“The bad news is time flies. The good news is you’re the pilot.” -Michael Altshuler

Monthly Archives: August 2023

“Your Financial Choices”

Tune in Wednesday, 6 PM “Your Financial Choices” on WDIY 88.1FM. Laurie will be Reviewing Financial tools on FINRA.ORG.

Questions can be submitted at yourfinancialchoices.com during or in advance of the live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

VNFA News…Countdown to 38 Years

Did you know… this month (August) in 1985, was the beginning of #TeamVNFA? Get to know our story and how we got here.

Read our story: https://valleynationalgroup.com/about-vnfa/our-story/

Did You Know…? The Importance of Navigating Cybersecurity? Part 1

Essential Cybersecurity Measures for Clients (a five-part series)

By: Rob Ziobro, VNFA Assistant Vice President, IT

Understanding cybersecurity measures is crucial to safeguarding your digital life in our interconnected world, where personal and business activities thrive online. Here are some valuable insights to help you navigate the intricate landscape of cybersecurity:

Secure Passwords Are Your First Line of Defense: Believe it or not, a strong password can be one of your most effective shields against cyber threats. Use unique combinations of upper and lower case letters, numbers, and symbols. Avoid easily guessable details like birthdays or pet names. And remember, it’s crucial not to reuse passwords across multiple accounts.

Multi-Factor Authentication (MFA): Adding an extra layer of protection, MFA requires more than just a password to access your accounts. This could involve a verification code sent to your phone, a fingerprint, or a facial scan on your smart device. By requiring multiple forms of identification, MFA significantly reduces the risk of unauthorized access, even if your password is compromised. And always remember, if you are prompted with an MFA request to log in to an account that you didn’t request, you may want to check the recent logins of the account or change the account password just to be sure your password wasn’t compromised.

Come back next week for our next topic called Phishing.

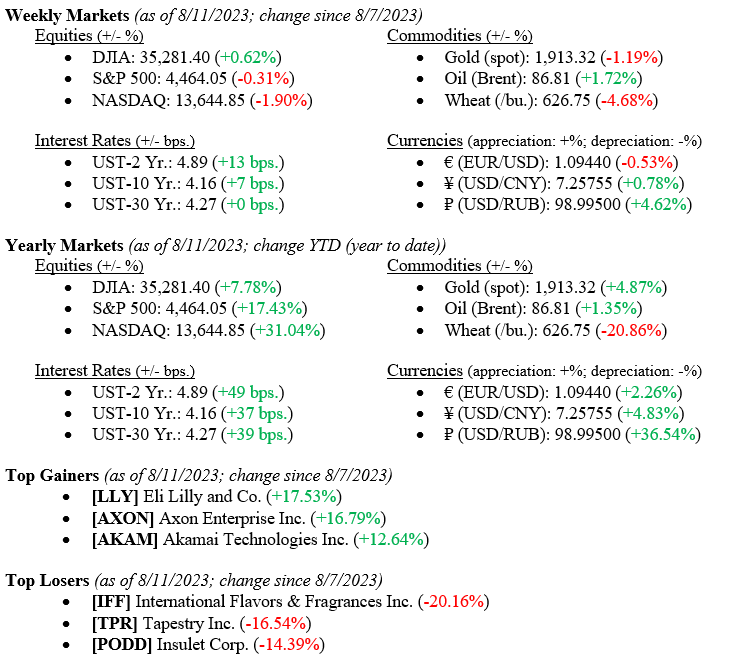

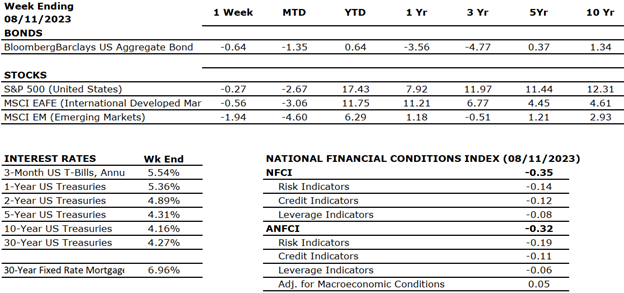

Current Market Observations

Markets ended last week mostly flat, with the Dow Jones Industrial average netting a 0.62% gain, while the S&P500 and NASDAQ lost 0.31% and 1.90%, respectively. Year-to-date returns on all three major indexes remain well in positive territory (see details below). In terms of economic data released last week, the Producer Price Index (PPI) increased month-over-month and year-over-year, which means it is still contributing to inflation despite it slowing considerably. While the Fed is waiting for solid economic data before announcing they won the inflation war, American Consumer’s inflation expectations are declining. The current inflation expectation rate is just 3.3% overall over the next year versus the 3.4% figure that was anticipated in July. Interest rates continued to increase last week, with the 10-year U.S. Treasury increasing seven basis points to end the week at 4.16%.

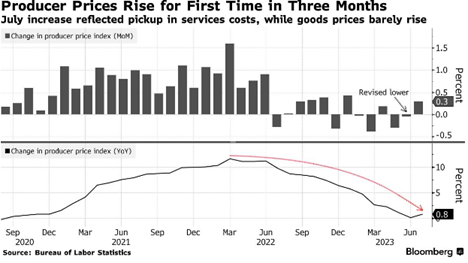

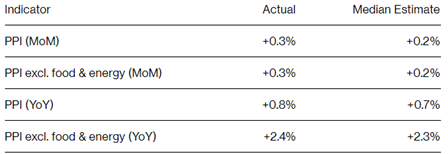

Global Economy

U.S. Producer Prices increased in July due to rises in service categories, underscoring the challenges in managing inflation. The Producer Price Index for final demand and the core index, excluding food and energy, rose by 0.3% in July, slightly surpassing predictions. Factors like stabilizing supply chains, limited overseas demand, and shifting consumer spending towards services have eased producer-level inflation. However, recent oil price hikes are reintroducing inflationary pressures. Inflation in healthcare services accelerated, impacting key inflation measures. Recent consumer price data indicating minimal gains might deter the Federal Reserve Bank from raising interest rates in September. The Core PPI, which excludes volatile components like food and energy, increased only 0.3% in July and 2.4% annually, which is getting close to the Fed’s target rate of 2.00%. See the detailed charts below from Bloomberg.

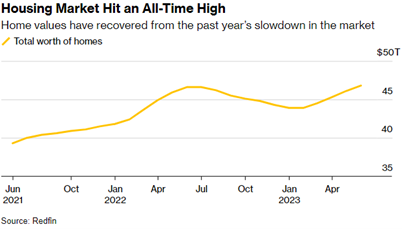

The U.S. housing market has rebounded, recovering nearly $3 trillion in lost value from the previous year’s slowdown. A continued shortage of listings has driven up prices and elevated the total worth of U.S. homes to a record $47 trillion, as reported by Redfin Corp, see Chart 2 below from Redfin. The reluctance of homeowners to relinquish their lower-rate mortgages amid rising borrowing costs has resulted in only 1% of U.S. homes changing ownership this year, the lowest figure in a decade.

Policy and Politics

During the upcoming BRICS (Brazil, Russia, India, China, & South Africa) economic summit in South Africa, discussions will revolve around increasing the utilization of local currencies for trade among member states, including establishing a common payments system and potentially forming a technical committee to explore the concept of a joint currency. The focus is not on replacing the U.S. dollar as the global currency but rather on enhancing the use of domestic currencies to foster trade and counterbalance the dominance of the U.S. This is important to us to watch as some BRICS countries are part of the major move in U.S. manufacturing around nearshoring (moving offshore manufacturing physically closer to U.S. headquarters) and friend-shoring (moving offshore manufacturing to trade partners deemed more “business friendly”) since the massive supply chain disruptions that were seen during the pandemic.

What to Watch

- Monday, August 14th

- U.S. Retail Gas Price at 4:30PM (Prior: $3.94/gal.)

- Wednesday, August 16th

- U.S. Housing Starts / MoM at 8:30AM (Priors: 1.434M / -8.02%)

- U.S. Job Openings: Total Nonfarm at 10:00AM (Prior: 9.582M)

- Thursday, August 17th

- U.S. Initial Claims for Unemployment Insurance at 8:30AM (Prior: 248k)

- 30 Year Mortgage Rate at 12:00PM (Prior: 6.96%)

As is typical in August, markets reach a calm/quiet period as Washington, DC, is on vacation with much of the rest of the country and world. Federal Chairman Jay Powell has slowly crafted his economic soft landing (battling inflation with higher interest rates and not sending the economy into a recession). However, the war is ongoing as inflation is still above the 2% target (U.S. Inflation Rate for July 2023 was 3.18%). As noted above, equity markets have slowly increased year-to-date, reflecting strong economic conditions, healthy labor and housing markets, and resilient consumers. Our mantra remains that investors can be cautiously optimistic for the remaining part of 2023.

The Numbers & “Heat Map”

Sources: Index Returns: Morningstar Workstation. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Three, five- and 10- year returns are annualized excluding dividends. Interest Rates: Federal Reserve, Mortgage Bankers Association.

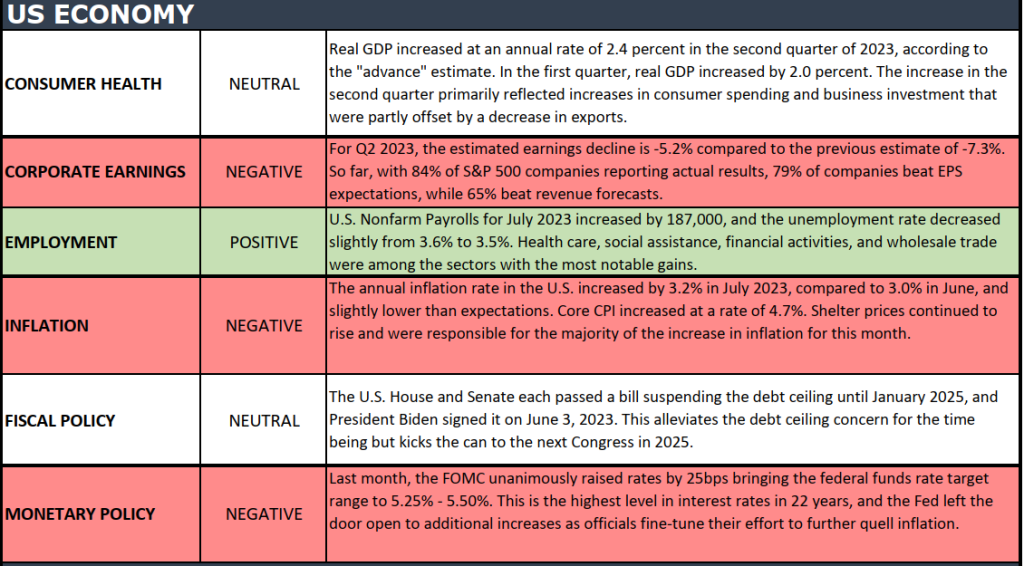

MARKET HEAT MAP

The health of the U.S. economy is a key driver of long-term returns in the stock market. Below, we grade key economic conditions that we believe are of particular importance to investors.

The “Heat Map” is a subjective analysis based upon metrics that VNFA’s investment committee believes are important to financial markets and the economy. The “Heat Map” is designed for informational purposes only and is not intended for use as a basis for investment decisions.

Quote of the Week

“When something is important enough, you do it even if the odds are not in your favor”-Elon Musk

“Your Financial Choices”

Tune in Wednesday, 6 PM “Your Financial Choices” on WDIY 88.1FM. Laurie will be discussing: Exploring Risks in Investing.

Questions can be submitted at yourfinancialchoices.com during or in advance of the live show. Recordings of past shows are available to listen or download at both yourfinancialchoices.com and wdiy.org.

Current Market Observations

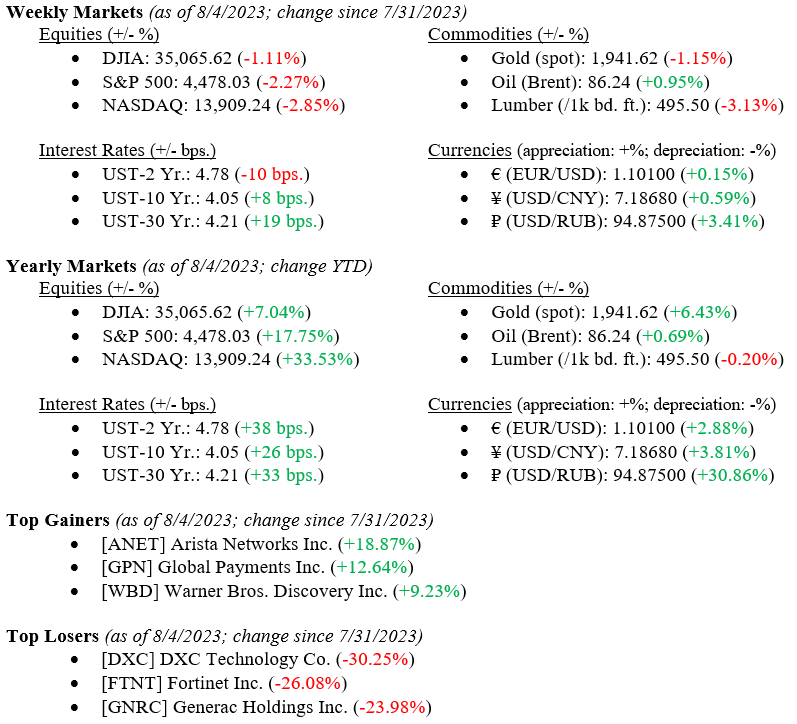

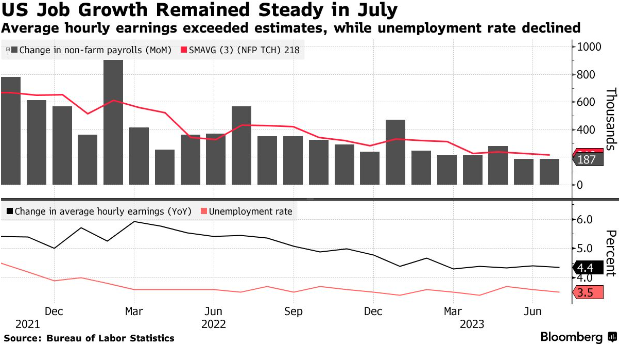

Markets ended the previous week lower overall, with the DJIA down 1.11%, the S&P down 2.27%, and the NASDAQ down 2.85%. Despite these slight moves downward, year-to-date equity indices are trying to make up for a weak 2022, with the Dow up 7.04%, S&P up 17.75%, and NASDAQ up 33.53%–they still have a way to go before breaking even. Still, at least this is a move in the right direction as the Fed continues to work towards avoiding a recession. Last week, U.S. recession probability dropped by about 2% to 66.01%, while unemployment fell to another record low of 3.50%. We are in the camp that the Fed will avoid a recession with its current path of interest rate hikes. While a recession is possible, we still believe that the Fed is well on its way to pulling off its “soft landing, Goldilocks” scenario.

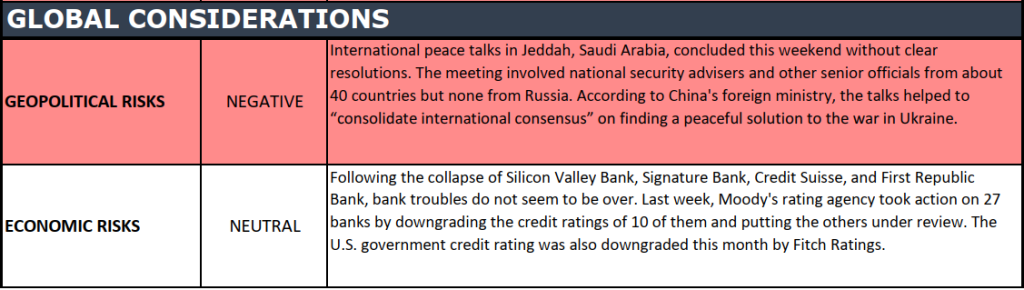

Global Economy

U.S. employment showed strong growth in July, accompanied by higher-than-anticipated wage increases, reflecting ongoing labor demand that is driving the economy’s renewed momentum. Nonfarm payrolls rose by 187,000, following a similar increase in June, with the unexpected decline in the unemployment rate to 3.5%, among the lowest in decades. The robust job and income gains suggest the economy can withstand rapid interest rate hikes aimed at curbing inflation, boosting consumer confidence, and potentially supporting spending and growth. Despite signs of wage growth slowing down due to labor supply and demand balancing after pandemic-related shortages, service providers, particularly in healthcare, financial activities, and construction, saw increased employment. The data, combined with relatively low inflation, suggest the Federal Reserve can manage price pressures without triggering a recession, influencing its upcoming decisions on interest rates. However, challenges remain, including potential future rate hikes and managing inflation, especially with the impending resumption of student loan payments. While President Biden’s policies have spurred growth, rising debt prompted a credit rating downgrade by Fitch Ratings.

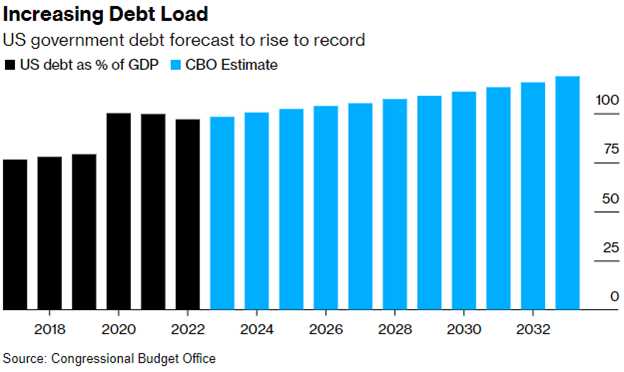

Fitch Ratings’ downgrade of U.S. government debt from AAA to AA+ has elicited criticism from both Washington and Wall Street, despite concerns over the nation’s swelling fiscal deficits and their potential impact on markets, the economy, and the upcoming presidential election. The downgrade comes after Fitch had previously warned of such a move due to debates over raising the debt limit. The downgrade was attributed to the expectation of deteriorating finances over the next few years due to tax cuts, new spending, economic shocks, and political gridlock. Treasury Secretary Janet Yellen criticized the timing and called the downgrade “arbitrary” and “outdated,” while market reactions were mixed, with bonds staying relatively stable but risk-sensitive assets taking a hit. The downgrade underscores the worsening U.S. fiscal outlook, although investors are likely to view it as a medium-term concern. The political fallout and debates over the downgrade are expected to continue through the 2024 election. Fitch’s action increases the U.S.’s debt vulnerability and projected debt-to-GDP ratio, raising concerns about the nation’s resilience to economic shocks. Despite this, the market’s reaction remains uncertain, as the downgrade could lead to increased safe-haven buying of U.S. Treasuries and the dollar.

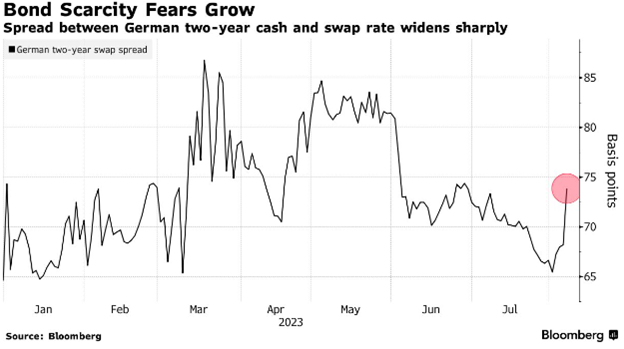

A surge in government bond selling intensified on Monday due to concerns about potential further interest rate hikes, leading to a rise in 30-year German bond yields to their highest level since 2014 and a six-basis point increase in similar-maturity Treasury yields. Although US equity futures saw a modest increase, investors remained wary as Federal Reserve Governor Michelle Bowman’s comments over the weekend hinted at the necessity of additional rate hikes to curb inflation. Anticipation for upcoming US inflation data added to market uncertainty, with the consumer price index reading expected to show a 0.2% rise in July, marking the smallest consecutive gains in 2.5 years. Despite this, stock trading remained relatively subdued, with European stocks retreating and German industrial output hitting a six-month low, signaling economic weakness.

What to Watch

- Monday, August 7th

- U.S. Retail Gas Price at 4:30PM (Prior: $3.869/gal.)

- Tuesday, August 8th

- U.S. Trade Balance on Goods and Services at 8:30AM (Prior: -68.98B USD)

- Wednesday, August 9th

- U.S. Crude Oil Stocks WoW at 10:30AM (Prior: -17.05M bbl.)

- Thursday, August 10th

- U.S. Consumer Price Index MoM/YoY at 8:30AM (Priors: 0.18% / 2.97%)

- U.S. Inflation Rate at 8:30AM (Prior: 2.97%)

- U.S. Initial Claims for Unemployment at 8:30AM (Prior: 227,000)

- 30 Year Mortgage Rate at 12:00PM (Prior: 6.90%)

- Friday, August 11th

- U.S. Producer Price Index MoM/YoY at 8:30AM (Priors: 0.14% / 0.13%)

- U.S. Index of Consumer Sentiment at 10:00AM (Prior: 71.60)

Did You Know…?

National Immunization Awareness Month (NIAM) is the entire month of August each year.

With the purpose to promote the importance of immunizations and raise awareness about the benefits of vaccination for people of all ages.

Visit the CDC for more information on National Immunization Awareness Month.