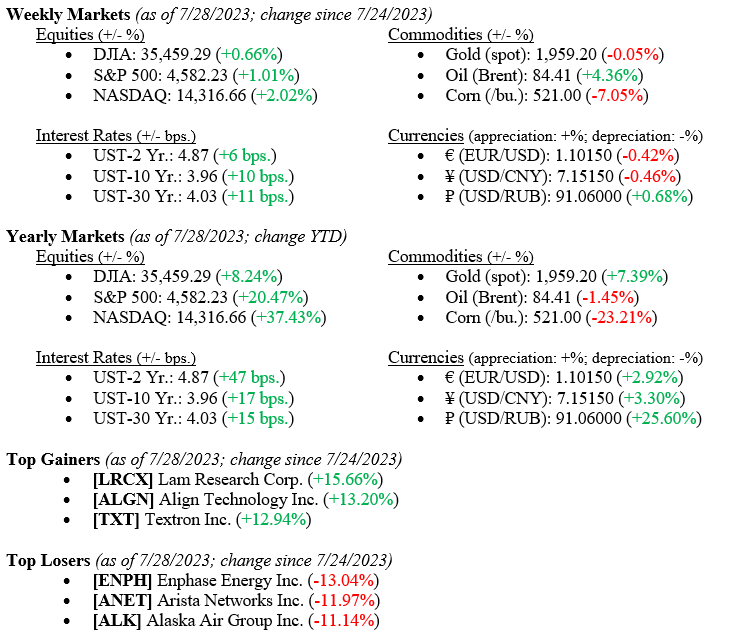

Week by week, the mythical “Goldilocks” scenario plays out, where the Fed tackles rampant inflation with higher interest rates and slows the economy as a result, but not so much so that we roll into a recession – this is also commonly called a “soft-landing,” and Fed Chairman Jay Powell, like others, is seeking this outcome. All the while, equity markets continue to quietly move higher as they did last week, with gains across all three major market indexes. For the week, the Dow Jones Industrial Average gained +0.7%, the S&P 500 Index added +1.0%, and the NASDAQ notched a gain of +2.0%. Year-to-date gains remain comfortably solid, with the Dow Jones Industrial Average at +8.2%, the S&P 500 Index at +20.5%, and the tech-heavy NASDAQ at +37.4% for the year.

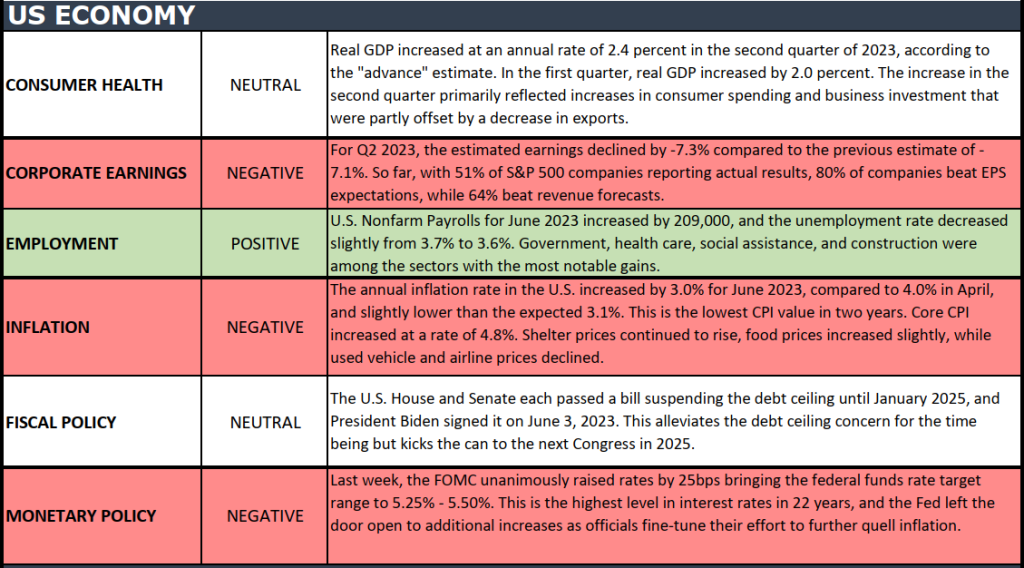

US Economy

Last week we showed how inflation has moved from 9.1% in July 2022 to just under 3% a year later. This sharp drop in inflation is a direct result of the Federal Reserve raising interest rates from a range of 0.00-0.25% to 5.25%-5.50% in just under 18 months. A move this fast and this steep in interest rates, which immediately inverted the yield curve, typically slows the economy so much that a recession is the result. We at TWC have consistently stood against this typical pattern this year. Our premise was based on a solid labor market as evidenced by an unemployment rate at a paltry 3.6%, healthy consumer spending, banks continuing to lend with healthy balance sheets, corporate earnings still in the green column, and the US housing market still growing.

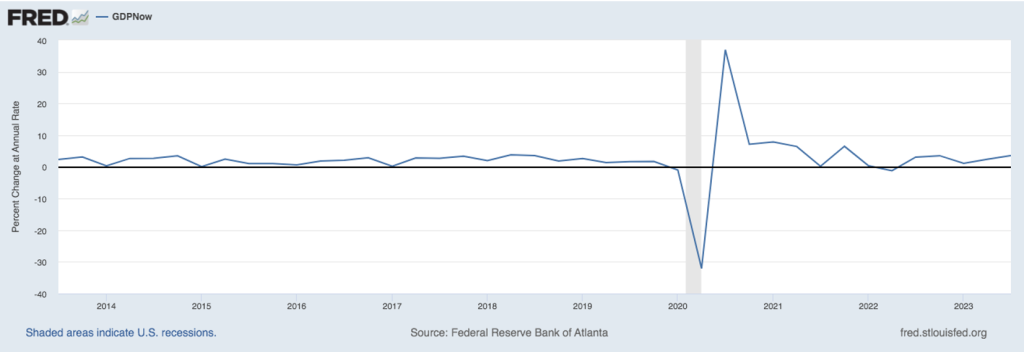

Markets continue to rally, seeing beyond the short-term concerns and instead looking ahead and understanding the fundamentals driving prices higher: we are near the end of the interest rate hikes, inflation is abating, and economic growth is accelerating rather than slowing. Last week, the Atlanta Fed raised second-quarter US GDP (Gross Domestic Product) estimates to +2.4% from +2.0%. See Chart 1 belowfromtheFederalReserveBankofSt. Louis, showingtheU.S. GDPestimate. The third quarter 2023 estimate for US GDP growth is +3.5%. Fed Chairman Jay Powell certainly seems to be getting his “Goldilocks” ending.

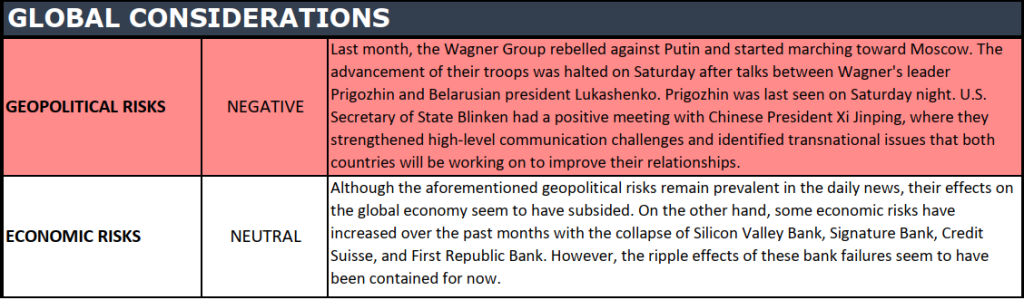

Policy and Politics

Washington is thankfully on vacation until after Labor Day so we can relax and not worry that new restrictive legislation will be dumped on consumers or corporations. Instead, we have a quiet period where the markets and economy will digest the news cycle this week, including earnings reports from some of the most important companies, including Apple and Amazon.com. Other important global news is coming from China, where further government stimulus was announced.

What to Watch

- U.S. Job Openings Non-Farm for June 2023, released 8/1/23, prior level 9.824M job openings.

- U.S. Labor Force Participation Rate for July 2023, released 8/6/23, prior rate 62.6%

- U.S. Unemployment Rate for July 2023, released 8/6/23, prior rate 3.6%

The “Goldilocks” scenario certainly is plausible, and last week we saw positive GDP growth along with declining inflation. All the while, companies continue to report favorable earnings, and the buzzwords of the future remain “artificial intelligence,” or AI. AI is supposedly turning out to be the panacea of everything that is wrong with the world, from healthcare to education to global climate change. We at VNFA remain cautiously optimistic about the economy and the financial markets, basing our assumptions on the American Consumer. Volatility remains calm, and Mr. Powell may get his soft landing, but vigilance and caution should always be used. Reach out to anyone at Valley National Financial Advisors for assistance.